Central bank digital currencies (CBDCs) have long been a topic of contested discussion, having often been met with a predominantly negative response in the crypto community. However, despite the skepticism, CBDCs undeniably serve as a significant use case for blockchain technology.

BDCs distributed through blockchain technology can provide cheaper, faster and possibly more accessible transactions than traditional banking systems, while also possessing the potential to more effectively counter illegal financial activity, including money laundering. Still, whether these benefits are worth the increased control by governments over citizens’ finances and the risks of system failure when central banks make mistakes is an open question for debate.

Cointelegraph Research maintains its CBDC Database in order to provide an up-to-date overview of the worldwide state of CBDC projects, gathering all the available data on the existing initiatives in this field.

Overall view

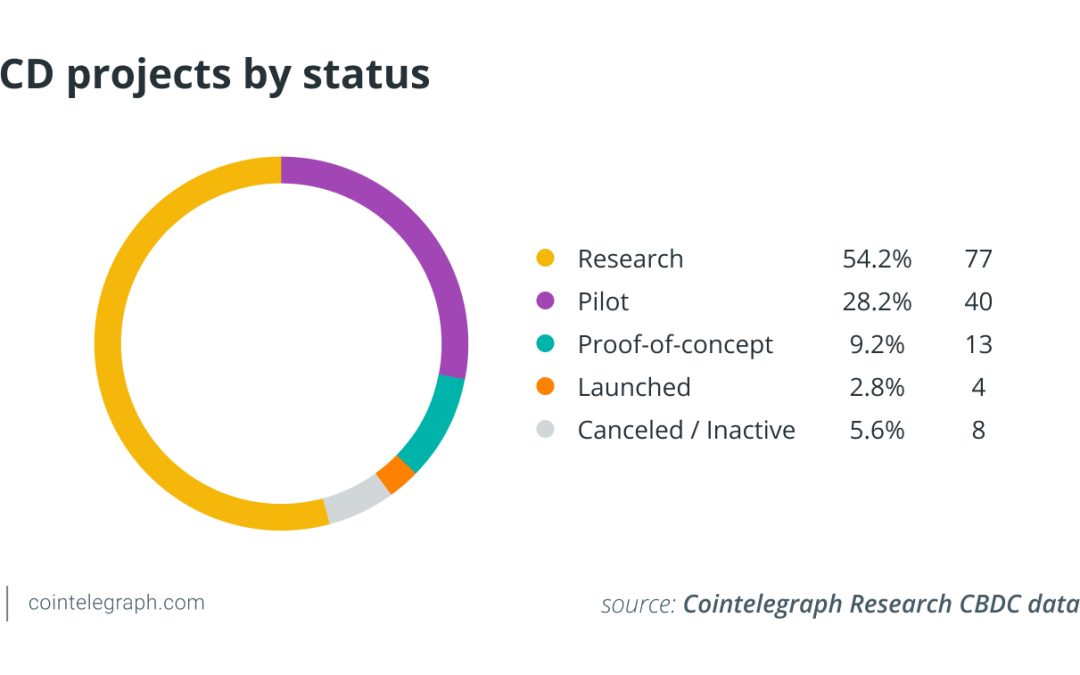

The number of existing CBDC projects has increased significantly over the past few years. Currently, over 100 countries are exploring the topic of CBDCs, and while approximately half of them are still in the stage of research and development, there are 39 countries that have either pilot, proof-of-concept or launched CBDC initiatives.

Particularly interesting is the process of CBDC discussion in countries where financial freedom is a topic of constant debate, such as the United States and Canada, especially given that many conservative politicians have strongly criticized or even prohibited the introduction of CBDCs.

In particular, Florida has already banned the usage of a potential U.S. CBDC in the state, while a whole group of states — including Alabama, Louisiana, North Carolina and Texas — have expressed opposition to the introduction of a CBDC in the United States.

Global initiatives

Contrary to that, countries like the United Arab Emirates, China and India seem to recognize the advantages of CBDCs in the field of international transactions and have launched their pilot projects, which are already showing results. For example, India’s digital rupee pilot, launched by the Reserve Bank of India, has attracted 50,000 individuals and 5,000 merchant users. If successfully implemented at the level of international trade settlements, these projects can quickly transfer to wholesale and retail use, seriously affecting the global financial and banking systems.

Explore the CDBC Database by Cointelegraph Research

The development of CBDC technology is also facilitated by the active participation of the private sector. In particular, R3, Bitt Inc., IBM and Ripple play major roles in shaping the CBDC technology landscape, as they are listed as key partners in over 30 different projects in this field. For instance, Ripple recently announced its participation in the development of a digital currency for Montenegro, as well as the potential issuance of shares of tokenized real estate assets for retail use of Hong Kong’s digital Hong Kong dollar.

Finally, there are countries under severe sanctions pressure that see CBDCs as a potential instrument for circumventing restrictions. The inability to work with most international banks and payment systems makes the prospect of using blockchain for international financial settlements more attractive than ever. Both Russia and Iran are actively developing CBDC projects and exploring the prospect of creating a gold-backed stablecoin.

Overall, judging by the current environment in the field of CBDCs, it is most likely that further development in this area will depend on the world’s major economies, as most smaller countries are hesitant about introducing CBDCs. However, despite the hesitancy of many countries, there are also outliers to this trend, with some smaller nations already actively pursuing the implementation of CBDCs. Detailed information about them, along with comprehensive data on CBDC development across the globe, can be accessed in the Cointelegraph Research CBDC Database.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.