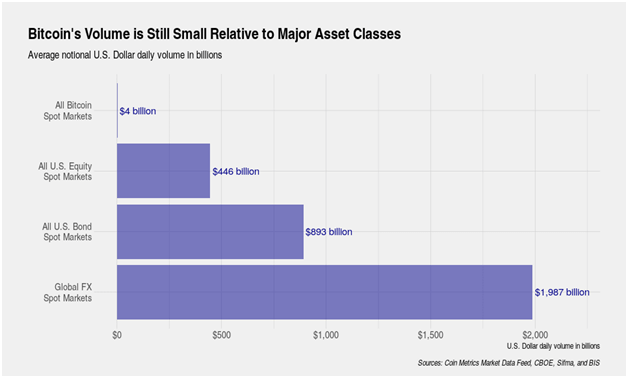

Bitcoin’s spot volume is tiny compared to the US equity and global exchange markets, however, data by Coinmetrics suggests that Bitcoin volume could surpass all major assets in the next four years

Bitcoin spot markets currently total around $4.1 billion in daily volume — an amount currently dwarfed in comparison to the $446 billion in US equity spot markets and the $893 billion US Bond spot markets.

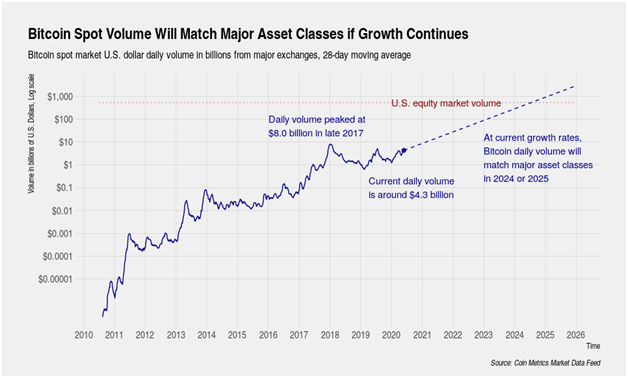

However, according to Coin Metrics, Bitcoin’s spot volume market could surge within the next four years to surpass both of these markets.

A look at the figures means that current daily spot volumes give Bitcoin a market capitalisation “most comparable in size to a large capitalization stock rather than a distinct asset class.”

While Bitcoin looks to attract large institutional investors, CoinMetrics notes that the low levels of volume on spot exchanges could be a reason for caution.

The research and analytics platform says that institutional investors — including endowments, pension funds, or sovereign wealth funds — might view Bitcoin as an investment “only suitable for a portion of the already small allocation to alternative assets rather than carving out a separate allocation towards it.”

Bitcoin spot volume peaked in 2017

Interest in Bitcoin drove the spot markets to its peak during the 2017 bull market, with daily volumes on exchanges hitting $8.0 billion.

If it maintains the same growth trajectory as seen over the last 10 years, Bitcoin’s daily volumes could match that of major asset classes by 2024 or 2025.

According to the data, a growth rate at historical levels will mean the pioneer crypto will need just four years to surpass the daily volumes of US equities. In about five years, Bitcoin’s billions of dollars in daily trading volume might have grown to exceed that of the US bonds market.

Most of Bitcoin’s volume is from the derivatives markets

Bitcoin’s trading volume is concentrated in the derivatives markets. Without the derivatives markets, volumes range around $4.3 billion on the spot market. When the average USD daily volume from the perpetual futures markets is added, the volume jumps to more than $18 billion.

This is because just like in the traditional markets, Bitcoin’s derivatives market is larger than the spot market. Margin traders can access derivative contracts that settle in fiat currencies, Bitcoin, and stablecoins.

Binance has the largest volume in daily Bitcoin perpetual contracts at an average of $2.596 billion. Huobi, BitMEX, Bybit, and OKEx make up the rest of the top five.

Bitcoin price squeeze

Bitcoin price retreated below $10k yesterday after pushing above the level for the first time since May 8. However, the pullback took Bitcoin down by about 5.7%.

The post Bitcoin’s spot volume could match all US equities within four Years appeared first on Coin Journal.