Bitcoin (BTC) bulls laid most of their options at $24,500 and higher for the March 3 options expiry, and given the recent bullishness seen from BTC, who can blame them? On Feb. 21, Bitcoin’s price briefly traded above $25,200, reflecting an 18% gain in eight days. Unfortunately, regulatory pressure on the crypto sector increased, and despite no effective measures being announced, investors are still wary and reactive to remarks from policymakers.

For instance, on Feb. 23, U.S. Securities and Exchange Commission Chair Gary Gensler claimed that “everything other than Bitcoin” falls under the agency’s jurisdiction. Gensler noted that most crypto projects “are securities because there’s a group in the middle and the public is anticipating profits based on that group.”

March 1 comments from two U.S. Federal Reserve officials reiterated the necessity for even more aggressive interest rate increases to curb inflation. Minneapolis Fed President Neel Kashkari’s and Atlanta Fed President Raphael Bostic’s comments also decreased investors’ expectations of a monetary policy reversal happening in 2023.

The stricter stance from the macroeconomic and crypto regulatory environment caused investors to rethink their exposure to cryptocurrencies. Nevertheless, Bitcoin’s price decline practically extinguished bulls’ expectation for a $24,500 or higher options expiry on March 3, so their bets are unlikely to pay off as the deadline approaches.

Bulls were “rug pulled” by negative regulatory remarks

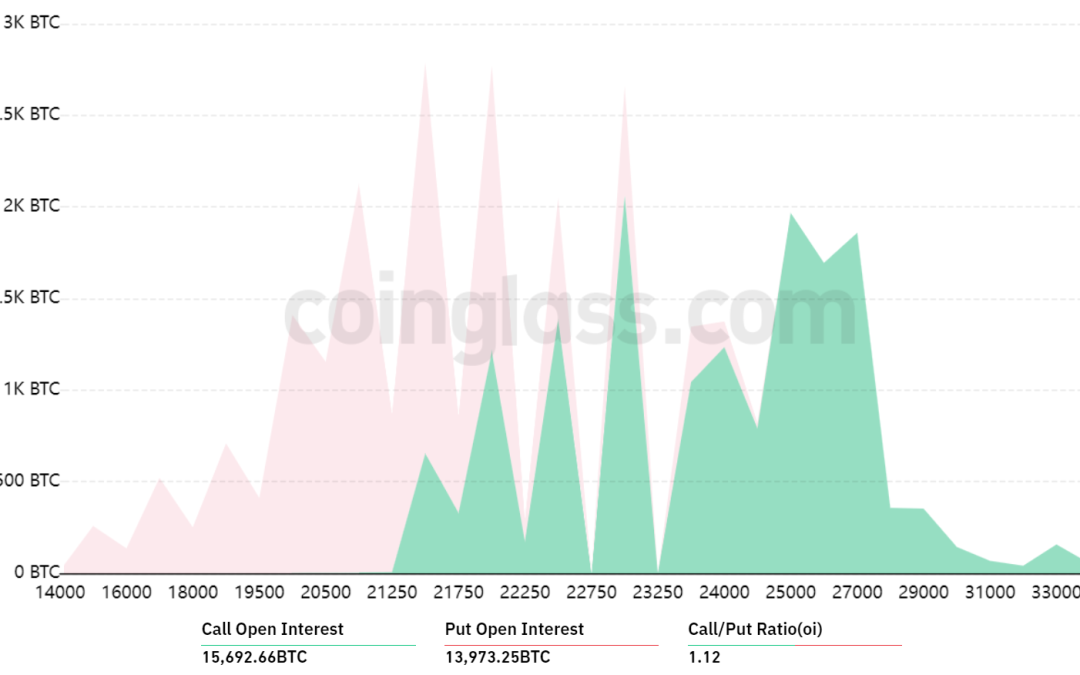

The open interest for the March 3 options expiry is $710 million, but the actual figure will be lower since bulls became overconfident after Bitcoin traded above $25,000 on Feb. 21.

The 1.12 call-to-put ratio reflects the imbalance between the $400 million call (buy) open interest and the $310 million put (sell) options. However, the expected outcome is likely much lower regarding active open interest.

For example, if Bitcoin’s price remains near $23,600 at 8:00 am UTC on March 3, only $50 million worth of these call (buy) options will be available. This difference happens because the right to buy Bitcoin at $24,000 or $25,000 is useless if BTC trades below that level on expiry.

Bears have set their trap below $23,000

Below are the four most likely scenarios based on the current price action. The number of options contracts available on March 3 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $22,000 and $22,500: 700 calls vs. 6,200 puts. The net result favors the put (bear) instruments by $120 million.

- Between $22,500 and $23,000: 1,000 calls vs. 4,800 puts. The net result favors the put (bear) instruments by $85 million.

- Between $23,000 and $24,000: 2,100 calls vs. 1,800 puts. The net result is balanced between bulls and bears.

- Between $24,000 and $25,000: 4,900 calls vs. 400 puts. The net result favors the call (bull) instruments by $110 million.

This crude estimate considers the call options used in bullish bets and the put options exclusively in neutral-to-bearish trades. Even so, this oversimplification disregards more complex investment strategies.

For example, a trader could have sold a call option, effectively gaining negative exposure to Bitcoin above a specific price, but unfortunately, there’s no easy way to estimate this effect.

Related:Bitcoin’s least volatile month ever? BTC price ends February up 0.03%

Could weak U.S. mortgage applications could benefit BTC bulls?

Bitcoin bulls must push the price above $24,000 on March 3 to secure a potential $110 million profit. However, data from an announcement from the Mortgage Bankers Association on March 1 might turn the tide favorably for BTC. The weekly volume of mortgage applications declined by 44% versus the same period in 2022, hitting the lowest level in 28 years.

Considering the negative pressure from regulators and investors’ eying the next Fed decision on March 22, bears have good odds of pressuring BTC below $23,000 and profiting by $85 million in the March 3 weekly options expiry. Still, there’s hope for Bitcoin bulls depending on how traditional markets react to the bearish mortgage applications data.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.