By Stephen Leeb

With most markets on lockdown on Halloween trading day, here is a big picture view of where the world is headed.

“This past week a New York Times headline that caught my eye was: “At Heart of U.S. Strategy; Weapons That Can Think.” The gist was that over the next few years the U.S. will be spending billions of dollars to make “smart” weapons, while also boosting our cyber budget by billions of dollars. It struck me as another example of how anytime we in the U.S. pound our chest about our mighty military, we always point to how much money have spent and plan to spend…

In a recent issue of Foreign Affairs, Michael O’Harlan and David Petraeus, men with exceptional military pedigrees, declare:

“U.S. forces have few, if any, weaknesses and in many areas…they play in a totally different league from the militaries of other countries…Nor is this likely to change anytime soon, as U.S. defense spending is almost three times as large as that of the United States’ closest competitor, China.”

Reassuring words? Maybe for a moment. But as soon as you think about it, they become anything but reassuring, showing that even when it comes to our most vital security issues, we make the fundamentally flawed assumption that money equates to wealth.

I’ve long been convinced that if the U.S. continues on what appears an ever more inevitable slide, historians will point to the day Nixon dropped the gold standard as launching that skid. Gold is wealth; paper is merely money. Money can facilitate the exchange of wealth, but by itself it is just paper or entries on a computer ledger and a very poor substitute for wealth. Commodities are wealth, and many vital commodities, as we pointed in a recent interview, can’t even be purchased any more – period. Information is also wealth. And no amount of money can guarantee an edge in information.

A few weeks ago, a 15- or 16-year-old who had recently become interested in chess wrote a letter to a chess blog asking how much he’d need to spend to become a Grand Master – how much for training, how much for practice time, coaches, etc. The only possible answer: not all the money in the world could turn a novice who’s already a teenager into a world-class player. Grand masters have a wealth of knowledge and savvy that can’t be acquired once you’re much past 7 or 8 years old. You’ve missed the boat.

Similarly, no amount of money enabled U.S. experts to crack the cell phone of the San Bernardino terrorists. But cyber experts from Israel, which spends a lot less on cyber issues, cracked it with relative ease. Israel, along with China and Russia, are among a number of countries, mostly located in Asia, that develop the skills of their gifted children at early ages. This has left the U.S. a poor second in critical areas ranging from cyber security to super computers, which will be the most essential tools in the next generation of a gold-centered monetary system.

Even nonbelievers should be starting to perceive the inevitability of gold replacing paper. A few metrics tell the story. First is the relationship between the dollar and economic growth. Despite the recent report of better-than-expected third-quarter GDP, the economy’s growth has been declining as the dollar has risen. In the wake of the Great Recession the dollar traded in a fairly tight range, while GDP growth in fits and starts peaked at 5 percent in the third quarter of 2014. The higher dollar has held GDP growth to less than 2 percent for the past two years.

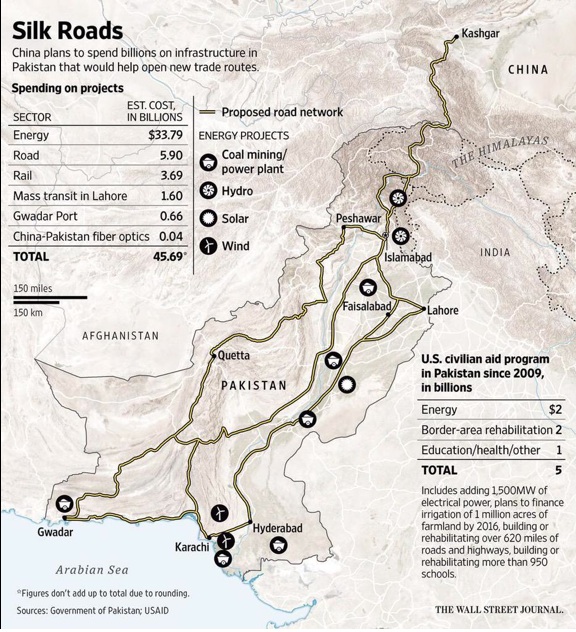

But commodities have begun to rise. Most major commodity indexes have climbed 10 percent or more this year. Even the temporary setback in obtaining an OPEC agreement won’t hold back real goods. Recently, for the first time since China announced its Silk Road initiative in 2013, a major article on the undertaking appeared in a major magazine, Foreign Affairs. Gal Luft , a senior advisor to the United States Energy Security Council, urged Washington to get aboard or lose out on the chance to benefit from the greatest infrastructure project in the history of civilization, many times the size of the Marshall Plan and already the destination of $1 trillion in Chinese exports this year, with dramatic growth likely for the foreseeable future.

But instead we’re likely to continue to use our dollars in ways that bear ever less connection to real wealth. Bear in mind that any effort to hold inflation down will crumble in the face of Western economies even weaker than ours. The result is that real interest rates will remain negative, an unalloyed positive for gold. At the same time the currency used along the Silk Road will be some combination of gold, the SDR, and the yuan. As we have said before, China’s edge in critical information technologies ensures its domination in virtual currencies such as the bitcoin, which will have multiple advantages in tomorrow’s gold-based world.

How High Will Gold & Silver Trade?

How high will gold go? Much depends on how much trade the Silk Road generates. Which means that if think gold could go to five digits, you don’t need a shrink – you’re sane as can be. And let’s not overlook gold’s poor cousin, which in the end could make you even richer, silver. The energies of our future will be anchored to solar, nuclear, and wind. The solar anchor will mean that already peaking silver will become some of the scarcest wealth around. If you’re dreaming of $100 silver, your dreams will be coming true before long.

To me it’s an ironic footnote to the Nixon years. Yes, history will record that America’s decline began when the much-maligned Nixon delinked the dollar from gold and let us conflate money and wealth. Meanwhile, though, you can make a fortune on the coming bull market in gold that will be the direct result of that decision.”