It’s possible that many people have already forgotten that Bitcoin’s (BTC) price closed 2022 at $16,529 and the recent rebound and rejection at the $25,000 level could raise concern among certain investors. Bears are pushing back at the $25,000 level and there has been multiple failed attempts at the level between Feb. 16 and Feb. 21. Currently, it looks like the $23,500 resistance is continuing to gain strength with every retest.

Pinpointing the rationale behind Bitcoin’s 45.5% year-to-date gain is not apparent, but part of it comes from the United States Federal Reserve’s inability to curb inflation while raising interest rates to its highest level in 15 years. The unintended consequence is higher government debt repayments and this adds further pressure to the budget deficit.

It’s virtually impossible to predict when the Fed will change its stance, but as the debt to gross domestic product ratio surpasses 128, it should not take longer than 18 months. At some point, the value of the U.S. dollar itself could become endangered due to extreme debt leverage.

On Feb. 23, the Fed, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency issued a joint statement encouraging U.S. banks that rely on funding from the crypto sector to prevent liquidity runs by maintaining strong risk management practices. Regulators said the report was spurred by “recent events” in the industry due to increased volatility risks.

Let’s look at derivatives metrics to better understand how professional traders are positioned in the current market conditions.

Bitcoin margined longs were used to defend the $24,000 level

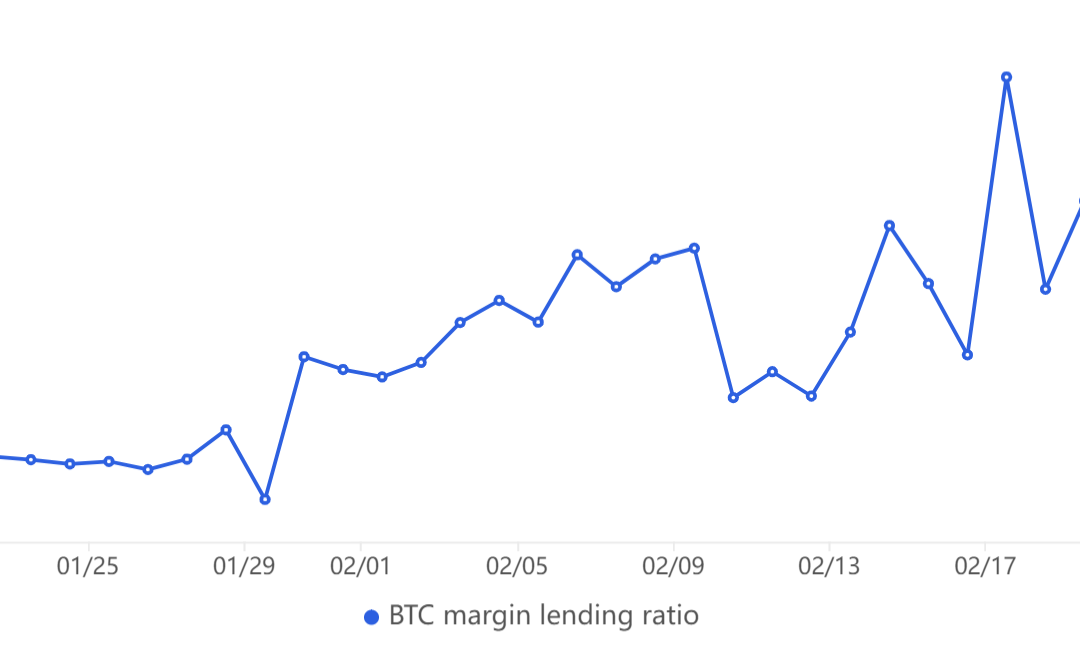

Margin markets provide insight into how professional traders are positioned because it allows investors to borrow cryptocurrency to leverage their positions.

For example, one can increase exposure by borrowing stablecoins to buy (long) Bitcoin. On the other hand, Bitcoin borrowers can only bet against (short) the cryptocurrency. Unlike futures contracts, the balance between margin longs and shorts isn’t always matched.

The above chart shows that OKX traders’ margin lending ratio increased between Feb. 21 and Feb. 23, signaling that professional traders added leverage long positions as Bitcoin price broke below $24,000.

One might argue that the excessive demand for bullish margin positioning seems a desperate move after the failed attempt to break the $25,000 resistance on Feb. 21. However, the unusually high stablecoin/BTC margin lending ratio tends to normalize after traders deposit additional collateral after a few days.

Options traders are more confident with downside risks

Traders should also analyze options markets to understand whether the recent rally has caused investors to become more risk-averse. The 25% delta skew is a telling sign whenever arbitrage desks and market makers overcharge for upside or downside protection.

The indicator compares similar call (buy) and put (sell) options and will turn positive when fear is prevalent because the protective put options premium is higher than risk call options.

In short, the skew metric will move above 10% if traders fear a Bitcoin price crash. On the other hand, generalized excitement reflects a negative 10% skew.

Related: IMF exec board endorses crypto policy framework, including no crypto as legal tender

Notice that the 25% delta skew shifted slightly negative since Feb. 18 after option traders became more confident and the $23,500 support strengthened. A skew reading at -5% denotes a balanced demand between bullish and bearish option instruments.

Derivatives data paints an unusual combination of excessive margin demand for longs and a neutral risk assessment from options traders. Yet, there is nothing concerning about it as long as the stablecoin/BTC ratio returns to levels below 30 in the coming days.

Considering regulators have been applying enormous pressure on the crypto sector, Bitcoin derivatives are holding up nicely. For example, on Feb. 22, the Bank for International Settlements general manager Agustín Carstens emphasized the need for regulation and risk management in the crypto space. The limited impact of the BIS statement on the price is a bullish sign and it possibly increases the odds of Bitcoin price breaking above $25,000 in the short-term.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.