Bitcoin Cash (BCH) only months old is being floated as a possible addition to a futures offering family by Cboe Global Markets (Cboe). Cboe is looking to differentiate itself from a growing chorus of rivals as it prepares to launch futures contracts by year’s end.

Also read: Egypt Finance Attorney General Calls for International Governance of Bitcoin

Bitcoin Cash Could be Family

December 2017 began with a giant announcement. Release pr7654-17 from the Commodity Futures Trading Commission (CFTC), titled CFTC Statement on Self-Certification of Bitcoin Products by CME, CFE and Cantor Exchange, began, “Today, the Chicago Mercantile Exchange Inc. (CME) and the CBOE Futures Exchange (CFE) self-certified new contracts for bitcoin futures products.”

In financial-speak that means legacy institutions are cleared to enter the cryptocurrency ecosystem.

Classic bureaucrat understatement reminded the public of the regulator’s burden: “Bitcoin, a virtual currency, is a commodity unlike any the Commission has dealt with in the past,” the Chairman said. “As a result, we have had extensive discussions with the exchanges regarding the proposed contracts.”

It was presumably a welcome boon to Cboe, which seemed to be lost in media excitement over CME’s firm dating of a futures rollout along with Nasdaq’s mid-2018 bid.

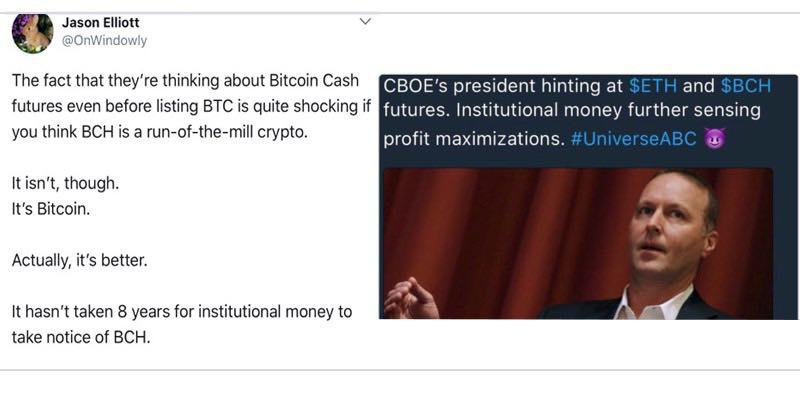

Frank Chaparro reports Cboe looks like it might be willing to up the competition by appealing to more than just one cryptocurrency. Paraphrasing Cboe President Chris Concannon, “the exchange thinks a family of cryptocurrency products, including futures for ether and bitcoin cash, could come to fruition as the market continues to mature.”

Cboe Once Bitten but Not Twice Shy

And if forward thinking when it comes to cryptocurrency futures is being scored, Mr. Concannon’s company has an inherited advantage over CME in that Cboe gobbled up Bats Global Markets. Bats was the first to attempt mainstreaming cryptocurrencies as an ETF, but was ultimately rebuffed by the SEC.

“I applaud Terry Duffy [of CME] in joining us in this endeavor,” Mr. Concannon told Business Insider with a wink. “This is the beginning of what will become a major asset class over the next 10 years. We started down this road in the form of an ETF. A healthy market is a healthy underlying market, derivatives markets, and an ETF. That will take time.”

Not to be outdone, Cboe made its own December announcement, stating “the Cboe Futures Exchange (CFE) has filed a product certification with the Commodity Futures Trading Commission (CFTC) to offer bitcoin futures trading,” adding the launch date would be shared soon publically.

Each contract “is equal to one bitcoin,” Cboe detailed. “The contract size is equal to a single bitcoin which allows for easy hedging of bitcoin positions.”

“The contract multiplier will be 1 so if a contract is trading at parity with bitcoin it will be worth about $9000 based on current pricing. The minimum tick for a directional, non-spread trade is 10 points or $10. A spread trade will have a much smaller tick of 0.01 bitcoin or $0.01,” Cboe continued.

“Standard, or monthly, contracts may be listed to expire for three continuous months and farther out for months on the March expiration cycle (Mar, Jun, Sep, Dec). There may also be up to four serial weekly expirations. Standard (think monthly) contracts will expire on the 2nd business day before the third Friday of the month which typically will be a Wednesday.”

Do you believe Cboe will add Bitcoin Cash? Tell us in the comments below!

Images courtesy of: Pixabay, Twitter, Bitcoin Cash.

At Bitcoin.com there’s a bunch of free helpful services. For instance, check out our Tools page!

The post CME Rival Cboe Suggests its Coming Futures Market Would Include Bitcoin Cash appeared first on Bitcoin News.