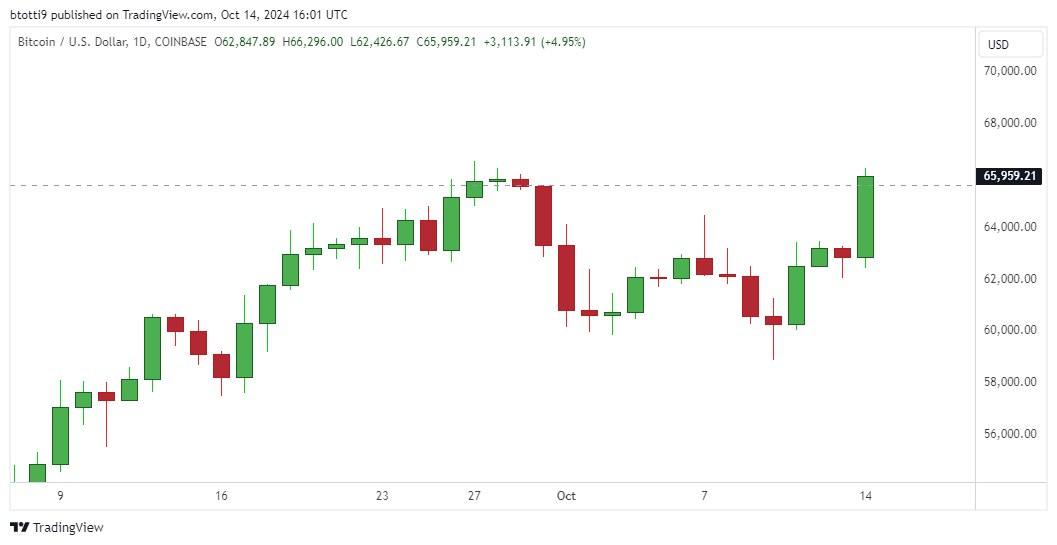

- Bitcoin price broke to above $66,000 for the first time in nearly three weeks.

- Cypto analysts at QCP say ‘Uptober’ and the US election sentiment could help bulls higher.

Bitcoin (BTC) price rose more than 6% to break above $66,000 on Monday, October 14, 2024 as most cryptocurrencies recorded 24-hour gains.

According to data from CoinGecko, BTC price had reached highs of $66,173 across major crypto exchanges.

On Coinbase it hit $66,296. The gains came as the flagship cryptocurrency bounced from the uncertainties witnessed the previous week, with Bitcoin bulls seeing a 4% flip in weekly price performance.

Bitcoin traded around $65,959 on Coinbase at the time of writing, suggesting a potential continuation amid gains across the S&P 500. The issue of China’s stimulus package was also told in trader sentiment. In the crypto market, the overall “Uptober” mood looked to have swung in as altcoins also rose.

Bitcoin surges ahead of US election

A forecast for BTC by the Singapore-based trading firm QCP Capital suggests BTC is showing price trajectories that mirror previous US election cycles.

If this trend continues, Bitcoin bulls may target further gains ahead of the Nov. election.

“Although there could be many factors that could explain today’s move, it is quite an interesting time if we look at historical price action. We are in the middle of October and just three weeks away from the US elections,” QCP said in an update on Telegram.

The trend in 2016 saw Bitcoin rise from around $600 three weeks to the election to above $1,200 in early January. It again happened in 2020, when BTC rallied from $11k around mid-October to hit $42k in January 2021.

“After months of trading in the range, will history repeat itself? Today’s rally has definitely given the market a glimmer of hope just as Uptober optimism was fading,” QCP added in the note.

Bitcoin reached an all-time high of $73k in March, with the rally coming amid halving sentiment and the launch of spot Bitcoin exchange-traded funds.