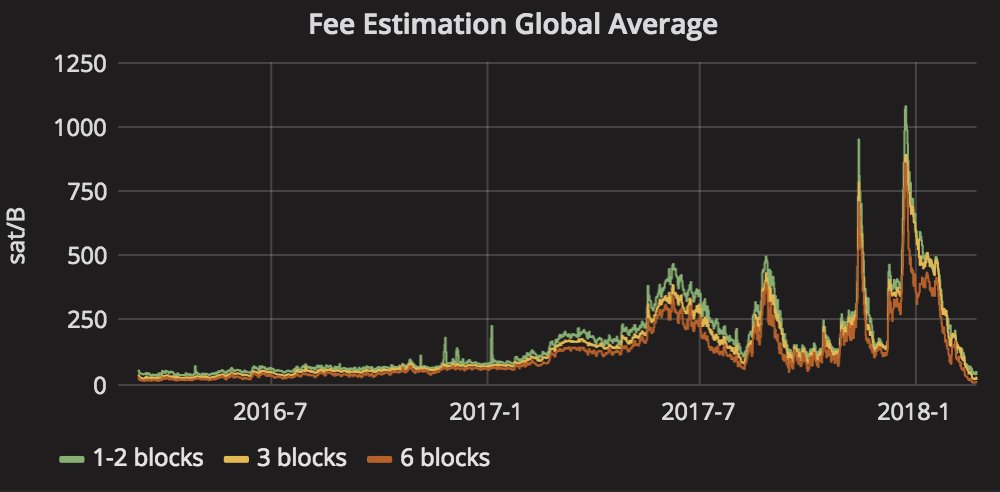

There’s never a bad time to be sending and receiving bitcoin, but right now is especially good. Fees are at the lowest in 18 months, with the average transaction value now under a dollar. This contrasts starkly with the latter quarter of last year, when rising fees peaked at $34. There’s a primary reason why fees have been dropping since then: with bitcoin too expensive to send, people simply stopped using it as currency.

Also read: How to Calculate Bitcoin Transaction Fees When You’re in a Hurry

Bitcoin Fees Take a Tumble

It’s not just the USD/BTC market that oscillates: bitcoin’s fee market follows suit. Due to various factors ranging from network usage to Segwit adoption and hashrate, fees can rise and fall significantly. Throughout 2017, that trajectory was largely an upward one, culminating, in December, with fees becoming infeasible. Transaction fees have been mercifully declining since then, hitting an 18-month low as of February 21, but given that daily transaction volume has halved in the same period, that’s not surprising. A standard six-block transaction can now be pushed through for as little as 15 cents. Bitinfocharts calculates a median fee of 52 cents, versus just over 1 cent for bitcoin cash.

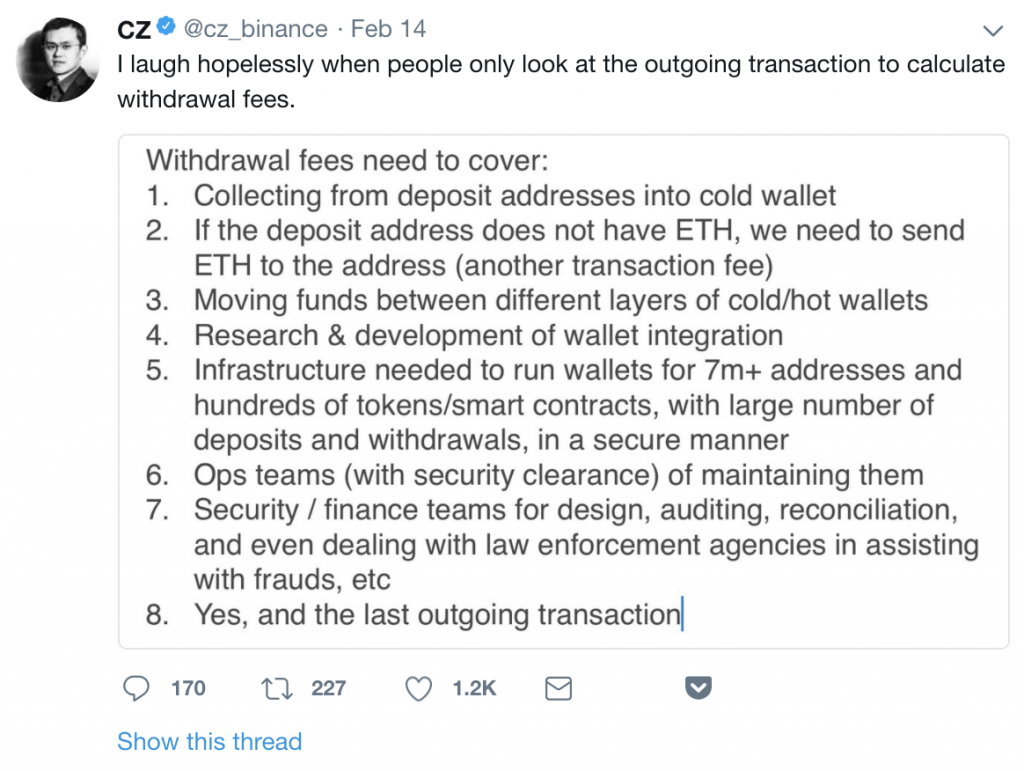

This reduction in transaction fees will not be felt by all bitcoin users however. Anyone withdrawing from an exchange will still be hit with standard fees. Binance and Kucoin, for example, set a flat rate of 0.001 BTC, or around $10.60 at current prices. As Binance CEO Changpeng Zhao pointed out in a recent tweet, though, exchanges have a case for charging above the base rate for the service they’re supplying. Whether they can justify charging upwards of $10 a time is a matter for debate though.

Why the Low Fees?

High transaction fees arguably helped push the “store of value” meme that was popularized on r/bitcoin last year. Saddled with a cryptocurrency that was too expensive to send in small amounts, there was little choice but to hodl and wait for BTC to appreciate in value. Soaring fees were one of the triggers for a number of businesses to stop accepting bitcoin including Stripe and, ironically, the North American Bitcoin Conference. Steam also stopped accepting bitcoin in December, citing “high fees and volatility”. Frustrating as fees have been for users of the bitcoin network, some good has come of this predicament.

Users and exchanges have scrambled to seek out ways of making transactions more efficient, with fixes including batching transactions together and adopting Segwit. Exorbitant fees also spurred quicker trials of the Lightning Network, though its adoption is still too low to have affected current bitcoin fees. Evidence suggests that the biggest driver in fee reduction was not technical, but sociological: on December 17, almost half a million bitcoin transactions were sent. That figure now averages under 200,000 a day.

With fees now at the lowest they’ve been in 18 months, it will be interesting to see whether retailers such as Valve will resume support for cryptocurrencies or steer clear until some sort of stability can be maintained. A number of companies have previously spoken of considering alternative cryptos, with Stripe mentioning litecoin, stellar, and bitcoin cash.

Bitcoin’s real test will come when people resume using the cryptocurrency as a medium of exchange and blocks begin to fill up once more.

Do you think bitcoin fees are now at a reasonable rate, or do they need to fall further still? Let us know in the comments section below.

Images courtesy of Shutterstock, and p2sh.info.

Need to calculate your bitcoin holdings? Check our tools section.

The post Bitcoin Usage Falls to Its Lowest in Months appeared first on Bitcoin News.