Just recently news.Bitcoin.com reported on the Chicago Mercantile Exchange (CME Group) planning to launch its bitcoin-based derivatives products this quarter. Now according to CME’s bitcoin futures market specs, the firm plans to launch its derivatives products on December 10 pending regulatory approval.

Also read: Troy University’s Malavika Nair Says Bitcoin Is Something Different Than a Classic Bubble

CME Group’s CEO Terry Duffy: ‘Our Exchange is the Natural Home for This New Bitcoin-Based Vehicle’

![]() At the end of October, the world’s largest options exchange announced it would be offering mainstream investors the chance to participate in bitcoin-based futures markets in Q4 of 2017. The company will follow the firm, LedgerX, which has been swapping bitcoin futures for a few weeks now. Terry Duffy, CME Group’s CEO, and Chairman explained at the time that there is a lot of interest in bitcoin derivatives products stating;

At the end of October, the world’s largest options exchange announced it would be offering mainstream investors the chance to participate in bitcoin-based futures markets in Q4 of 2017. The company will follow the firm, LedgerX, which has been swapping bitcoin futures for a few weeks now. Terry Duffy, CME Group’s CEO, and Chairman explained at the time that there is a lot of interest in bitcoin derivatives products stating;

Given increasing client interest in the evolving cryptocurrency markets, we have decided to introduce a bitcoin futures contract — As the world’s largest regulated FX marketplace, CME Group is the natural home for this new vehicle that will provide investors with transparency, price discovery and risk transfer capabilities.

CME’s Aims to Launch Futures Products on December 10

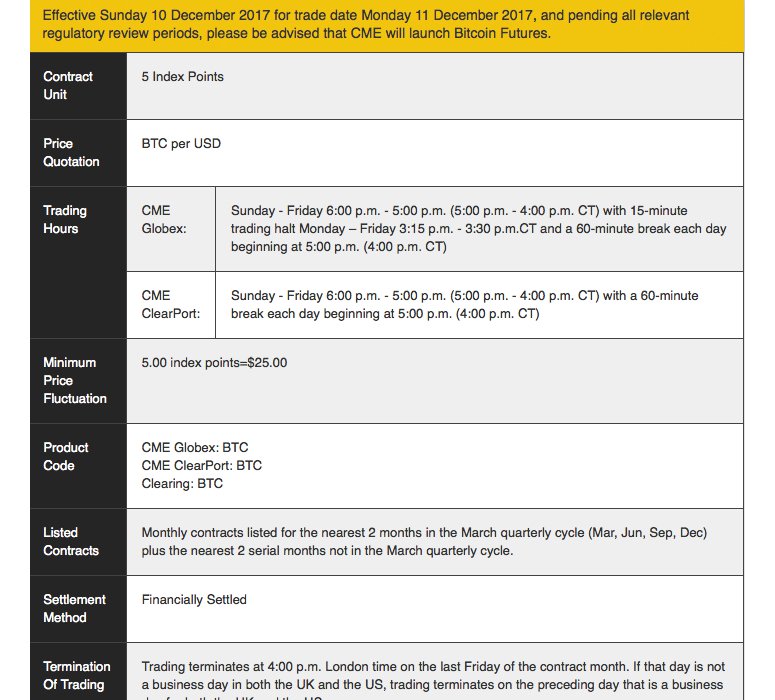

CME has released its futures market specs, and on November 19 a date was revealed for launch time pending U.S. regulatory approval.

“Effective Sunday 10 December 2017 for trade date Monday 11 December 2017, and pending all relevant regulatory review periods, please be advised that CME will launch Bitcoin Futures,” explains CME Group’s most recent update.

CME’s futures will be based on the price of BTC per USD with a contract unit of five index points. The products will be listed on CME, Clearport, and CME’s Globex central standard time, and the five index points will be $25. Further, registered monthly contracts will be for the nearest two months in the March quarterly cycle (Mar, Jun, Sep, Dec) plus the nearest two serial months not in the March quarterly cycle, explains CME.

Will Futures Tame Bitcoin’s Volatility or Amplify Price Swings?

Some speculators believe CME’s futures products will bring less volatility to bitcoin spot markets. For instance, the company’s contracts will be issued for $25 USD but will not swing more than 20 percent above or below the previous settlement prices. However taming bitcoin’s significant price fluctuations with futures markets is currently a theoretical concept as cryptocurrency is a whole new beast as far as trading is concerned.

For now, a bunch of bitcoiners are looking forward to seeing what CME’s bitcoin futures bring to the digital asset’s ecosystem, and cryptocurrency enthusiasts will soon find out.

What do you think about CME Group launching its bitcoin futures contracts on December 10? Let us know in the comments below.

Images via Pixabay, and CME Group.

Do you like to research and read about Bitcoin technology? Check out Bitcoin.com’s Wiki page for an in-depth look at Bitcoin’s innovative technology and interesting history.