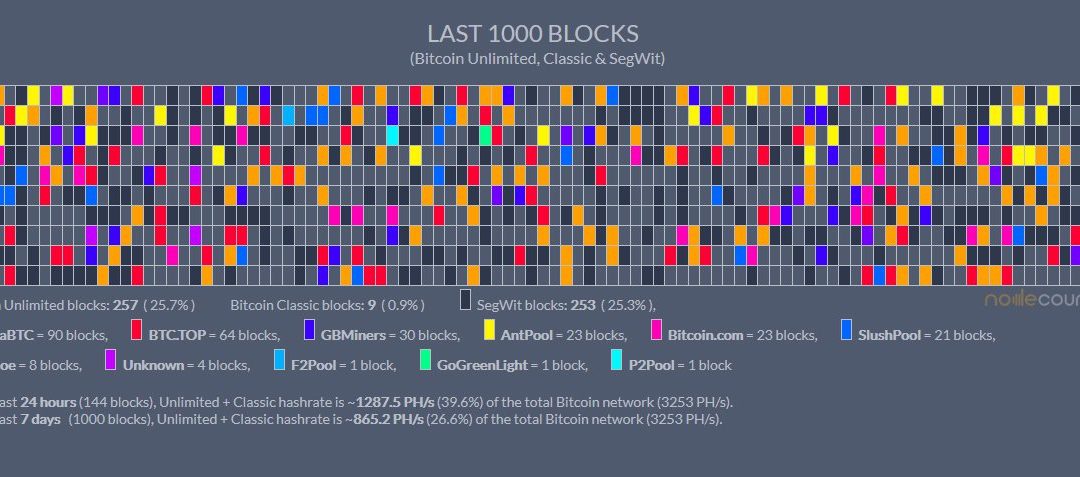

Bitcoin Unlimited, the new grassroots client, reached 39.6% over a 24 hour period earlier this week, its highest ever. Now standing at more than 30% over the longer one week period.

Bitcoin Unlimited reaches almost 40% network share over the past 24 hours – image from nodecounter

The new client aims to increase bitcoin’s transaction capacity to meet growing demand and reduce fees as they now average $1 per transaction. It further aims to return more predictable transaction times which currently can be delayed from hours to days.

It has found much support from miners with Antpool, bitcoin’s biggest mining pool, switching to Bitcoin Unlimited on Tuesday. The decision was somewhat surprising, but discussions of a flag day soft fork to force segwit appears to have incentivized the miner to move.

There are now in total ten mining pools on Bitcoin Unlimited, with just one further pool sufficient to allow for near 50% temporary share due to variance. One such pool is to be expected as Chandler Guo, a digital currencies miner, is to open a new pool that will mine on Bitcoin Unlimited.

It is not known if any business is running the new client, but Blockchain.info, Coinbase, Bitpay, Bitgo and many other bitcoin businesses, have advocated for bigger blocks in general and have complained regarding delays.

Critics say Bitcoin Unlimited gives power to miners regarding blocksize decisions and its emergent consensus system is untested. Supporters argue that all nodes decide on the blocksize and the emergent consensus system has been live tested during the increase of the soft limit from 250kb to 500kb to 750kb and then 1MB.

There are arguments on whether the system allows for re-organization with Charlie Lee, Litecoin’s Founder and Coinbase employee, stating that “if at any point, the [Bitcoin Core] chain grows longer (in PoW) than the [Bitcoin Unlimited] chain, the BU client will reorg to the [Bitcoin Core] chain.”

ViaBTC’s founder, Haipo Yang, has suggested that miners wait for Bitcoin Unlimited to reach 75% of the network’s hardware share to avoid a chain split on the same proof of work chain.

There is, however, a community split. Thus, blockstream employees might PoW fork the chain, but BTC.TOP’s founder, Jiang Zhuoer, has stated that $100 million has been set aside to attack any minority chain and make it inoperational.

Any upgrade to bigger blocks is likely to be gradual to give businesses and node operators considerable time. As the client is now nearing 30% share over 1,000 blocks with variance giving it 40%, such upgrade process might begin.

If it nears 40% in the longer 1,000 blocks time-frame, then there might be a shift in attitude as temporary variance would give it 50%. Thus, the client gains serious consideration with activation likelihood considerably increasing.

It is at 50% when, conceptually, it is a done deal. At that point, all businesses will want to be running the BU client. Miners, too, might find it safer, while the general opinion would probably move to ask when, rather than if.

The time frame is probably months, if this year at all. The likelihood of its activation is difficult to predict, but segregated witnesses has stagnated, leaving BU as the only standing option at this point in time.

Once it activates, there is no difference whatever as far as end-users are concerned except that fees would be lower and transaction times would be more predictable. Due to bitcoin’s current politics whereby Michael Marquardt, r/bitcoin’s top moderator, applies biased censorship, miners are incentivized to attack the minority chain to avoid any arguments over the bitcoin name. A chain split therefore appears unlikely, but if there is one, there is no difference for end users except that now they hold their coins on both chains.

If Bitcoin Unlimited does activate, it would be the first time ever in the entire blockchain space that a decision in such a decentralized manner without any guidance or leadership has been made.

Image from Shutterstock.