The Commodity Futures Trading Commission (CFTC) has filed charges against 14 crypto companies—12 the regulator says failed to register as futures commission merchants (FCMs) and two more that allegedly lied about being registered with the CFTC.

According to a Wednesday press release, the 12 relatively unknown options merchants accused of failing to register with the CFTC are New York-based. The two companies that are accused of “making false and misleading claims of having CFTC registration and National Futures Association (NFA) membership”—Climax Capital FX and Digitalexchange24.com— are based in Texas and Arkansas, respectively.

The CFTC oversees derivatives markets rather than spot commodity markets. Rather than regulating commodities themselves, the CFTC regulates futures contracts and derivatives products like swaps.

The CFTC has traditionally taken more of a backseat role in crypto regulation than the Securities and Exchange Commission (SEC), but there are signs this might be changing as the two regulatory bodies jockey for power.

Earlier Wednesday, crypto exchange Kraken agreed to pay $1.25 million to settle charges with the CFTC after the regulator accused Kraken of failing to register as an FCM and offering illegal margined digital asset transaction services.

The CFTC also brought a high-profile suit against BitMEX, which it accused of offering U.S. customers leveraged and unlicensed crypto products. BitMEX agreed to pay a $100 million dollar fine to settle the civil charges.

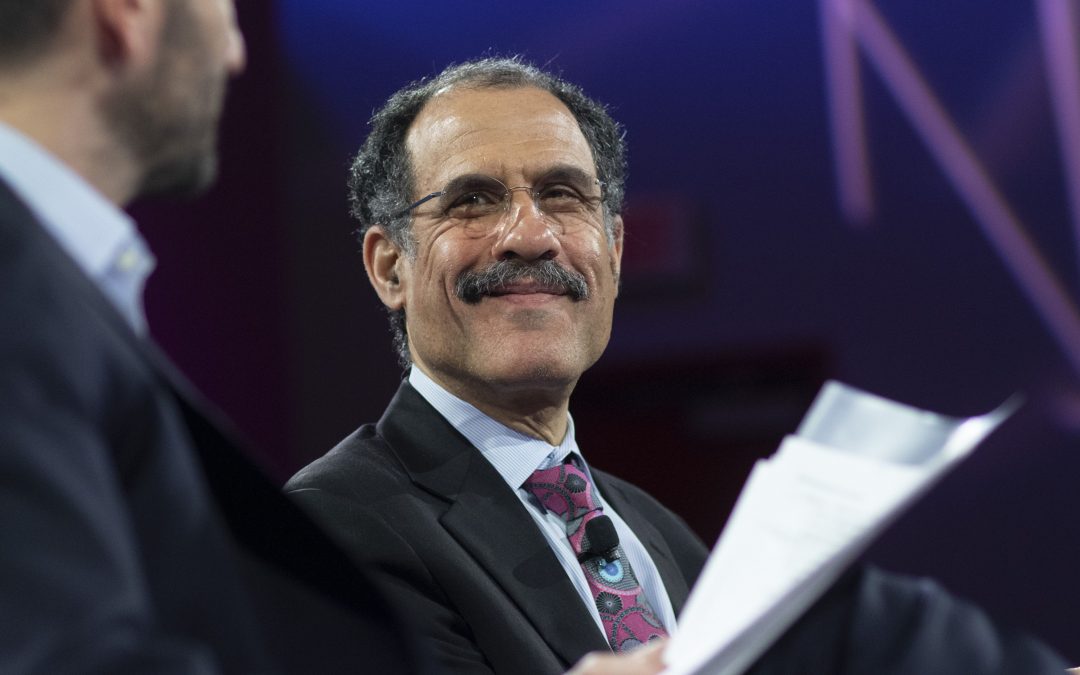

With the announcement on Tuesday that Commissioner Dan Berkovitz would be departing the CFTC to serve as the SEC’s general counsel under Chairman Gary Gensler, the normally five-person CFTC will be operating with a skeleton crew of only two commissioners: Commissioner Dawn Stump and Acting Chairman Rostin Behnam.