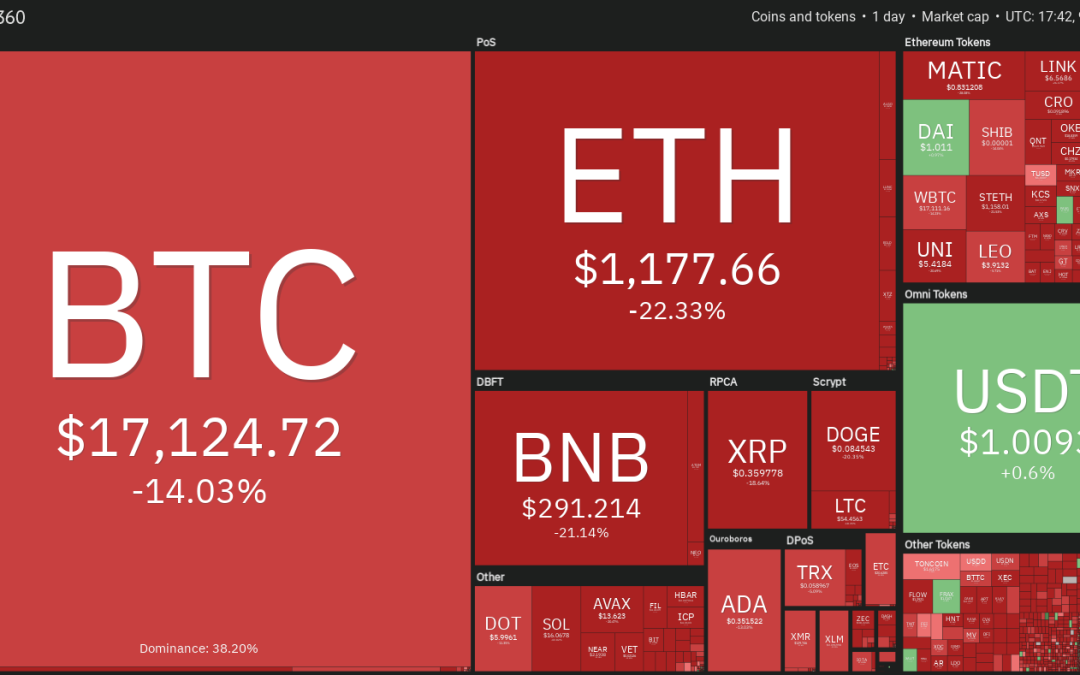

Crypto markets crumbled for a second day as the fallout from FTX’s liquidity troubles continued to negatively impact investor sentiment.

Throughout the day Bitcoin (BTC) price dropped, falling to a new yearly below $16,000 as Binance announced that it would back out of its agreement to acquire FTX. Investors had pinned their hopes on a rather swift market rebound if Binance was successfully able to acquire FTX, but now that the deal is scuppered, BTC and altcoin prices has sold-off further.

Another factor having a potential impact on the market is a wave of successive liquidations in Solana’s decentralized finance markets. Earlier in the day, cryptocurrency exchange Crypto.com emailed its users to inform them that all Solana-based USD Coin (USDC) deposits had been suspended.

A notice on the Crypto.com website also said:

“Please be informed that we have suspended deposits and withdrawals of the USDC and USDCT on the Solana Blockchain in the Crypto.com App and Exchange.”

At the time of writing, the price of Solana’s native SOL (SOL) coin is down 34%, trading at $16.10. FTX’s native FTX Token (FTT) is also 32% down on the day and trades for $3.78.

Data from Coinglass shows $832 million in total liquidations over the past 24 hours, and many traders expect the figure to increase.

Related: Galaxy Digital discloses $77M exposure to FTX, $48M likely locked in withdrawals

For further backstory on what is happening with FTX, click here to watch Cointelegraph Markets’ explainer on the situation.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.