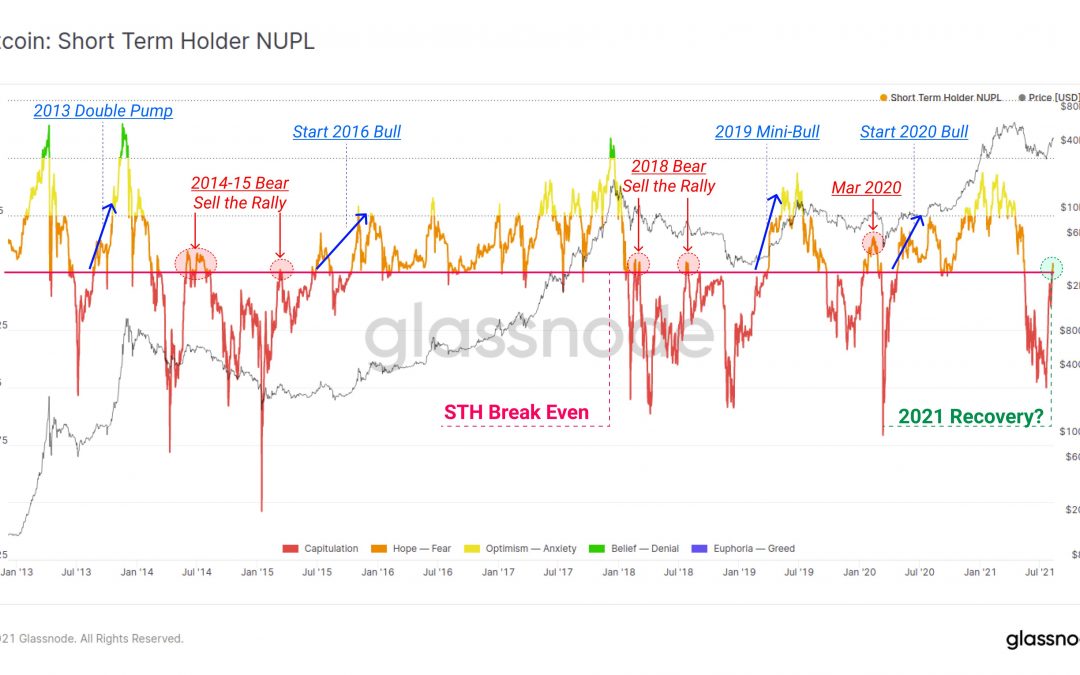

A Bitcoin (BTC) on-chain indicator that spotted dead cat bounces during the yesteryear bearish market corrections has flashed again in August 2021.

Dubbed as “Bitcoin: Short Term Holder NUPL,” the indicator takes into account the unspent transaction output, or UTXO, of BTC transactions not more than 155 days old. In doing so, it attempts to determine whether or not an investor is profitable within 155 days of purchasing and holding Bitcoin.

Therefore, if the NUPL, which stands for Net Unrealized Profit/Loss, returns a reading below zero, it means investors are making a loss on their Bitcoin investments. Conversely, an NUPL above zero shows that investors are making a profit.

Glassnode reported Thursday that the Bitcoin NUPL for short-term investors recovered back above zero, signifying their profitable state for the first time since May 2021’s crypto market crash. Meanwhile, the blockchain analytics platform also signaled fears of potential sell-off, citing fractals from 2014-15, 2018, and March 2020 bear cycles.

In detail, short-term Bitcoin holders earlier used the recovery rallies during corrections to secure interim profits.

The price action from 2014-15 bearish session shows BTC/USD resuming its downside correction despite a 100% rebound. Similarly, in 2018, a 97.41% upside retracement did little in securing the market from the prevailing bearish bias.

The latest upside recovery in 2021 came after Bitcoin prices crashed from circa $65,000 to around $29,000. The cryptocurrency rallied to $46,787 on the Bitstamp exchange following a major rebound afterward—a 63.59% jump.

Bitcoin corrected lower again on Thursday, falling below its psychological support level of $45,000. At its intraday low, the cryptocurrency was changing hands for $44,100.

The dissenting bullish case

Glassnode noted that such “rapid recoveries” are common in two cases: either bear market relief rallies or disbelief phases of bull markets.

Therefore, in saying so, the blockchain analytics platform did not rule out the possibility of an extended bull run, such as the one seen during the upside booms of 2013, 2019, and 2020.

More evidence corroborating the bullish outlook came from Glassnode’s report published earlier this week. The platform spotted a decline in short-term holders in line with a rise in long-term holders, insomuch that the Bitcoin supply held by long-term holders reached a new all-time high of 82.68% of all the coins in circulation.

Related: Large hodlers accumulate Bitcoin below $50K as BTC transactions over $1M soar

Meanwhile, the coin possessed by short-term holders dropped to 25% of the net Bitcoin supply in ciculation, suggesting a run-up in holding behavior.

Historically, when the short-term holder ratio drops to 20%, it leads to a supply squeeze scenario, i.e., when coins in circulation fall short of the current demand.

“This is extremely similar to the volume of coins held by [long term holders] in October 2020 before the primary bullish impulse started,” Glassnode analysts wrote, adding:

“Whilst the supply squeeze based on the [short-term holder] Supply Ratio is not yet at 20%, there are numerous indicators and trends in play that suggest it may hit it in mid-September (but that the conditions for a supply squeeze are already in play).”

Bitcoin was trading around $44,200 at the time of this writing.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.