Cryptocurrency markets experienced a long bearish cycle last year which has continued into 2019. With some of the top cryptocurrencies like bitcoin cash (BCH) and bitcoin core (BTC) losing significant fiat value, large holders, otherwise known as ‘whales,’ have been able to accumulate massive amounts of digital assets. According to the top 100 rich list addresses for both coins, the world’s richest bitcoin holders have taken full advantage of ‘weak hands’ and discounted prices.

Also read: Mt. Gox CEO Claims the Coinlab and Brock Pierce Deals Never Materialized

Large BTC Holders Gathered 150,000 Coins Since December 17, 2018

During the start of the weekend on Feb. 22, popular cryptocurrencies were coasting along after making some decent gains a few days prior. However, on Feb. 24 prices fell sharply and most coins lost 10 percent of their fiat value in a 30-minute timeframe. This type of trend has been a consistent pattern over the last 14 months. These ups and downs have allowed large BTC and BCH holders to capture coins at a cheaper rate every time prices have dropped and whales have managed to stockpile thousands of coins. Looking at the top 100 rich list addresses for both networks indicate that whale wallets increase their accumulated holdings during every large drop. The large drop on Feb. 24 was no different and whales managed to get a lot more BCH and BTC immediately after crypto prices were slashed.

The rich list for the top 100 BTC holders also shows a bunch of exchanges, but these wallets are clearly labeled so the public can track them. Today, on Feb. 25, cryptocurrency exchange Bittrex has the largest BTC cold wallet with 130,005 BTC ($494 million). In fact, the five largest BTC addresses recorded on Bitinfocharts.com are all owned by exchanges Bitfinex, Bitstamp, Huobi, and Binance. Aside from exchange wallets, a good portion of large wallet owners are unknown, and observing the rich list can give people a good indication of how much influence whales have over the price.

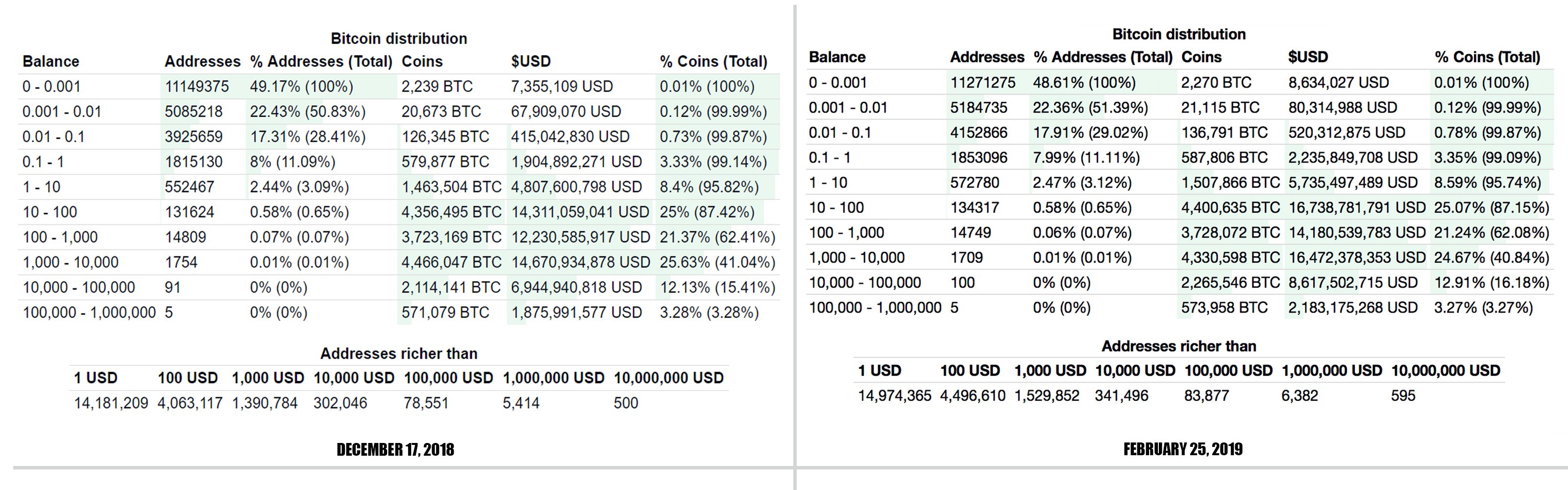

At the moment, the 100 richest addresses have between 10,000 to 1,000,000 BTC or 16.18 percent of all BTC in circulation. From December 17, 2018 up until Feb. 25, 2019, the five largest wallets which belong to exchanges increased by 2,879 BTC ($10.8 million). But the remainder of the top 100 whales (some of which are smaller exchanges) managed to accumulate 151,405 BTC ($572 million) in less than two months. Holders who have 100-1,000 BTC (14,749 addresses) have seemingly given up a lot of coins to the much larger holders as wallets of this size have decreased from 72.13 percent to 62.08 percent.

Bitcoin Cash Whales Increase Holdings

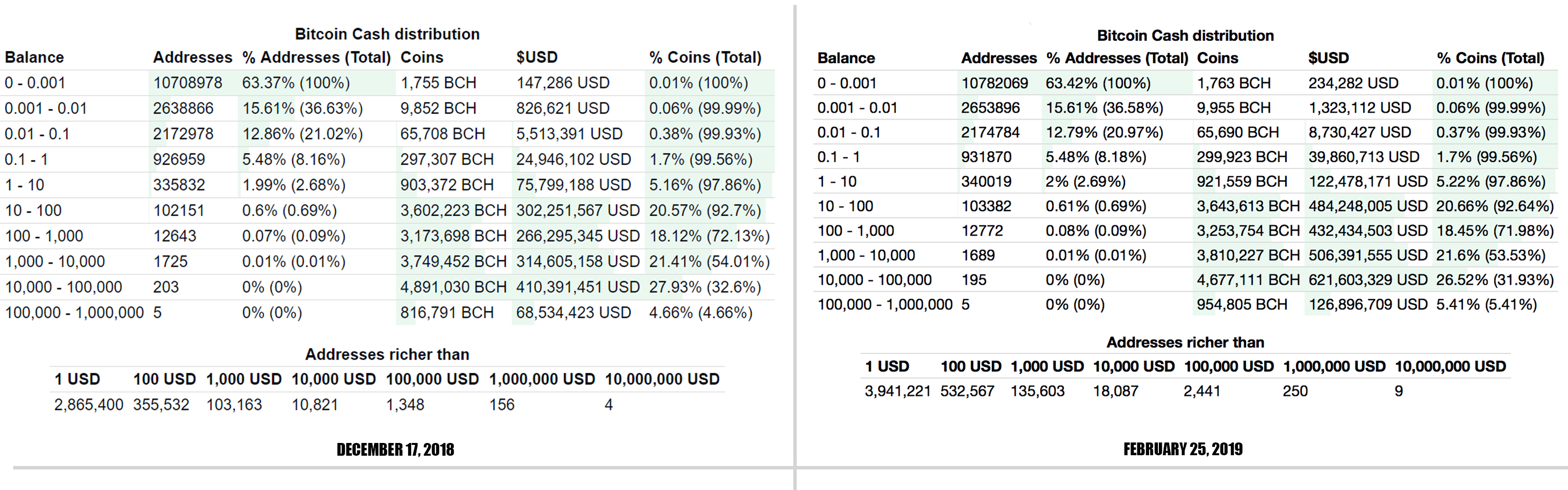

The bitcoin cash (BCH) top 100 addresses rich list shows similar findings, but the distribution of coins in circulation is quite different. Addresses that own more than 10,000 to 1,000,000 BCH comprise 195 addresses or about 26.5 percent of the BCH in circulation. The top 100 BCH addresses have seen a significant increase after each price drop and there was a lot of accumulation after the dump on Feb. 24. One particular BCH address which contains 57,889.45 BCH ($7.8 million) has shown a significant increase since December 2018 and over the last two months. There are 103,382 addresses with 10-100 BCH which represents approximately 20.66 percent of the coins in circulation. Even though BCH distribution is different than BTC, the massive BCH whales in the top 100 rich list are also accumulating thousands of BCH during the lows. The top five largest holders have managed to capture 138,014 BCH ($19.2 million) since Dec. 17, 2018.

Another noticeable sighting is a few of the wealthiest bitcoin addresses that have been dormant for years have followed similar accumulation patterns. Because crypto prices have seemingly touched ‘bottom’ or possibly close to that point, dormant whale addresses have been moving since November of last year collecting more coins. Speculators believe these once silent whales may be trying to hoard more coins by catching the highs and lows at precisely the right time.

Large crypto holders and whales have been discussed among the cryptocurrency community for years and the tradition continues. Every time unexplainable market phenomenons occur like the price movements this past weekend, people point the blame at whales. Mapping the bitcoin wealth distribution after these events take place, however, gives a clearer presentation of large periods of BCH and BTC accumulation. Moreover, alternative cryptocurrency rich lists indicate that large holders of ethereum (ETH), litecoin (LTC), and other popular coins are stockpiling assets as well.

What do you think about BCH and BTC whales accumulating more bitcoins after the prices dump? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Trading View, Bitcoin.com, and Bitinfocharts.com

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH, and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post Bitcoin Whales Have Accumulated Thousands of Coins in the Last 2 Months appeared first on Bitcoin News.