Hedge fund manager Jesse Myers believes Bitcoin is on its way to a staggering $10 million per BTC.

In a new interview with Coin Stories, Myers breaks down the math and the timeline behind his big prediction.

Myers says Bitcoin is emerging as a hard and scarce store of value in a world of ever-increasing debt and currency devaluation.

“We have now entered an era where the value proposition of holding bonds or holding fiat money is very bad, because the national debt and the unfunded liabilities going forward are going to necessitate a level of printing that will outpace the nominal yield on holding bonds.

That’s the only way out we have. We now have $31 trillion of national debt, $170 trillion of unfunded liabilities in the US alone.

Then you’re talking about $3 trillion a year in interest expense when we’re already running a multi-trillion dollar deficit in our budget. So you’re talking about something like $4 trillion dollars of deficit going forward that you have to print in order to make that up…

So that’s what Bitcoin is competing with as the lowest hanging fruit, I think in terms of where people have their value parked.”

Myers says Bitcoin is competing in an asset world that totals about $900 trillion in size, with a current level of global crypto adoption that is far less than some analysts believe.

“It’s a question of how much can Bitcoin win, how much value can Bitcoin actually take here. It is currently a $400 billion asset in a $900 trillion ocean. That means it’s 1/2000th of the world’s value, and that means collectively the world has a 0.05% percent allocation to Bitcoin.”

Myers says Bitcoin’s maximum supply of 21 million BTC will create a massive supply shock as the leading cryptocurrency’s rate of adoption increases.

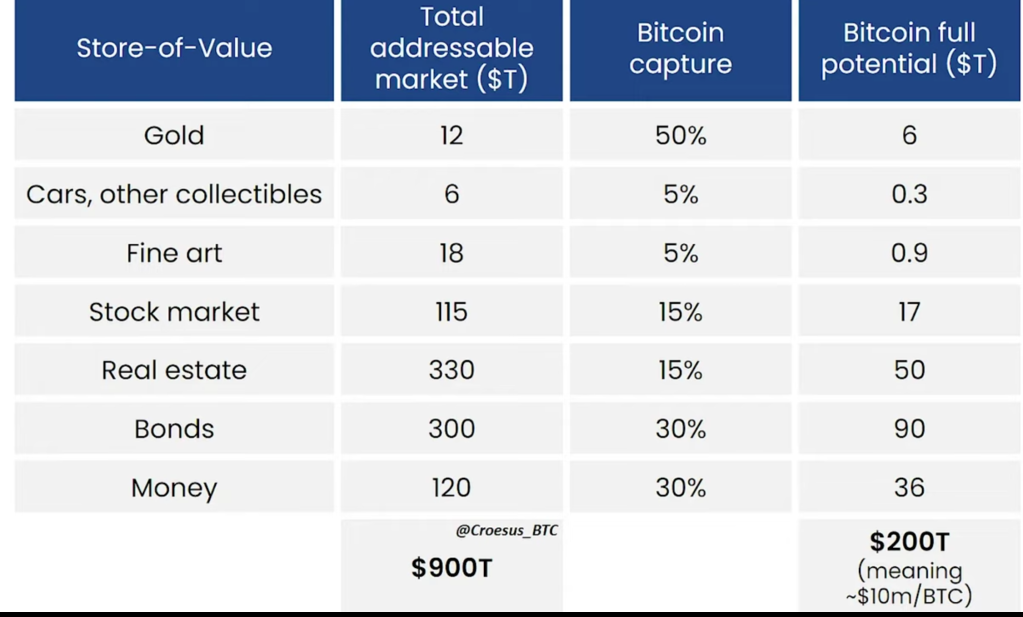

He then breaks down the math that brings him to $10 million per BTC in today’s dollar terms, which is centered on Bitcoin capturing half of gold’s market cap as well as additional percentages of the world’s top store of value categories.

As for his timeline, Myers says the key factor is how long it will take for the general public to gradually learn more about Bitcoin and understand its true value proposition. He believes his price target will become a reality within the next few decades.

“I think we have begun the Bitcoin era, where having BTC as a major if not primary pillar of your personal savings strategy is the winning formula. And it will take a generation for people to really get the picture.

So when I when I say Bitcoin has, I think, a conservative chance of becoming $10 million dollars a coin in today’s dollars, that means going from 0.05% of the world’s value to 25% of the world’s value.

Bitcoin is just going to suck it in, ingest it like a black hole. That’s what I think we’ve embarked on now and it will only be really clear in hindsight that those are the mechanics that were playing out right before people’s eyes while everyone was convinced that this was just Monopoly money.”

As for the potential risks to Bitcoin’s future, Myers says regulatory roadblocks are a top concern.

He also believes Bitcoin’s virality is key to its future, and that it’s imperative for those who understand its benefits to spread the word and educate the next wave of investors.