With the incredible rally of the crypto market in 2020, more and more people are looking to get into cryptocurrencies for the first time, and Capital.com wants to offer international traders a way to seize these opportunities. Their award-winning trading platform gives users access to contracts for difference (CFDs) on more than 3,000 assets including cryptocurrencies, stocks, indices, Forex and commodities.

Before signing up to a new exchange, however, most traders want answers to some important questions: Is it safe? What features does it have? What does it cost? What are its advantages and disadvantages? Well if you’re most traders then you’ve come to the right place! We’ll be looking into all these issues and many more in the following review.

3 Steps to Sign Up to Capital.com

- Register: At Capital.com it’s simple to create a free trading account – you just need an email address and a password. To complete your registration you will also have to prove your identity with a photo or scan of your passport, national ID document or driver’s licence

- Fund your account: Once your identity has been verified, there are an array of different payment methods for making your first deposit. These include using a credit card, debit card, bank wire transfer, ApplePay, Webmoney and Giropay. All subsequent deposits can also be made via Neteller and Skrill

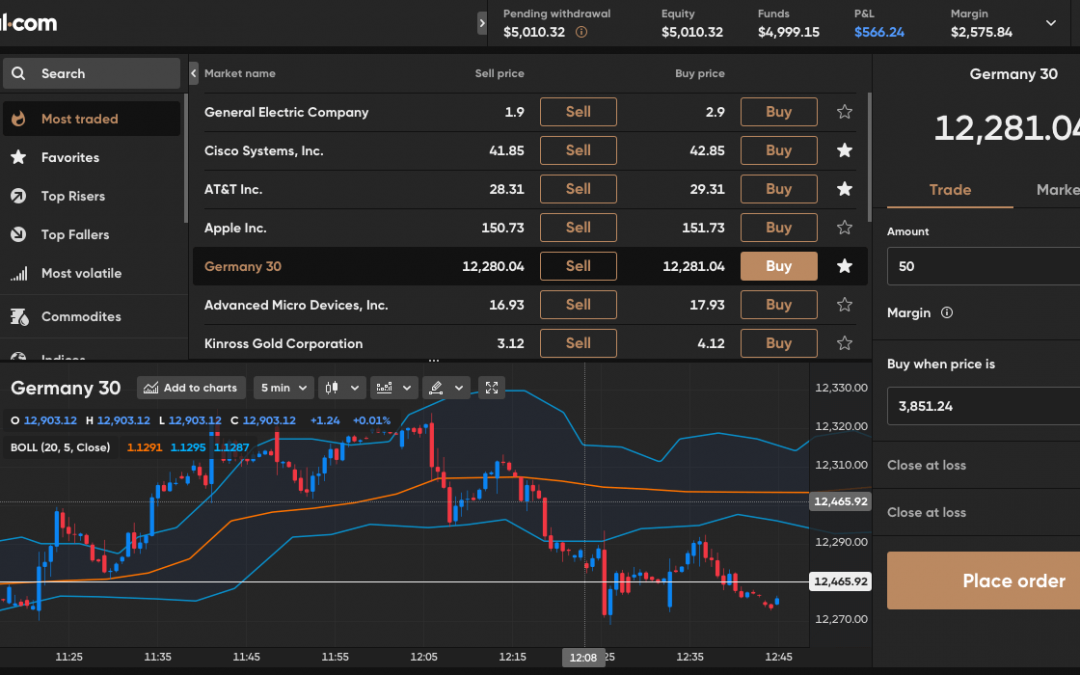

- Start trading: Your account is now ready to begin trading! The user-friendly interface will show you real-time prices for over 3,000 assets. But remember that CFDs and spread bets are high risk, so why not take advantage of Capital.com’s educational app, online courses and trading guides?

Capital.com Pros and Cons

Pros

- Free award-winning, easy to use platform

- 0% commission and no hidden fees

- Competitive spreads

- Fast order execution

- Access to over 3000 markets, including 70 cryptocurrency trading pairs

- Negative balance protection

- Mobile app for iOS and Android

- 24/7 customer support

- Access to educational resources

- Free demo accounts

- FCA regulated for high privacy and security standards

Cons

- Not as many cryptocurrency trading pairs as some crypto-centric exchanges

- Separate live account required for each different fiat currency

- Spread betting only available to clients registered under the FCA licence

Capital.com Compared

Capital.com is set apart from other exchanges by the award-winning AI-enabled technology that powers its platform, not to mention the ability to trade in more than 3,000 markets from Bitcoin to Apple to gold all in one place, eliminating the hassle of opening accounts on multiple exchanges for different assets. Its unique features have so far attracted 788,000 clients, who have traded $88 billion on the platform thanks in part to competitive fees and spreads offered by Capital.com are very competitive.

However, CFDs and spread betting aren’t for everyone, and those traders who prefer to use lower risk instruments may prefer to research the numerous other trading platforms and exchanges available, some of which also offer staking programs for certain cryptocurrencies.

History of Capital.com

Capital.com was founded in 2016, born out of the belief that finance and trading should be more accessible, useful and engaging. After going live in June 2017, Capital.com is now one of the largest CFD brokers in Europe, operating from its offices in the UK, Cyprus, Gibraltar and Belarus. The team behind it has a lot of experience in the development and innovation of online trading platforms, as well as a deep understanding of the regulatory framework of trading and financial compliance.

CEO Jonathan Squires brought to the platform 20 years’ worth of experience of developing new brands into market leaders. He has worked at a senior level in companies such as GlobalData, Trinity Mirror Digital and The Stars Group, leading to a significant impact on their respective market shares.

With an M.Sc in Computer Systems Engineering, Capital.com’s London CEO, Ivan Gowan, provides strategy and knowledge developed from the 15 years he spent as a member of the Senior Leadership Team of the London-based IG Group. During his time there, he was responsible in part for IG’s successful adoption of digitised spread betting and CFDs.

Capital.com was founded with the aim of building the easiest to use and most transparent financial platform possible while transforming the relationship between a trading platform and its customers. To this end they developed Emotional Quotient (eQ), a proprietary feedback system which helps traders to train their minds by identifying biases and unconscious behaviour with the use of artificial intelligence. Capital.com also launched Investmate in 2018, a dedicated educational app designed to help people get into investing.

Capital.com: Regulation and Security

Capital.com boasts high standards of privacy and security as it is regulated by the world’s top financial watchdogs, including the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). After becoming one of the earliest platforms to adopt regulations from the European Securities and Markets Authority (ESMA), Capital.com was also the first to comply with the 2018 ESMA leverage restrictions, which enhanced client protection.

Is Capital.com Safe?

As a licenced and regulated investment company, Capital.com keeps your money safe by storing its clients’ funds in segregated accounts at some of the largest European financial institutions including Eurobank, Raiffeisen and Royal Bank of Scotland. The broker is also a member of the Financial Services Compensation Scheme (only for FCA clients) and the Investor Compensation Fund (only for CySEC clients), and is audited by the accounting heavyweight Deloitte.

The trading platform guarantees the full protection of your personal data as well, which is not disclosed to any third parties except the regulator. Personal information is encrypted and protected at the highest possible level in full compliance with PCI Data Security Standards.

On top of this, Capital.com offers effective risk management tools such as negative balance protection, instant price alerts and stop loss and take profit orders, as well as offering a free demo account where clients can try out the platform’s features and practise their skills in a totally risk-free environment.

Capital.com Reputation

Capital.com has been building a reputation as a trustworthy environment where traders can develop their skills with access to thousands of world-renowned markets. It is a trusted partner of Trading View and Investing.com, and by the end of 2020, its international platform had enticed more than 788,000 clients and processed over $100 million in deposits.

Clients can also be encouraged by the many accolades the platform has won from prestigious international awards bodies, including Best Online Trading Platform in the 2019 Shares Awards and Most Innovative Broker and Most Transparent Brokerage Service Provider in The European’s Global Business Awards 2020.

Furthermore, Capital.com has earned itself a solid 4.5 star rating at TrustPilot.

Is Capital.com for Me?

I’m a Beginner

The user-friendly platform has an intuitive and easy to use interface along with a whole host of educational resources. The Investmate app offers a tailored approach to financial education where users can quickly find topics they want, save relevant information as favourites and take part in quizzes. Capital.com also offers online courses and trading guides where newbies can get to grips with the terms and concepts associated with leverage and CFD trading. On top of this, anyone can open a demo account and try out their skills without risking anything.

I’m Advanced

For those more seasoned traders, Capital.com is likewise an attractive option as it provides access to over 70 technical indicators, thousands of charts, client sentiment, price alerts, and 1:200 leverage (for professionals). The broker has ensured maximum performance through its development of a microservice hosting system where different elements of the platform are hosted on different servers to avoid downtime. Clients can also look forward to AI-powered post-trade analysis and continual market updates, news, forecasts and analytic features to help them stay on top of the latest developments.

What are the Benefits of Trading Crypto in Capital.com

Trading at Capital.com comes with a whole host of advantages. It provides a huge choice of instruments and markets including stocks, indices, commodities, Forex and cryptocurrencies, all of which clients can access to trade on market swings with CFDs and spread betting. One advantage of using CFDs or spread betting is that investors don’t actually have to own the stocks they invest in or lay out large sums of capital.

The leveraging system also offers the chance to maximise rewards as investors can trade with larger amounts than they deposited. The maximum leverage available on retail accounts varies depending on the asset and the regulator under which you are registered, with a maximum of 30:1. It’s important to remember though that trading on margin magnifies potential losses as well as potential returns.

The wide range of technical indicators offer more than 80 different studies that can be applied to markets. Traders can make use of moving averages for trend trading, the Relative Strength Index for overbought and oversold measures and Stochastics for swing trading, as well as more sophisticated approaches such as using Bollinger bands to gauge changes in market volatility.

Fees and Costs of Capital.com

Capital.com provides most of its brokerage services for free. It offers 0% commission and traders won’t incur any fees for deposits, withdrawals, real-time quotes, opening/closing trades, educational material and dynamic charts and indicators.

The platform is compensated for its services through the buy/sell spread which varies across different instruments. Spreads start from 0.6 pips for EUR/USD, 0.8 pips for GBP/USD, 0.03 for US crude oil futures, 1 for FTSE 100, 1.6 for Nasdaq 100 and 34 for BTC/USD.

The only additional cost is the overnight fee which differs with the instrument. You can find the specific overnight fee for your chosen instrument in the market information panel in the Capital.com platform, and unlike other brokers, Capital.com charges an overnight fee that is based only on the leverage provided rather than the entire value of your position.

Capital.com: Payment Methods & Limits

Funds can be deposited or withdrawn via a range of international methods:

- Debit card

- Credit card

- Bank wire transfer

- Webmoney

- Multibanco

- iDeal

- Sofort

- Giropay

- ApplePay

- Przelewy24

- Qiwi

- 2c2p

- Astropay TEF

- Trustly

- UnionPay China

- Dragonpay (online banking)

- Doku

- Bank Thailand (online banking)

- Bank Malaysia (online banking)

- Bank Indonesia (online banking)

- NganLuong (online banking)

The minimum deposit is $20, £20, €20 or zł20 for all payment methods except wire transfer, which has a minimum of €250 or equivalent in the trading account currency.

The maximum deposit is $3,000 for the Standard account, while the Plus and Premier accounts allow higher deposits with minimums of $3,000 and $10,000 respectively.

Trading flexibility depends on the amount you have in your balance.

Capital.com sets its daily payment limits for SafeCharge users depending on traffic:

1. For Non-3D traffic:

- €12,000 for new users

- €35,000 for senior users

2. For 3D traffic:

- €20,000 for new users

- €50,000 for senior users

Users become ‘senior’ two days after their first successful payment – before that they are considered ‘new’. 3D secure traffic adds an extra layer of safety to online transactions and requires additional authentication, other than the PIN and CVV.

Trading limitations

- Minimum trade size is $100

- There is no maximum limit, this will be however much capital you have to trade

Capital.com: Performance, Features and Functionality

The broker provides a one-click trading experience with access to over 3,000 markets encompassing stocks, commodities, indices, Forex and cryptocurrencies, all in the same place – no need to sign up to multiple exchanges to access different asset classes.

A unique benefit of Capital.com is its smart trading app. It reveals cognitive biases that prevent traders from making profitable trading decisions through the use of an AI-powered trading bias detection system. It will automatically spot any deviations in your trading behaviour, immediately alert you and offer helpful content to boost your trading skills.

Trading Platforms and Accessibility

Capital.com’s award-winning trading platform is online – no need to download anything. It has a clear layout with light and dark colour scheme options for your preference and provides seamless multi-chart toggling, allowing you to effortlessly toggle in and out of up to six tabs.

The charts are easy to read and customisable – traders can choose candlestick, bar, area, Heikin-Ashi or line charts. They then have the use of a diverse range of drawing tools including Fibonacci retracements and trend lines to identify major support and resistance levels.

The platform is also available on mobile for Android and iOS devices, so you can trade on the move.

Educational Resources

The platform provides a plethora of educational resources. As well as the Investmate app which allows users to set personal goals with access to more than 30 courses, short lessons and quizzes, the website also offers webinars, an extensive glossary and comprehensive guides covering various markets, trading strategies and principles of trading psychology.

On top of this, Capital.com’s Chief Market Strategist, David Jones, leads a successful Youtube channel with nearly 90,000 subscribers. They upload videos throughout the week offering in-depth market reviews and technical analysis of all kinds of financial assets.

Trading options

In 2020, Capital.com introduced spread betting, a flexible way of speculating on upward and downward market moves. This method of trading is particularly beneficial to traders from the UK and Ireland where it is free from capital gains tax and stamp duty (subject to changes in tax laws.)

Account Types

Capital.com offers 3 types of account:

- Standard account: This account has a minimum deposit of up to $3,000 and offers leverage of up to 30:1. The benefits are advanced charts, a range of markets and negative balance protection.

- Plus account: This account type requires a minimum deposit of $3,000 and offers leverage of up to 30:1. In addition to the Standard account benefits, the Plus account also offers a dedicated platform walkthrough, custom analytics and a dedicated account manager

- Premier account: The final account type at Capital.com requires a minimum deposit of $10,000 and provides leverage of up to 30:1. It comes with all the benefits of the Plus account as well as exclusive webinars and premier events

Final Thoughts on Capital.com

Having stocks, commodities, indices, Forex and cryptocurrencies all available in the same place certainly makes Capital.com a useful one-stop shop for traders with varied interests. While the CFD trading offered is high risk, it also provides traders with access to markets that would otherwise be difficult to gain exposure to, as well as the opportunity for leveraged returns.

The broker’s impressive record of compliance with regulators and security standards should give clients peace of mind, while the offerings of negative balance protection and other risk management tools should also inspire confidence.

In conclusion, the demo account and vast array of educational materials, along with the advanced charts and technical indicators, would appear to make Capital.com a welcoming environment for the inexperienced and seasoned trader alike.

FAQ’s

What markets can I trade?

Capital.com offers contracts for difference on over 3,000 of the most popular and liquid assets, including stocks (like Apple), commodities (like Silver), indices (like the Germany 30), currency pairs (like EUR/USD) and cryptocurrencies (like Bitcoin).

What features does the platform have?

Customers can make use of over 70 technical indicators, extensive drawing tools, seamless multi-chart toggling, dynamic price alerts, risk management tools and AI-powered trading behaviour analysis.

What does it cost?

Creating an account at Capital.com is free and the broker offers 0% commission. There is no fee for deposits, withdrawals, real-time quotes, opening/closing trades, educational material or dynamic charts and indicators. The only potential cost is the overnight fee and the spreads are competitive.

Is Capital.com suitable for beginners?

While the financial instruments on offer are high risk, those with less trading experience can take advantage of the free online courses, webinars, trading guides and educational Investmate app. Clients can also open a demo account to build their trading confidence without risking any of their own money.

Which currencies can I use to open an account?

Customers can open a live account in GBP (£), EUR (€), USD ($) or PLN (zł) and the minimum deposits are £20, €20, $20 or zł100 (for all payment methods except wire transfer). You will need to add a new live account to use a different currency and any profit you receive is converted into your account currency.

Is my money safe?

Capital.com is a licensed and regulated investment company that keeps its clients’ funds in segregated bank accounts at some of Europe’s largest financial institutions, so your money is secure. They have also introduced a compensation scheme as required by the regulator.

Can I trade via my mobile?

Yes. The mobile trading app is available for iOS and Android devices from the App Store and Google Play Store.

Does Capital.com provide support?

A professional level of customer support is available 24/7 via live chat, email, phone, Telegram, WhatsApp, Viber and Facebook. The customer service team can communicate with clients in English, Italian, Spanish, French, German, Arabic, Turkish or Russian.

Warning: CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly because of the use of leverage. Around 75% of retail investor accounts lose money when trading CFDs and spread bets with this provider. Before trading these assets make certain you understand how they work and whether you can afford to take the high risk of losing your money.

The post Capital.com Review 2021 appeared first on Coin Journal.