Cointracking.info, commonly just referred to as CoinTracking, is one of the leading cryptocurrency portfolio managing and crypto tax software.

It started out as a cryptocurrency portfolio tracking app before adding the tax reporting features that have made it extremely popular in the crypto circles.

How it works

In a nutshell, CoinTracking has a dual role: a crypto portfolio manager and a tax reporting software.

But first things first. You need to first download the CoinTracking app and create an account for you to use the CoinTracking software.

As a crypto portfolio manager, CoinTracking allows users to link with all the crypto exchanges and cryptocurrency wallets that they are using and view the value of their cryptocurrency assets in a single interface.

CoinTracking analyses all trades in real-time and gives an overview of the value of their coins including the realized and unrealized gains and losses. It integrates with over 70 crypto exchanges and it can track over 7000 cryptocurrencies.

As a tax reporting software, Cointracking.info integrates with a wide range of leading cryptocurrency exchanges to gather trading history for creating tax reports automatically. It supports different forms of annual crypto tax reports based on different standards (i.e. capital gains, FBAR, Form 8949, and the German Income Tax Act). It also supports automatic import.

You can input your trading data either manually, by a manual CSV import from exchanges, or fully automatically via APIs.

CoinTracking pricing

CoinTracking offers a tiered pricing model with four packages that include Free, Pro, Expert, and Unlimited.

Free

The CoinTracking Free package allows users to generate tax reports manually using CSV files with a limit of 100 entries (i.e. the reports are not automatically generated). It only allows users to generate tax reports for a maximum of 200 crypto transactions. It does not allow for auto imports but it allows for up to two manual imports.

Pro

The CoinTracking Pro package costs $131.88 annually. If you pay for two years upfront, you get a $60 discount. You can also choose to pay for a lifetime subscription that goes for $425.

The Pro package allows users to generate tax reports for a maximum of 3,500 crypto transactions. It allows for 5 auto imports on each coin and unlimited manual imports.

Expert

The Expert package costs $203.88 annually. However, if you pay for two years upfront, you can save up to $84. You can also choose to pay for the lifetime subscription which costs $919.

The Expert package allows users to generate tax reports for a maximum of 20,000 crypto transactions. It allows for 10 auto imports for each coin and unlimited manual imports.

Unlimited

The Unlimited package costs $659.88 annually although you can save $240 by paying for two years upfront. You can also choose to pay for a lifetime subscription at a cost of $5299.

The unlimited package allows users to generate tax reports for an unlimited number of crypto transactions. It allows up to 50 auto imports on each coin and unlimited manual imports.

Process of generating tax report on CoinTracking

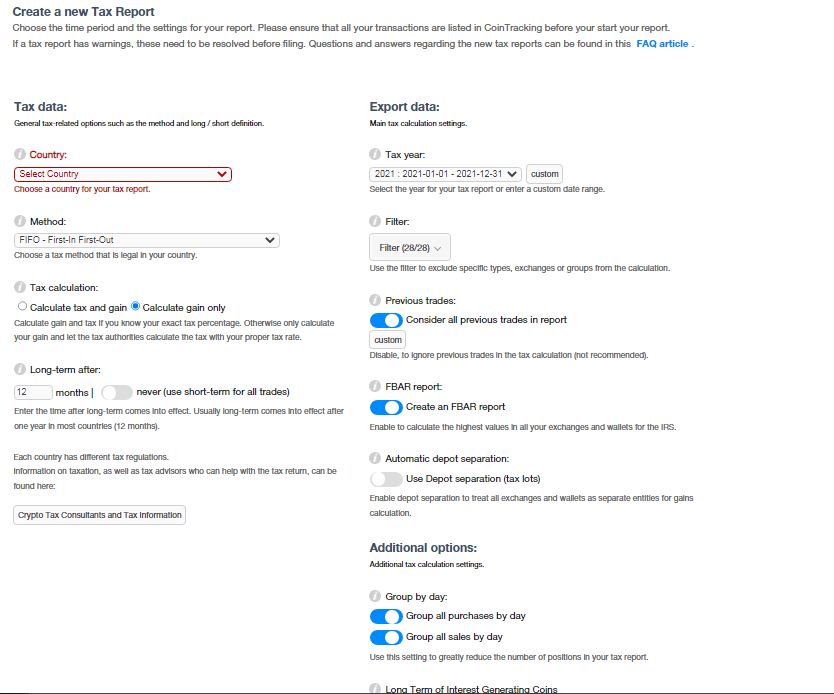

To generate a tax report using CoinTracking, click on the Tax Report button under the ‘Tax Report’ tab. then fill in the required details including your country, year, method and type of calculation (Calculate tax and gain or Calculate gain only) among others.

Then click on ‘Generate a new Tax Report now’.

Pros and cons of CoinTracking

Pros

- CoinTracking supports imports from all most all crypto exchanges and wallets including popular hardware wallets like Trezor and Ledger Nano S.

- The paid packages allow users to automatically prepare tax reports in a wide range of methods including FIFO, LIFO, HIFO, AVCO, and ACB.

- The process of creating tax reports using the CoinTracking app is simple and straightforward.

- The CoinTracking app is designed to fit with a wide range of tax laws including the US tax laws, the Capital Gains, the FBAR, Form 8949, and the German Tax declaration under the Income Tax Act among many other.

Cons

- The Free package does not allow users to automatically generate tax reports.

- The numerous features can be overwhelming for crypto beginners.

- The pricing packages are charged annually rather than monthly, making it expensive especially for low-volume traders.

Why you should use Cointracking

If you are looking for a one-stop app that can allow you to track your crypto portfolio and generate your crypto tax reports, then CoinTracking could be a good choice. You can even choose to use the free package, especially if you are a low-volume crypto trader, where you manually input your trading data.

It allows you to generate reports using a wide range of methods including FIFO, LIFO, HIFO, AVCO, and ACB and it is also compatible with crypto tax laws in a wide range of countries around the world.

It is also relatively easy to use and integrates with a wide range of crypto exchanges and wallets allowing you to automatically import trading data from the exchanges and wallets that you use.

Final Verdict

In a nutshell, the CoinTracking app is a great tool for crypto investors and traders and it is designed to suit beginners, experienced individual traders/investors, and institutions.

It is a leading tax reporting platform that is run by a well-reputed company that keeps improving its product features to conform to the ever-changing crypto landscape, especially when it comes to crypto laws.

The post CoinTracking review: its pros, cons, and how it works appeared first on CoinJournal.