Bitcoin price is on its way towards reaching $1,500. Over the past seven days, bitcoin has surged from $1,278 to $1,471, recording a 13.4 percent weekly increase in price. Although alternative cryptocurrencies, or altcoins, have experienced a similar trend in growth, altcoins are struggling to maintain stability.

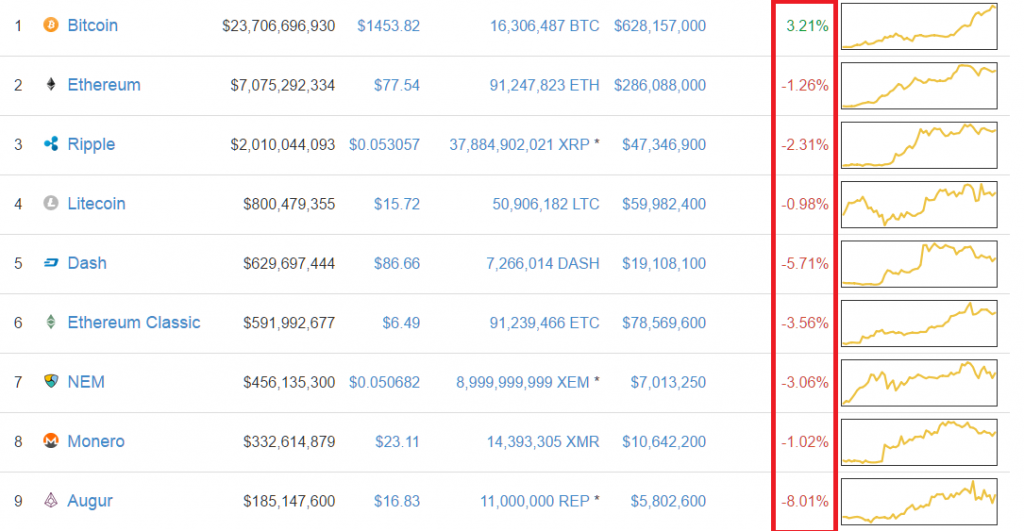

Screenshot from CoinMarketCap.

As seen in the image above, most cryptocurrencies with the exception of bitcoin have demonstrated a decline in price on May 2. Such trend in the price of altcoins followed a massive surge in value in the past three days, with assets such as Ethereum’s Ether establishing its new all-time high price and market cap at over $7 billion.

Yet, even the top cryptocurrencies are struggling to deal with volatility and as bitcoin and security expert Andreas Antonopoulos noted, volatility is not beneficial for the industry and the market.

In October of 2015, he wrote:

“Don’t be too excited with recent bitcoin short squeeze and rapid price climb. Volatility is bad even when it’s going upwards. Volatility is good for traders and bad for the overall industry. I’m more concerned about the long-term health of the industry.

He expressed his concern over the rising volatility rate at the time and its negative impact on the overall industry of bitcoin. Since then, as demonstrated in a graph presented by bitcoin analyst and data provider Willy Woo, bitcoin volatility declined significantly, from around 50 percent in 2013 to 6.5 percent in the past 60 days.

The entire cryptocurrency market is on an upward trend due to bitcoin’s explosive growth. Some investors are actively looking into various cryptocurrencies because they believe the probability of investing in bitcoin and generating large profit margins is relatively small. A large portion of the trading community have also invested in other cryptocurrencies due to bitcoin’s current scalability issues and blockchain congestion. The rest have invested in complementary cryptocurrencies such as Ethereum, Zcash and Monero that offer features or functionalities which bitcoin lack.

Overall, it would not be an exaggerated reasoning to attribute the recent surge in the altcoin market to the growing demand toward bitcoin. Moreover, the emergence and rising popularity of initial coin offering (ICO) have further triggered the interests of investors in alternative cryptocurrencies.

However, there exist some altcoins that have actual users and active communities. Ethereum, for instance, is utilized by its community of developers and regular users to pay for applications. Within Ethereum, the fee for running an application is called Gas. Zcash and Monero are used by active communities that are concerned over bitcoin’s lack of financial privacy and strengthened AML and KYC policies.

The vast majority of altcoins listed on market data platforms are experiencing an increase in price due to the overwhelming performance of top cryptocurrencies such as bitcoin. Therefore, when bitcoin maintains stability, most of the altcoins tend to become more volatile and fluctuate wildly.

In order for a cryptocurrency to secure an active user base who are utilizing the token for an actual use case, it is important that the volatility rate remains low.

Featured image from Shutterstock.

Advertisement: