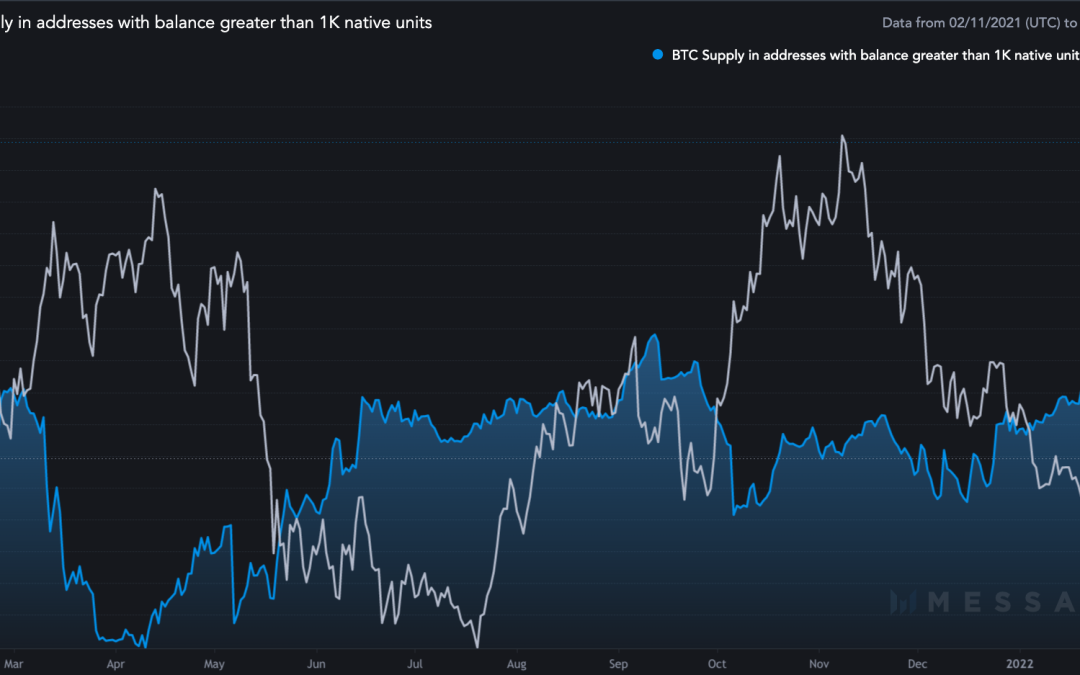

Bitcoin (BTC) addresses holding at least 1,000 BTC, the so-called whales, have started accumulating more tokens during the recent market recovery. As of Feb. 10, the total supply in these addresses was 8.096 million BTC versus 7.95 million on Jan. 24, according to data from Coin Metrics.

Bitcoin whales and institutional inflows

The buying sentiment among the richest crypto investors picked momentum during Bitcoin’s recovery in the past two weeks as BTC rebounded from its 2022 low of $33,000 on Jan. 24 to around $43,500 on Feb. 11.

Small Bitcoin investors, addresses that hold less than 1 BTC, so-called “fishes,” also joined the accumulation spree during the recent Bitcoin price rebound.

Meanwhile, data resource Ecoinometrics shows the Coin Metrics data in the form of clusters, showing a synchronous accumulation behavior among Bitcoin whales and fishes.

Interestingly, the clusters looked the same as they did in the days leading up to BTC’s record high of $69,000 in November 2021.

“Once more this cycle, this rebound in price correlates pretty well with both the small fish and the whales addresses buying simultaneously for an extended period of time, wrote Nick, an analyst at Ecoinometrics, in a note published on Fed. 7, adding:

“I don’t know if this signal is going to continue being predictive of a sustained rally, but hey, for now it is working fine.”

A report published by CoinShares this week also showed a rise in inflow across crypto funds last week. Notably, the capital injections into these funds have quadrupled to $85 billion, with $71 million flowing into Bitcoin-focused investment products, suggesting renewed institutional interest is also buoying BTC’s price recovery.

“Right now it is just warming up”

Nick suggested that Bitcoin has enough room to grow its valuation in the coming months, citing a so-called “aggregated risk score,” derived from four parameters: risk of overextended market, risk of a low-demand and high-supply situation, risk of holders taking profits, and risk of increased selling pressure.

Related: Bitcoin rejects sell-off as 7.5% US inflation fails to keep BTC down for long

The outcome is represented in the colors red and blue suggesting a hot and cool market, respectively. The hotter the market, the higher the selling pressure.

“Right now it is just warming up,” the Ecoinometrics analyst said, adding that “in theory, there is no obstacle to the price rising much higher except for the lack of momentum.”

BTC price levels to watch

Meanwhile, on-chain data tracking planform Whalemap projected $46,200–$49,000 as Bitcoin’s “current resistance range,” citing higher trading activity inside the price area in the past.

Similarly, the firm noted that the $41,400–$42,400 range is now acting as support, as shown in the chart below.

“Closest on-chain resistance according to whale accumulations is only at ~$47,000, it noted.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.