More Bitcoin addresses have been created in the past week, with average holdings now 79% in profit

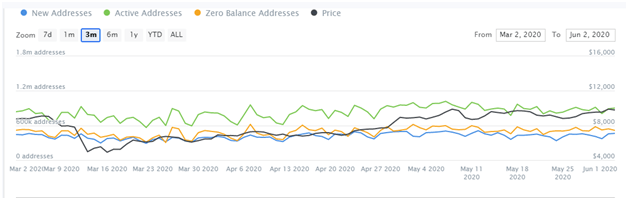

According to data from IntoTheBlock, the number of new addresses on the Bitcoin network has grown in the past three days.

On Sunday, over 370,000 new bitcoin addresses were created. The number has since risen as the cryptocurrency’s monthly close in May ended on a positive note and began June with a surge to prices above $10,400.

On June 2, users on the Bitcoin network created more than 463k new addresses.

The weekly average growth for new addresses is currently at 3.73%, while the percentage of wallets with no funds in them has fallen. On May 30, close to 580,000 wallets held zero bitcoins, but that number has fallen by 9% over the last three days to now stand at around 515,000 wallets.

The number of unique active addresses in the last 24 hours has jumped to over 902,000, up from around 695,000 when Bitcoin closed above $9,360 to serve yet another impressive close in May.

On-chain analytics site Bitinfocharts shows that the number of unique active addresses on the Bitcoin network touched their lowest level on May 28 at 475k. The previous low was over two months ago on March 25 when active addresses stood at around 456k.

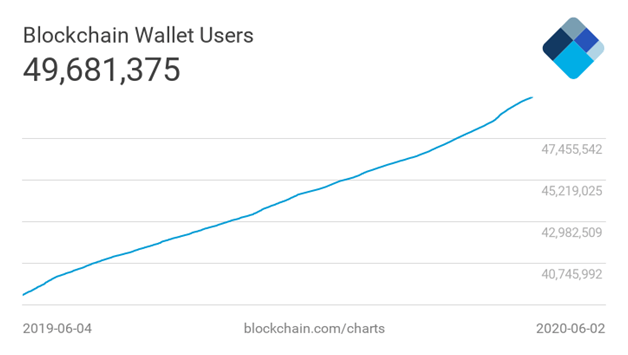

Unique Bitcoin addresses on Blockchain.com have grown by over 10 million since June 2019, up from about 39 million to over 49 million.

Most bitcoins stay in wallets for three years

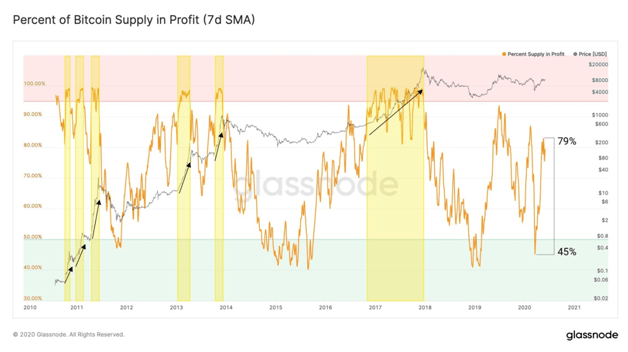

Buyers hold their Bitcoin assets in their wallet addresses (on-chain) for an average of three years, data shows. On-chain data analysis platform Glassnode recently released data that shows the percentage of Bitcoin moved on-chain and at the prices that transactions took place.

According to the statistics, 10.9% of tokens held in addresses were moved when Bitcoin’s price was last at around $10k. The majority of the transactions happened when Bitcoin traded between $5,000 and $10,000, a range that began in October 2017 to date.

Glassnode data also shows that nearly 80% of all Bitcoin supply is currently in profit. The percentage has sharply increased since March 12, when only 45% of supply was in profit as prices crashed on Black Thursday.

According to the analytics platform, if levels of profitability move above 90% or higher, then Bitcoin will have entered a bull market.

The post Bitcoin wallet addresses increase by 4% as total supply reaches 80% profit appeared first on Coin Journal.