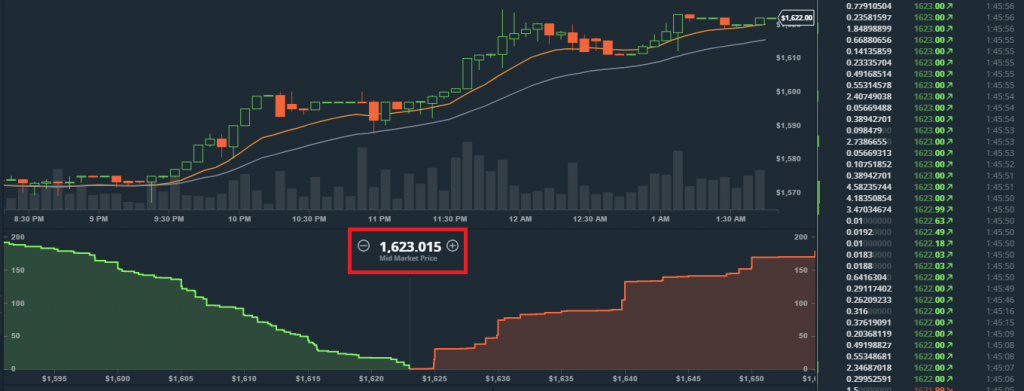

Bitcoin price is close to reaching $1,600. Currently, as global average, bitcoin is being traded at $1,594. However, some major exchanges including Coinbase’s GDAX and Japan’s Bitflyer have already begun to list a trading value higher than $1,600, with GDAX reaching $1,623 minutes before the time of reporting.

On May 3, CryptoCoinsNews previously reported that bitcoin price established its new all-time high at $1,567, for the third time this week. Bitcoin price is continuing its week-long momentum led by the Japanese and US markets, as it quickly approaches the $1,600 region in global average.

Currently, the majority of bitcoin trading is being processed in Japan and thus, the focus of global investors and traders are set in the Japanese market and industry. The daily trading volume of the US exchange market has decreased over the past two days. The Japanese exchange market has already reached $1,600, with its dominant bitcoin exchange Bitflyer trading bitcoin at a price of 180,000 yen, or $1,601.

The upward trend in bitcoin price is being supported by a rise in demand for bitcoin in the Japanese and South Korean markets. Although the South Korean exchange market only accounts for around 7 percent of the global exchange market in terms of market share, it is trading bitcoin at an average price of $1,648. Historically, the Chinese and South Korean markets have always offered arbitrage opportunities for traders.

One of the key factors that is preventing bitcoin price from surging past $1,600 and hitting new all-time highs is the inorganic trading price listed and demonstrated by Chinese bitcoin exchanges. The demand for bitcoin has substantially decreased in the regulated Chinese bitcoin exchange market due to the tightening of regulations. If the weekly trading volumes and average trading price of LocalBitcoins China is included to balance the trading value of bitcoin on regulated exchange markets, bitcoin most likely would have entered the $1,600 region already,

The weekly trading volume of LocalBitcoins China still demonstrates a high demand for bitcoin within the country. Thus, while the outlook on bitcoin remains optimistic within the Chinese market, the local exchange market is failing to represent the demand of investors.

As of now, the two major driving factors of bitcoin price are the explosive growth of the bitcoin industry in Japan and the optimism over the integration of Segregated Witness (Segwit) triggered by Litecoin’s recent implementation of the Bitcoin Core development team’s solution.

Investors have become increasingly excited in regard to the potential integration of Segwit on bitcoin. Although it seems unlikely based on the trend of the market, industry and communities, investors are still showing support toward bitcoin and believing in the possibility of the integration of a scaling solution.

Featured image from Shutterstock.

Advertisement: