As Chinese-based bitcoin exchanges plan to shut down, bitcoin investors are taking their trading elsewhere. They will now focus on broker-facilitated, over-the-counter exchanges.

Also read: Nebraska Ethics Board Allows Attorneys to Accept Bitcoin

Prior to exchange shutdown notices, most traders conducted OTC exchanges on Weechat messenger. As a result of government crackdowns on Weechat users, bitcoiners have made an exodus over to privacy-centric messaging app Telegram. A Quartz article detailed the situation:

The favored app for arranging OTC trades was WeChat, the ubiquitous platform run by Chinese tech giant Tencent. Now brokers are moving to chat platforms operated by non-Chinese companies to keep the trades going, in response to new rules tightening controls on chat groups

A surge of traders have now moved to Telegram for its encryption protocols. They should now be able to disregard government as they continue to trade and speculate on various cryptocurrencies.

Exchange Crackdown Will not Harm Bitcoin

It appears this investor pivot to secret OTC trading, foreshadows how underground bitcoin trading may manifest in China. Investors and brokers will conduct trades silently, under the cover of Telegram’s encrypted darkness. In this sense, it is unlikely bitcoin or cryptocurrency will be harmed in the long term. The resiliency of the technology will emerge while under duress from the Chinese government.

trading may manifest in China. Investors and brokers will conduct trades silently, under the cover of Telegram’s encrypted darkness. In this sense, it is unlikely bitcoin or cryptocurrency will be harmed in the long term. The resiliency of the technology will emerge while under duress from the Chinese government.

Eric Zhao, the computer engineer who runs the CNLedger Twitter account echoed this sentiment, saying: “Exchanges are not what give value to blockchain assets like bitcoin. It is the intrinsic technology and numerous applications who play decisive roles.”

OTC Trading Necessary Because Chinese Authority May Block Access to Exchanges

Even though Bitcoin will survive regardless of what happens — there are a myriad of unverified reports coming out of China that authorities may block certain bitcoin sites. One document states the Network Bureau would stifle trading.

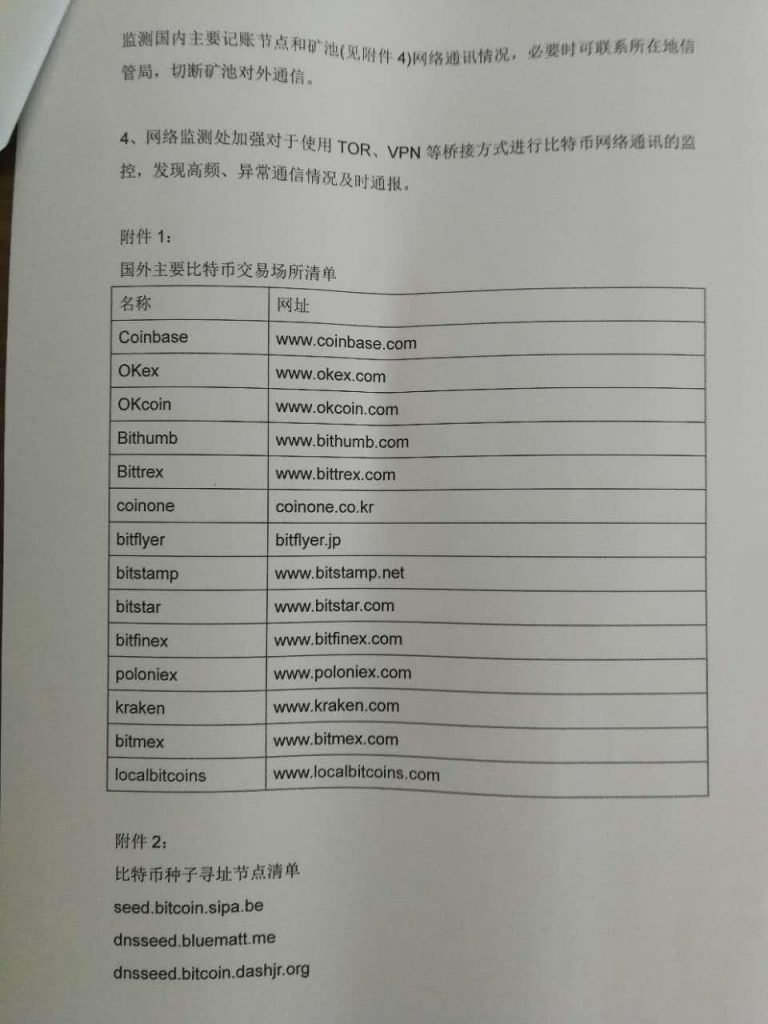

Loosely translated, the document states the Bureau would block access to Main BTC exchanges from abroad, including limiting API access. It would also block seed node addressing.

Loosely translated, the document states the Bureau would block access to Main BTC exchanges from abroad, including limiting API access. It would also block seed node addressing.

The Chinese government would also take action. It will analyze all DNS and IP addresses, and hand in lists to the IT Bureau. The document further stated:

Meanwhile, to prevent the domestic block nodes to sync with nodes abroad, government will monitor the communication between the domestic block node with the pool(appendix 4). In case of emergency, cut down the network of the pool. Monitor highly on the BTC network’s communication via bridge connection, TOR and VPN etc. Inform the most frequent request.

It is good to keep in mind that these reports are unverified, and they could, in part, be “fake news.” Nonetheless, it is clear the Chinese government is clamping down on cryptocurrencies, but traders appear to be unfazed as they maneuver to access underground and OTC trading networks.

What do you think about JP Morgan Securities Ltd. purchasing bitcoin-based exchange-traded-notes? Let us know in the comments below.

Images via Shutterstock

Need to calculate your bitcoin holdings? Check our tools section.