Bitcoin exchange Bitfinex announced on Friday that it has started allowing Bitcoin Cash deposits and withdrawals. However, some customers were upset when they learned that the exchange credited their accounts with approximately 0.85 BCH per bitcoin instead of using the typical 1:1 ratio.

Also read: Coinbase Reverses – Plans to Allow Bitcoin Cash Withdrawals in January 2018

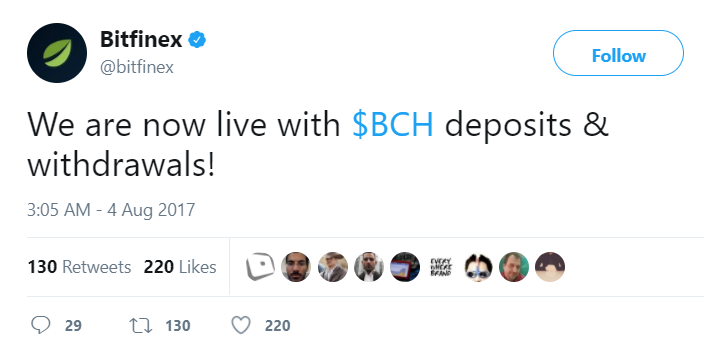

Deposits and Withdrawals Enabled

Bitfinex announced on Friday that the platform has started allowing deposits and withdrawals of Bitcoin Cash (BCH), the new cryptocurrency which resulted from the August 1 Bitcoin network split.

The announcement came the day after the exchange started BCH margin trading and had recently completed crediting its customers with approximately 0.85 BCH per bitcoin held at the time of the fork.

Customers Shortchanged

Bitfinex explained that its distribution methodology took into account margin positions ![]() which led to a deficit in BCH to pay customers with. Specifically, “margin longs in BTC/USD and margin shorts in XXX/BTC” did not receive BCH and “margin shorts in BTC/USD and margin longs in XXX/BTC” did not pay BCH. Meanwhile, customers holding bitcoin and bitcoin lenders at the time of the fork received BCH. Bitfinex declared:

which led to a deficit in BCH to pay customers with. Specifically, “margin longs in BTC/USD and margin shorts in XXX/BTC” did not receive BCH and “margin shorts in BTC/USD and margin longs in XXX/BTC” did not pay BCH. Meanwhile, customers holding bitcoin and bitcoin lenders at the time of the fork received BCH. Bitfinex declared:

We will be resolving this discrepancy in the form of a socialized distribution coefficient.

The exchange subsequently detailed that its methodology has yielded the distribution coefficient of 0.7757, so customers would only get 0.7757 BCH per bitcoin.

Not First Customer Loss Socialization

This is not the first time Bitfinex has used the tactic of spreading the losses among its customers. One year ago, the exchange announced its plans to use the same tactic of distributed loss allocation in the wake of its April 2016 hack and theft of 119,756 bitcoins.

Bitfinex said at the time that it would initiate “a socialized loss scenario among bitcoin balances and active loans to BTCUSD positions.” It then promptly issued digital IOUs to its customers that allowed both the trading and redemption of their missing bitcoins at a later date.

Bitfinex said at the time that it would initiate “a socialized loss scenario among bitcoin balances and active loans to BTCUSD positions.” It then promptly issued digital IOUs to its customers that allowed both the trading and redemption of their missing bitcoins at a later date.

Despite many early complaints from its customers, the tactic worked for Bitfinex to avoid bankruptcy. In April, the company announced that it had successfully paid back all customers.

Unlike the plan formulated a year ago, however, the exchange’s BCH distribution policy does not offer an IOU to customers for their missing 15%.

Large-Scale Manipulations

The exchange claims that following its methodology announcement on July 27, “several accounts began large-scale manipulation tactics” such as wash trading and self-funding shorts. These actions were “an attempt to obtain BCH tokens at the expense of exchange longs and lenders on the platform,” the exchange described, adding that it has sanctioned the manipulators for violation of its terms of service.

The exchange claims that following its methodology announcement on July 27, “several accounts began large-scale manipulation tactics” such as wash trading and self-funding shorts. These actions were “an attempt to obtain BCH tokens at the expense of exchange longs and lenders on the platform,” the exchange described, adding that it has sanctioned the manipulators for violation of its terms of service.

These manipulations caused the BCH distribution coefficient to plummet, Bitfinex explained, and said that they then decided to adjust the coefficient to “disallow any hedged BTC balances in excess of any such hedged balances that may have existed at the time of the July 27th distribution announcement.” In the end, the coefficient was increased to roughly 0.85 BCH per bitcoin. The exchange noted:

This adjustment increases the distribution coefficient from 0.7757 to 0.8539.

Distribution Unfair?

Customers who were not margin trading on Bitfinex recently were particularly unhappy with receiving 15% less BCH compared to most other exchanges which offer a 1:1 ratio.

One user tweeted, “[I] joined Bitfinex to split my bitcoins to BTC + BCH. Didn’t borrow, go long or short. Got 15% stolen by the exchange.” Another user concurred, “same here, it’s totally thief. We don’t play margin, or have any responsibilities for Bitfinex’s lost, we have no reason to pay 15% 4 that.” Another tweet directed at the exchange noted:

Thanks for your solid platform, however lots of users are angry about your distribution policy which is considered unfair, 0.85!

However, Bitfinex maintained its stance that “the intent of the BCH distribution mechanism was to protect lenders who were already locked into loans at the time of the announcement and to avoid distributing negative balances to shorts on an uncertain value of an unproven digital asset.”

What do you think of Bitfinex’s approach to distributing BCH to its customers? Let us know in the comments section below.

Images courtesy of Shutterstock, Bitfinex, Twitter

Need to calculate your bitcoin holdings? Check our tools section.