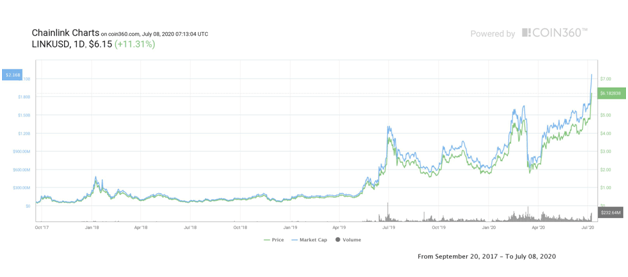

LINK/USD jumps to $6.15 to register its highest trading price ever

Chainlink’s price jumped to a new all-time high after surging more than 25% to hit $6.17 — obliterating the previous ATH at $4.82 reached in early March.

The massive gains meant Chainlink’s year-to-date gains have now outpaced those recorded by Bitcoin.

Currently trading at highs of $5.86, LINK/USD is now up 210% in 2020, compared to Bitcoin’s 30%. LINK/USD is up 3,480% since its ICO price in 2017.

The spike has also now seen the token become the 12th largest cryptocurrency by market cap at $2.16 billion.

What’s behind Chainlink’s price jump?

The price of Chainlink has risen in line with the surge in decentralized finance (DeFi) projects, causing the digital asset’s price to increase over the last few months. In that time, DeFi projects have seen their overall market cap rise exponentially.

Chainlink has also struck up numerous partnerships in the decentralized finance sector. The platforms are to be integrated with Link, to create a large ecosystem, including the Kyber Network, Aave, Protocol, Synthetix and recently bZx.

Chainlink will be able to increase its usage of oracles by connecting DeFi protocols to data feeds — including data related to prices of other digital assets.

The price surge for the LINK/USD token also comes on the back of news that China’s blockchain consortium has integrated the cryptocurrency’s price oracles. As reported in Cointelegraph, the consortium has launched 135 nodes, likely signalling that the oracles are also going live.

All of this, plus the expectation of staking on the Chainlink platform, is bullish news for LINK/USD.

LINK is riding momentum

At the moment, LINK/USD is riding upward momentum, having surged more than 25% in the last 24 hours.

Price for Link is likely to trend higher as traders enter the price discovery zone. Price is trading above the moving averages, so there is no telling where solid resistance is at the moment.

However, there the likelihood of a correction is there, given increased exchange volumes. According to Glassnode, there has been a new high seen in the number of coins sent to exchanges in June and July, up to levels last seen in March.

Therefore, it is likely that prices could experience a short-term pullback as the signal shows investors expect a downturn is in the offing.

The post Chainlink price shoots for the moon as a 25% boost takes it to $6.17 appeared first on Coin Journal.