When it was announced on Monday that Circle would be acquiring Poloniex, much of the focus was on the $400 million reported to have changed hands. It was a good bit of business for both parties, ran the general consensus, and not a bad deal for customers of the exchange either, who might finally experience something resembling customer service. The ramifications of the deal extend far further, however, hinting at the shape of U.S. cryptocurrency trading to come.

Also read: Cryptocurrency Exchange Poloniex Has Been Bought by Circle

More Compliance, Less Securities

On the surface, the Circle-Poloniex deal looks like a simple changing of the guard: out with the old, in with the new. As a holder of a coveted Bitlicense, and the operator of several popular trading apps, Circle is everything Poloniex is not: mobile, user-friendly, and well connected. Its acquisition of the rickety but well-regarded Polo exchange is an indicator of the new world that cryptocurrency traders are being herded into, one characterized by more compliance and less securities tokens. It’s a world which looks very similar to the realm of traditional finance that cryptocurrency was once meant to subvert.

On the surface, the Circle-Poloniex deal looks like a simple changing of the guard: out with the old, in with the new. As a holder of a coveted Bitlicense, and the operator of several popular trading apps, Circle is everything Poloniex is not: mobile, user-friendly, and well connected. Its acquisition of the rickety but well-regarded Polo exchange is an indicator of the new world that cryptocurrency traders are being herded into, one characterized by more compliance and less securities tokens. It’s a world which looks very similar to the realm of traditional finance that cryptocurrency was once meant to subvert.

It is no secret that one of Circle’s biggest backers is Goldman Sachs. The Poloniex deal gives the Wall Street investment group a major stake in the cryptocurrency game but without getting its hands dirty or reputation sullied. If Circle transforms Poloniex and the exchange prospers, Goldman Sachs profits. If things go awry, it’s Circle’s problem, not Goldman’s. One of the reasons why bitcoin was hailed as a disruptive technology was the way in which it redistributed wealth from the 1% to the geeks, anarchists, and cypherpunks. Now the pendulum has swung the other way. Not only do the old guard have skin in the game; they’re now running the game.

Wall Street Wades In

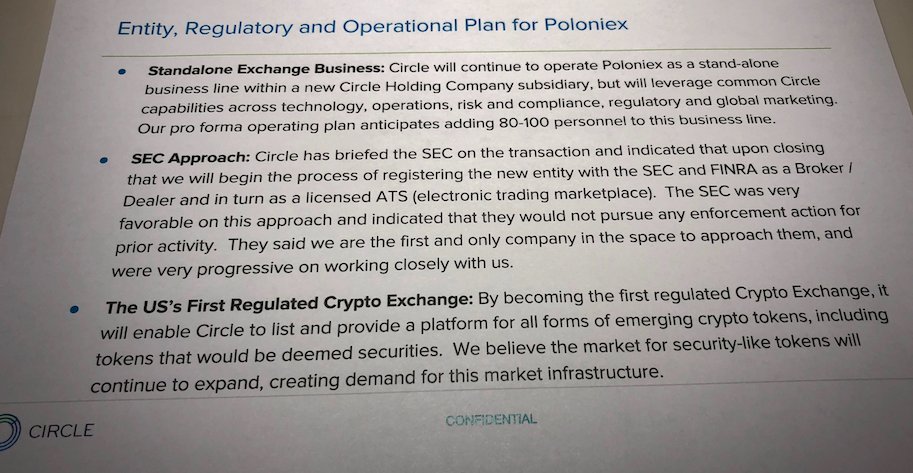

Circle’s acquisition of Poloniex doesn’t grant it (and by extension its backers, including Goldman Sachs) instant hegemony over the cryptoverse. There’s a lot of other exchanges out there and a lot of other countries that are beyond its grasp. Within the U.S, though, there’s evidence that the old boys’ club of traditional finance is starting to assert itself in the cryptosphere. The New York Times’ Nathaniel Popper shared a leaked slide from a Circle presentation which purported to show tacit approval for the takeover from the SEC.

The gist of it went something as follows: “You guys buy Poloniex, get its house in order, and we won’t come after you for the sins of the past”. It’s possible that this slide has been misinterpreted, with Coinbase Board of Directors member Kathryn Haun retorting: “After 12 years with the feds I’d be very surprised to see a statement like that ever made by an enforcement body.” What can be asserted confidently is that Circle is very well connected, and would not have entered into the Poloniex deal without assurances, no matter how informal, that its $400 million new football would not be punctured by a sudden subpoena.

Poloniex Gets a Pass

If Poloniex has been guilty of any misdeeds, they likely pertain to failure to perform full compliance – something the exchange has since introduced. Joseph Weinberg, chairman of KYC platform Shyft, believes this to be the case, stating: “In the past, Poloniex had a lot of issues with onboarding new users and properly building out its KYC process, mainly due to the large amounts of time it takes to verify users…Through this acquisition, Circle will deploy more people to help handle compliance – more employees to build and process KYC due diligence faster. This is the same type of issue traditional banks have when it comes to scaling. Compliances costs keep multiplying.”

The other issue Poloniex might need to address is delisting tokens that constitute securities. Regulatory agencies may demur, but in the eyes of the public, listing securities and failure to perform full compliance are hardly major crimes. It’s not as if Polo has been laundering hundreds of millions of dollars a la Btc-e, the exchange which the Justice Department shuttered last year after indicting its operator Alexander Vinnik.

The status of crypto tokens which may constitute securities, and thus fall foul of SEC regulations, has been a matter of some debate. Bittrex has been delisting tokens for months, potentially for this very reason, and Bitfinex has also barred U.S. customers from trading tokens on its exchange. In the wake of the Circle-Polo deal, one lawyer speculated that a number of tokens on Poloniex may be delisted, going so far as to predict: “You’re going to see most Alts disappear from US exchanges.” That seems unlikely, but tokens that represent a share in a platform – and which are thus eligible for dividends – will almost certainly be at risk. Some people believe that Circle’s purchase of Poloniex will enable the exchange to start listing security tokens, once the requisite permissions are in place.

Maximum Oversight from Hereon In

Cryptocurrency exchanges today are virtually unrecognisable from the free and easy days of Mt Gox and Vircurex, when KYC consisted of an email address and passwords were stored in plaintext. Both of those exchanges have since been hacked into oblivion, and many more have fallen by the wayside. Save for major players like Kucoin and Binance – which are beyond the realms of U.S. regulators, and don’t allow fiat deposits in any case – mandatory KYC/AML is now the norm.

Cryptocurrency exchanges today are virtually unrecognisable from the free and easy days of Mt Gox and Vircurex, when KYC consisted of an email address and passwords were stored in plaintext. Both of those exchanges have since been hacked into oblivion, and many more have fallen by the wayside. Save for major players like Kucoin and Binance – which are beyond the realms of U.S. regulators, and don’t allow fiat deposits in any case – mandatory KYC/AML is now the norm.

Due to robust compliance procedures, coupled with the transparency that blockchain provides, officials now have greater insight into cryptocurrency users – their personal details, transfers, and trades – than they do of investors from any other financial market. Thanks to increased regulation coupled with investment from the Goldman Sachs of the world, the future of money looks not so different from the past.

How do you feel about Goldman Sachs indirectly gaining a stake in Poloniex and do you think the SEC gave Circle assurances in advance? Let us know in the comments section below.

Images courtesy of Shutterstock, Twitter, and Circle.

Need to calculate your bitcoin holdings? Check our tools section.

The post Circle-Poloniex Deal Presages the Future of Cryptocurrency Exchanges appeared first on Bitcoin News.