Popular cryptocurrency exchange Coinbase has been forced by court order to hand over thousands and thousands of its customers’ names and assorted personal information to the US Internal Revenue Service (IRS) in the agency’s effort to collect tax.

Also read: How To Regain Control From Nanny Zuck

Coinbase Sends Out IRS Notice

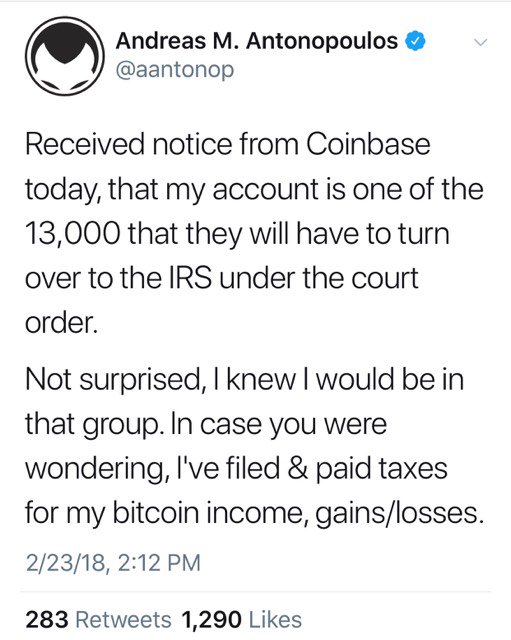

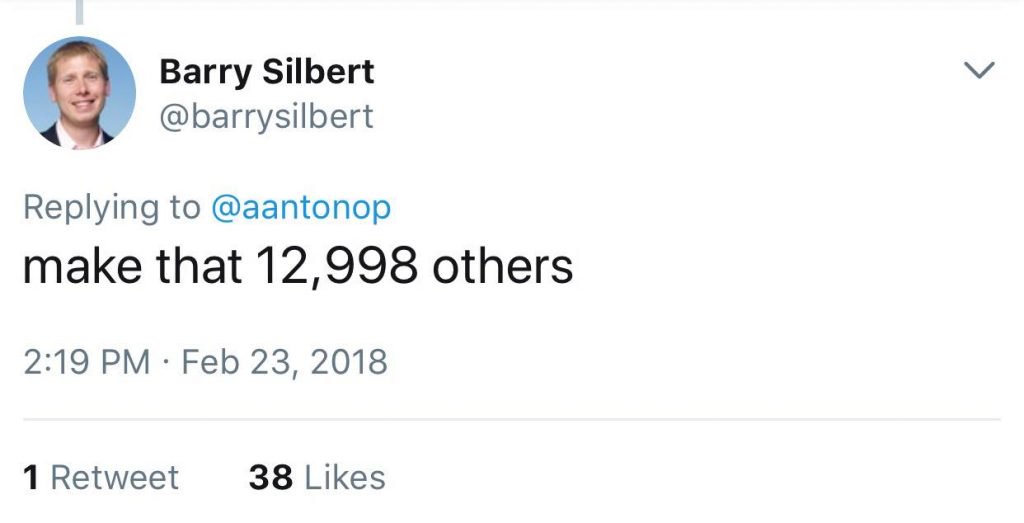

“Received notice from Coinbase today,” Tweeted Andreas Antonopoulos, “that my account is one of the 13,000 that they will have to turn over to the IRS under the court order. Not surprised, I knew I would be in that group. In case you were wondering, I’ve filed & paid taxes for my bitcoin income, gains/losses.”

Coinbase users would be wise to check email spam folders. It could be the difference in a potential IRS audit or worse. On Friday, the San Francisco-based cryptocurrency exchange notified thousands of customers, some 13,000, in compliance with a court order to provide the IRS with “taxpayer ID, name, birth date, address, and historical transaction records for certain higher-transacting customers during the 2013-2015 period.” The subject line read, An important message from Coinbase.

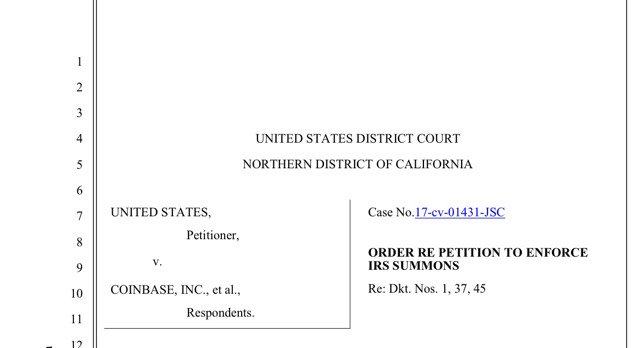

The announcement stems from a rather valiant fight Coinbase mounted in response to a late 2016 summons from the United States tax arm, “demanding that Coinbase produce a wide range of records relating to approximately 500,000 Coinbase customers. Coinbase fought this summons in court in an effort to protect its customers, and the industry as a whole, from unwarranted intrusions from the government.”

Be Careful Out There

Indeed, one of the revelations to come out of that tussel was how few US crypto enthusiasts had even bothered to address the tax issue. There was also plenty of ambiguity in how the US government ultimately classified bitcoin in particular. Nary a day passed when a bureaucrat would fail to disparage the decentralized currency, denying its definition or value. That left more than a few bitcoiners with the feeling the IRS had bigger and more important fish to fry.

That was, of course, until crypto markets started their nonstop boom. Nothing quite changes government minds and hearts like wealth. Suddenly, this niche phenomenon was building rather large capitalization and complexity. As a result, Coinbase continues, “After a long process, the court issued an order that represents a partial, but still significant, victory for Coinbase and its customers: the order requires Coinbase to produce only certain limited categories of information from the accounts of approximately 13,000 customers.”

Coinbase’s weird month continues, as Visa and Worldpay were forced to clarify why duplicate transactions appeared on customer accounts. These are the kinds of user experiences that can permanently sour customers, and so the exchange was sure to have bolded and italicized, “This issue was not caused by Coinbase.” The same might be said for the tax issue, however the company did choose the centralized route as opposed to decentralized cryptocurrency exchanges and peer-to-peer arrangements.

There’s plenty of misinformation regarding tax preparation and what qualifies. Enthusiasts are encouraged not to be coy on the issue, especially if they’ve transacted publicly on centralized exchanges such as Coinbase and are US residents. Regardless of one’s opinion on the morality of tax, the IRS has courts and cops and cages on its side. Governments are shockingly fantastic at two things: mass murder and revenue collection. Google crypto tax preparation outfits, scour forums, and seek trusted advice. Avoid anyone or organization encouraging running afoul of tax law unless they’re willing to pay fines and occupy a jail cell on their advice.

How are you handling the crypto tax issue? Let us know in the comments section.

Images courtesy of Pixabay, Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post Coinbase Compelled by IRS to Provide 13,000 Customers’ Information appeared first on Bitcoin News.