Bitcoin, the world’s largest cryptocurrency, was lower as the market prepares for this week’s Federal Reserve monetary policy meeting, where the U.S. central bank is expected to slow down its money printer.

The two-day meeting, which starts Tuesday and concludes Wednesday, is expected to end with the Fed announcing plans to cut the pace of its $120 billion-a-month of asset purchases by $30 billion every month, or double the current rate of reduction. Some cryptocurrency traders and investors say the stimulus program has bolstered bitcoin’s allure as an inflation hedge, so a reversal of the loose-money policy might be bearish.

Bitcoin, which tends to trade in tandem with traditional markets, started December around $57,000 and is now trading around the $47,000 mark. The cryptocurrency is down over 30% from its all-time high in November.

Why is bitcoin down?

Lennard Neo, head of research at Stack Funds, attributed the cryptocurrency’s recent drop to the market uncertainty leading investors to take risk off the table. Bitcoin is seen by some investors as a risk-on asset, which generally refers to assets that have a significant degree of price volatility such as industrial metals, equities and commodities; all things being equal, tighter monetary policy would theoretically make these risk-on assets less attractive.

Investors are hesitant to buy bitcoin at current levels, according to Oanda Senior Market Analyst Edward Moya. Traders may anticipate one last major push lower for the cryptocurrency, which could see it test the $40,000 level, before bulls want to aggressively buy back in, he said.

Laurent Kssis, a crypto exchange-traded fund (ETF) expert and director of CEC Capital, said he doesn’t anticipate an imminent move upwards for the cryptocurrency based on liquidations and trading volumes. He said a break above $50,000 may happen at a much slower pace than many had hoped for.

“The U.S. has woken up and bought on anticipated lower bitcoin prices, which has pushed the price up slightly, but it is still under pressure,” concluded Kssis.

“There appears to be a strong feeling of uncertainty over market direction, despite strong indicators across various charts,” said Quantum Economics crypto analyst, Jason Deane.

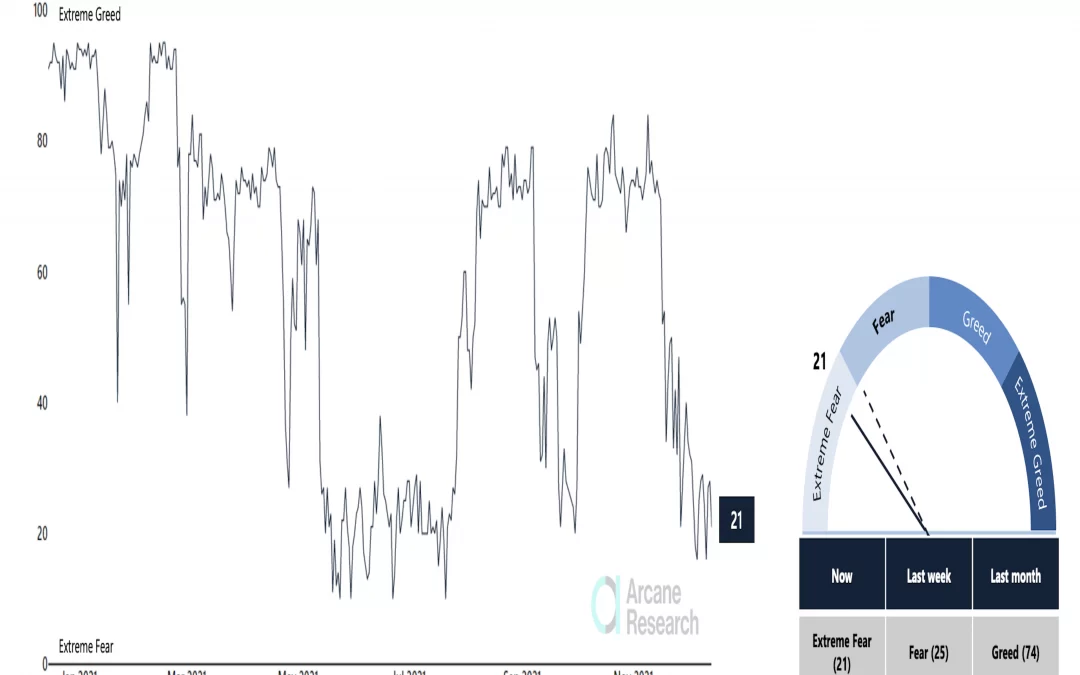

Fear and greed index

Short-term sentiment and confidence levels for the cryptocurrency – check out the Fear and Greed Index – appear to be playing a stronger role than long-term fundamentals, such as all-time highs in active addresses, hash rate, according to Deane.

The Fear and Greed Index, a tool used by some investors to gauge the market, has now signaled “extreme fear” for almost one month straight.

The last time the index read a prolonged fearful market sentiment was at the start of the summer in the Northern Hemisphere, when market sentiment was “fearful” for almost two months straight, according to Arcane Research’s weekly report.

“We expect the uncertainty to remain the predominant consideration for the time being until there is enough momentum to break through,” said Deane.

Ether, the second largest cryptocurrency by market capitalization, is trading below $4,000 and is down 12% in the last 7 days.