Bitmex traders can now speculate on the price of bitcoin cash after the exchange activated futures trading. As a consequence, 20x leveraged trading is now live under the $BCHX17 ticker. The exchange has also announced that it will be selling the BCH holders were entitled to and distributing it in the form of BTC. The disbursal process will be completed before the end of the year.

See also: Grayscale Investments Plans to Sell GBTC-Based Bitcoin Cash Reserves

Go Long Or Go Short

Bitcoin futures have been big news of late, but it’s bitcoin core that’s been hogging the headlines, largely thanks to CME’s announcement that it will soon be permitting bitcoin ![]() futures contracts. The arrival of bitcoin cash futures at Bitmex adds further evidence that BCH is starting to see widespread adoption from vendors, wallets, and exchanges.

futures contracts. The arrival of bitcoin cash futures at Bitmex adds further evidence that BCH is starting to see widespread adoption from vendors, wallets, and exchanges.

Hong Kong’s Bitcoin Mercantile Exchange is famed for its futures trading, which offers up to 100x leverage on bitcoin and other cryptocurrencies. The arrival of BCH futures spells good news for fans of the cryptocurrency as well as for speculators. In many respects, futures trading is well-suited to BCH, allowing believers to long it, sceptics to short it and agnostic traders to go either way.

There’s a Contract Out on Bitcoin Cash

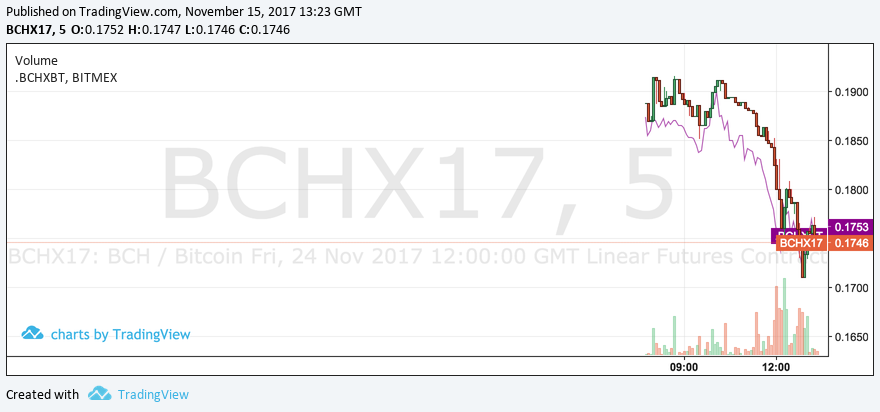

The full contract details specify a 5% entry taker fee and exit taker fee on the initial margin. Contracts are settled in BTC, and there’s a minimum price increment of 0.0001 BTC. At the time of publication, BCH futures had a volume of 1,570 BTC, a number that’s likely to rise as word of bitcoin cash futures spreads. Traders who’d gone long on BCH got off to a bad start, as the currency dropped amidst a BTC rally that has left other coins in its wake. In the days and weeks ahead however, there’ll be ample opportunities for profit-taking on both sides.

The Great BCH Giveaway

On August 1, when bitcoin cash was born, all bitcoin holders became eligible to receive an equal share of the new cryptocurrency. Many exchanges distributed BCH right away, but others dithered, unsure of the best approach to take. Bitmex has finally reached a decision on the matter and has announced that it will sell all its BCH and distribute it to customers in the form of BTC.

The move raises the possibility of large quantities of BCH being dumped onto the market in the coming weeks, assuming Bitmex hasn’t found a private seller. The Hong Kong exchange is following in the shoes of Bitcoin Investment Trust sponsor Grayscale Investments, which recently announced a similar plan. With Grayscale unleashing as much as 175,000 BCH between now and February, it will be interesting to see how this affects the price of bitcoin cash. For Bitmex traders who have an opinion on that, there’s now a means to profit from the movement of BCH whatever the outcome.

Do you think exchanges should distribute BCH as BTC or should they give it back to customers as bitcoin cash? Let us know in the comments section below.

Images courtesy of Shutterstock.

Keep track of the bitcoin exchange rate in real-time.