On Friday, June 11, a total of $565 million in Bitcoin (BTC) options are set to expire. This is significant because the last couple of weeks have been a massive deception for bulls. After all, the price was struggling to sustain the $33,000 support.

However, an unexpected bullish turn of events led to an 18.5% hike from the $31,000 low on June 8 to $38,491 today. This strong move saved the bulls because any level below $34,000 would have wiped 98% of the current call (buy) options.

Who saved the day?

First, MicroStrategy, a publicly-traded company that holds over $3.2 billion worth of Bitcoin, concluded a $500 million bond offering on June 8, and the proceeds will be used to buy more BTC.

On the same day, El Salvador’s Legislative Assembly approved Bitcoin as legal tender in the country. President Nayib Bukele stated that accepting Bitcoin would be mandatory for all businesses. Furthermore, the government announced that it would eventually hold $150 million worth of BTC in a trust fund.

The positive newsflow continued on June 8 after Victory Capital, a $157 billion asset manager, announced plans to invest in a private fund that tracks the Nasdaq Crypto Index, 62% comprised of Bitcoin, 32% Ether (ETH), and 6% in other altcoins.

Do bulls or bears have the upper hand?

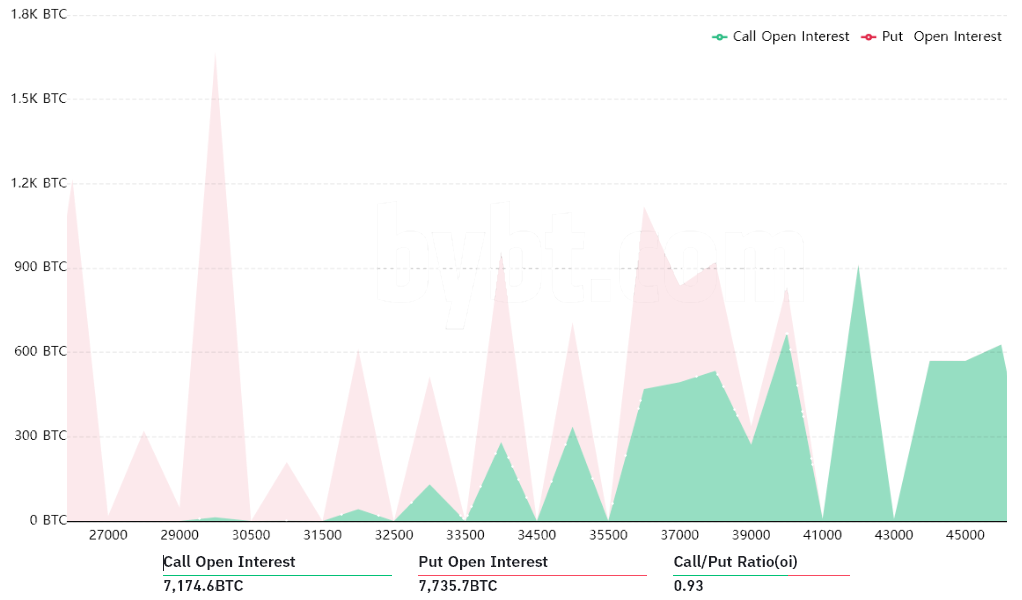

The initial picture slightly favors bears because the call-to-put ratio stands at 0.93, although this indicator values every option the same. However, the right to acquire Bitcoin at $42,000 in less than 24 hours is currently worthless, so this call option is trading below $40 each.

Related: Report says El Salvador Bitcoin pump failed to attract smart money, for now

A similar effect is in place for the neutral-to-bearish put options at $30,000 and lower. Holders have no benefit in rolling it over for the upcoming weeks because these contracts also became worthless. Therefore, to better assess how traders are positioned for Friday’s options expiry, analysts need to concentrate on the $33,000 to $41,000 range.

Bitcoin soared over 11% to $37,100 on June 9, causing some neutral-to-bullish call options to enter a profitable position. With less than 24 hours until Friday’s expiry, the call (buy) options up to $41,000 amount to 3,235 BTC contracts, currently worth $120 million.

On the other hand, the neutral-to-bearish put options down to $33,000 total 3,045 BTC contracts, presently valued at $113 million. Therefore, both sides are virtually balanced for Friday’s expiry.

Had Bitcoin remained below $34,000, bears would have an $84 million advantage, but the sequence of positive events seems to have been just enough to salvage the situation.

While there are no guarantees that the price will hold, at least the incentives for both sides to pressure the price are currently balanced.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.