A major blockchain trial is moving toward implementation in Chile.

Revealed today, global tech giant IBM is making public a project with the Santiago Stock Exchange that will find Latin America’s third-largest stock exchange incorporating a blockchain-based securities lending solution built jointly by the two companies.

As explained by IBM, the new tool will help enable Chile’s securities lenders, banks, stock exchanges, institutional clients and regulators, to exchange information, while reducing the time it takes for relevant back-office processes by 40%.

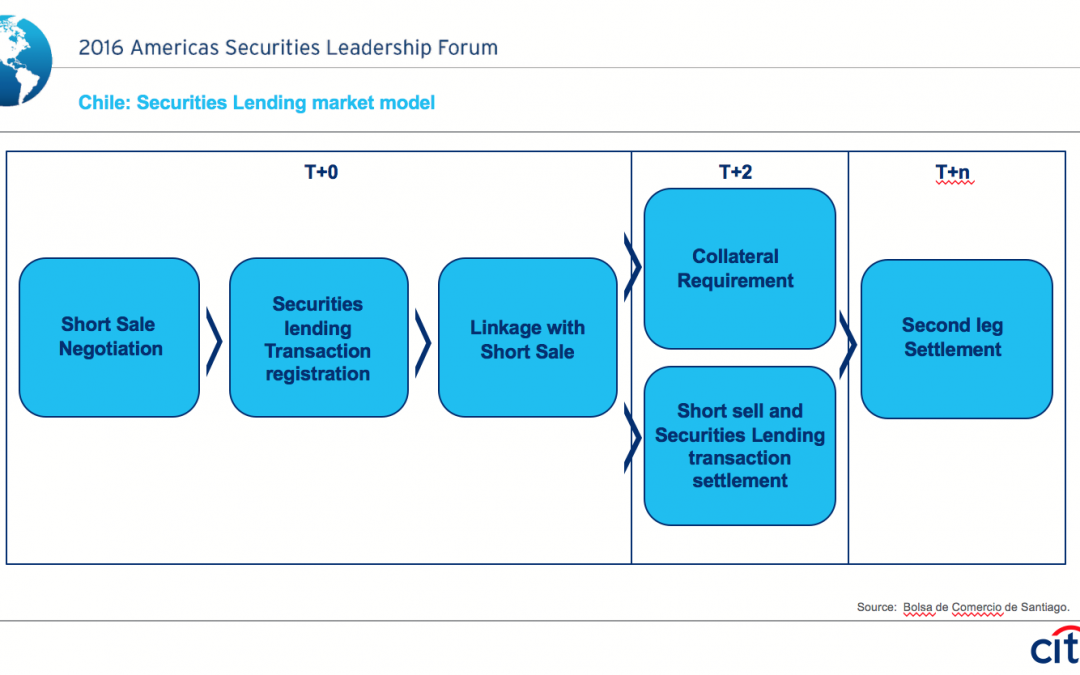

In this way, Santiago Stock Exchange CIO Andrés Aray indicated notably that it’s not the trading process – where certain ownership rights associated with a stock or derivate are traded in exchange for collateral – that is being automated, but rather the complex process that supports such economic activity.

Aray told CoinDesk:

“We spend two-to-three days after trading signing contracts, adding the assets, and the intermediary needs to create the collateral, all of that will now be put in a block that will be queried by different intermediaries.”

Santiago Stock Exchange, Aray explained, will now seek to create a private blockchain network for the exchange of this information, whereby participating banks and regulators will also operate nodes.

Aray went on to describe the process as “a great use case” for blockchain due to the complexity and the expense involved.

“The key thing that blockchain will provide is transparency related to the collateral in the lending short sale. Regulators and pension funds here in Chile, they have to know who the lender and the borrower are, and what kind of collateral they have in transactions,” he continued.

No POC

As explained by Aray, the announcement that the project will move toward implementation marks the end of year-long journey borne out of its past working relationship with IBM.

“At the end of the last year, we started thinking in real use cases. In 2010, we recreated our trading platform with IBM technology, and we are repeating the experience with blockchain technology,” Aray said.

This discovery process, he reported, led his team to travel to IBM’s New York offices to whiteboard different ideas for how the tech could potentially solve business pain points.

Ultimately, Aray stressed that the solution is not just a proof-of-concept, and that, by the end of the year, the goal is to begin using the system to track collateral relationships.

“We want to prove to the market and the regulators that this technology is possible,” he said.

The idea is now to run the blockchain-based system in parallel with its existing system over the next three-to-six months, with the goal of migrating the process completely to a distributed ledger next year.

Scaling plans

The goal over the next year is for the Santiago Stock Exchange to use its market position to build a larger ecosystem around the project.

For example, Aray noted that the Santiago Stock Exchange trades online stocks with other exchanges in countries like Peru in Mexico, and that these processes could begin to become more automated via DLT systems.

“It’s a small step for us, but it’s an important step to prove how Hyperledger Fabric can scale and move forward next year,” he said.

Fabric is one of the various standalone DLT frameworks within Hyperledger, one initially contributed by IBM developer Christopher Ferris. As such, according to IBM vice president of blockchain technologies Jerry Cuomo, the project is also an example of the current state of its projects with partners around the world.

Armed with working technology, Cuomo noted that the Santiago Stock Exchange must turn its focus to building a network effect.

Cuomo told CoinDesk:

“This is about taking it to the next level and starting to bring more of a consortium around [the project].”

Chilean peso image via Shutterstock