The Chinese authorities may be moving toward a broad clampdown on Bitcoin, including peer-to-peer (P2P) exchanges and over-the-counter (OTC) trading platforms. Using the Great Firewall to block IP addresses, access to foreign bitcoin exchanges could be blocked and the Bitcoin transaction network could be disrupted within the country. Bitcoin miners are also worried that their operations could be restricted.

Also read: Beijing Sets Deadlines for Bitcoin Exchanges – Customers to Withdraw Funds Quickly

Broad Clampdown Includes P2P & OTC Platforms

Chinese authorities have reportedly informed several industry executives at a closed-door meeting in Beijing on Friday that they are “moving toward a broad clampdown on bitcoin trading,” according to the Wall Street Journal on Monday. Citing people familiar with the matter, the news outlet wrote:

Regulators have decided on a comprehensive ban on channels for the buying or selling of the virtual currency in China that goes beyond plans to shut commercial bitcoin exchanges.

“Until last week, many entrepreneurs in China’s Bitcoin circles had thought authorities might shut down only commercial trading activity while tolerating peer-to-peer, or over-the-counter, bitcoin platforms, which enable buyers and sellers to find each other and trade directly,” the publication further detailed.

This news came after Beijing had ordered bitcoin exchanges to shut down, which many have already complied with, including Btcchina, Huobi and Okcoin. Following the regulatory crackdown, bitcoin’s prices initially fell but have since recovered. China’s trading volume has dropped to the fourth position globally, as traders migrated business to OTC markets and exchanges outside of China. Trading volumes on Localbitcoins subsequently spiked exponentially, news.Bitcoin.com recently reported.

This news came after Beijing had ordered bitcoin exchanges to shut down, which many have already complied with, including Btcchina, Huobi and Okcoin. Following the regulatory crackdown, bitcoin’s prices initially fell but have since recovered. China’s trading volume has dropped to the fourth position globally, as traders migrated business to OTC markets and exchanges outside of China. Trading volumes on Localbitcoins subsequently spiked exponentially, news.Bitcoin.com recently reported.

Last week, Bitkan suspended its OTC cryptocurrency trading service. The suspension, which began on September 14, affects the platform’s mobile app and site for BTC and BCC OTC services, the company announced.

Blocking Access to Bitcoin Exchanges Abroad

The Wall Street Journal also noted on Monday that, according to “people familiar with the matter”:

A broader clampdown will likely include blocking mainland access to websites of foreign bitcoin exchanges such as Coinbase in the U.S. and Bitfinex in Hong Kong.

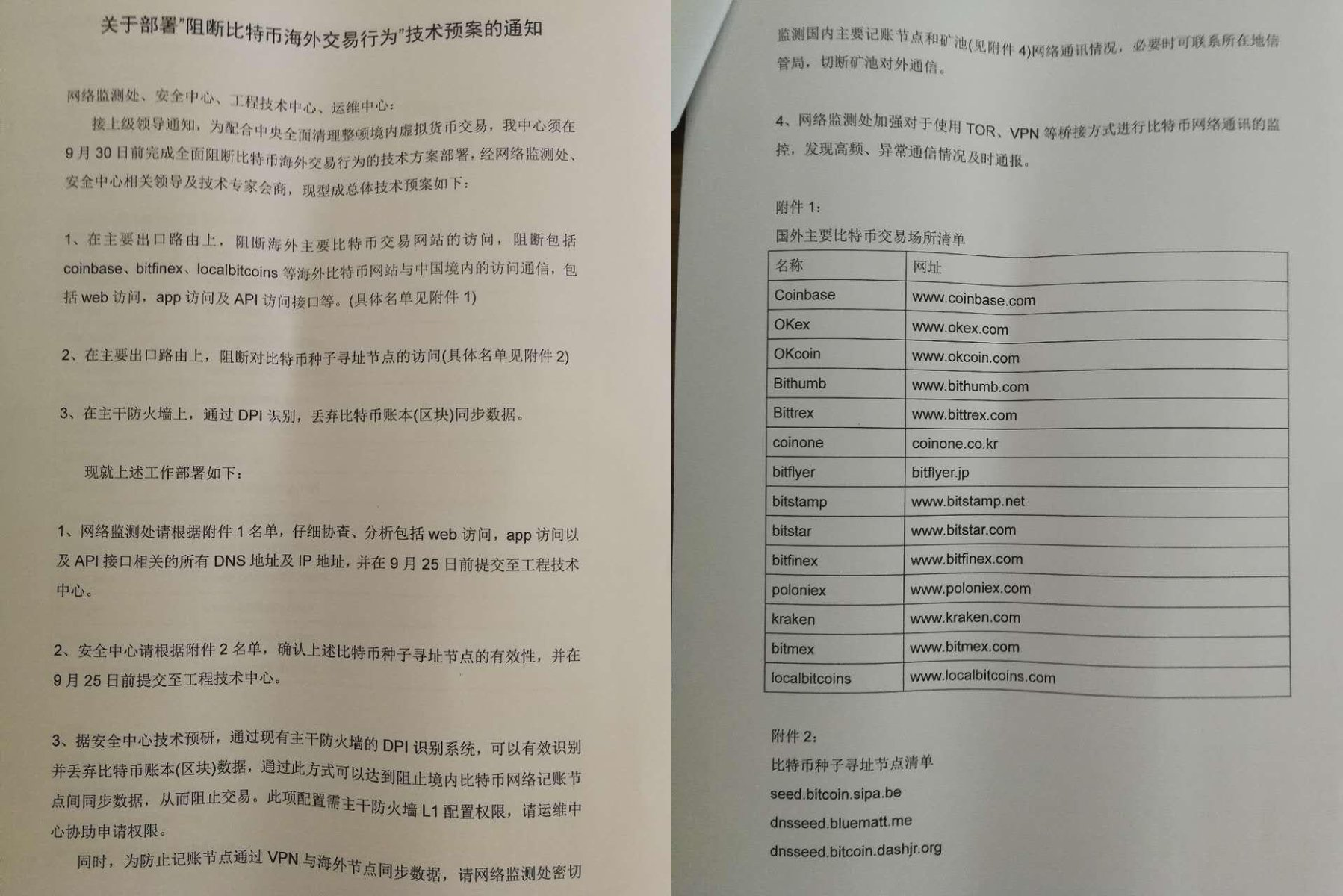

This concurs with a document which surfaced last week detailing how the Chinese government will try to block access to bitcoin exchanges and other important services that reside outside of the country. While the document is unverified, Sina claimed that it is authentic.

The bitcoin exchanges specifically named in the document include Coinbase, Okcoin, Bithumb, Bittrex, Coinone, Bitflyer, Bitstamp, Bitfinex, Poloniex, Kraken, Bitmex, and Localbitcoins.

Blocking External Bitcoin Network Nodes

According to the above document, all DNS and IP addresses of websites, apps, and APIs from foreign bitcoin exchanges will be analyzed, and access to each will then be blocked by the Great Firewall before September 30.

According to the above document, all DNS and IP addresses of websites, apps, and APIs from foreign bitcoin exchanges will be analyzed, and access to each will then be blocked by the Great Firewall before September 30.

The document also indicated an attempt to disrupt the basic P2P network routing of Bitcoin itself inside the country, which could disrupt the flow of bitcoins across the border. The government will monitor the network communication between domestic nodes and pools to prevent domestic nodes from syncing with nodes abroad. In addition, Bitcoin network communication bridges will be monitored including Tor and Virtual Private Networks (VPNs).

To circumvent China’s Great Firewall, some people have been able to use both the above methods in the past. However, an entrepreneur told the Wall Street Journal that “using VPNs as a workaround will be difficult.” Although the use of VPNs is not yet directly illegal in the country, China has found a way to convict people for selling VPN software. Earlier this month a Chinese man was imprisoned for doing so. The conviction was for “providing software and tools for invading and illegally controlling the computer information system,” according to the South China Morning Post.

To circumvent China’s Great Firewall, some people have been able to use both the above methods in the past. However, an entrepreneur told the Wall Street Journal that “using VPNs as a workaround will be difficult.” Although the use of VPNs is not yet directly illegal in the country, China has found a way to convict people for selling VPN software. Earlier this month a Chinese man was imprisoned for doing so. The conviction was for “providing software and tools for invading and illegally controlling the computer information system,” according to the South China Morning Post.

Bitcoin Miners Will Be Affected Too

While China’s bitcoin trading volume has fallen, its mining market share remains the largest in the world. The same aforementioned entrepreneur told the Wall Street Journal:

Until now, Chinese miners considered themselves immune from Beijing’s evolving stance on bitcoin trading. One entrepreneur said miners are now worried about authorities moving to limit their operations.

“With the tightening of the monitoring policy of bitcoin, the mining business is also affected,” a 21st Century Economic News reporter wrote on Tuesday. A Shenyang mining equipment dealer told the reporter that mining equipment does not sell well right now because of the current panicked market sentiment. With the domestic bitcoin trading platforms closing down and the prospect of overseas trading channels blocked, “mining business will be hit hard,” he said.

Do you think China will crackdown on all of the above bitcoin trading channels and harm their own mining industry? Let us know in the comments section below.

Images courtesy of Shutterstock, Asian Correspondent, and Sina

Need to calculate your bitcoin holdings? Check our tools section.