While Bitcoin (BTC) price support may be psychological for some traders, the statistics behind BTC remaining over $20,000 for a week are strong indicators of price support or, in other words, a new bear market floor. Multiple Bitcoin data points might be able to establish a $20,000 support level.

Last week, Bitcoin reached a high of $20,961. However, it never sustained its upward momentum as the rally fizzled out, failing to break $21,000 support. As a result of the rally as well as the rejection, Glassnode, in its most recent report, analyzes whether or not Bitcoin is hammering out a bear market floor.

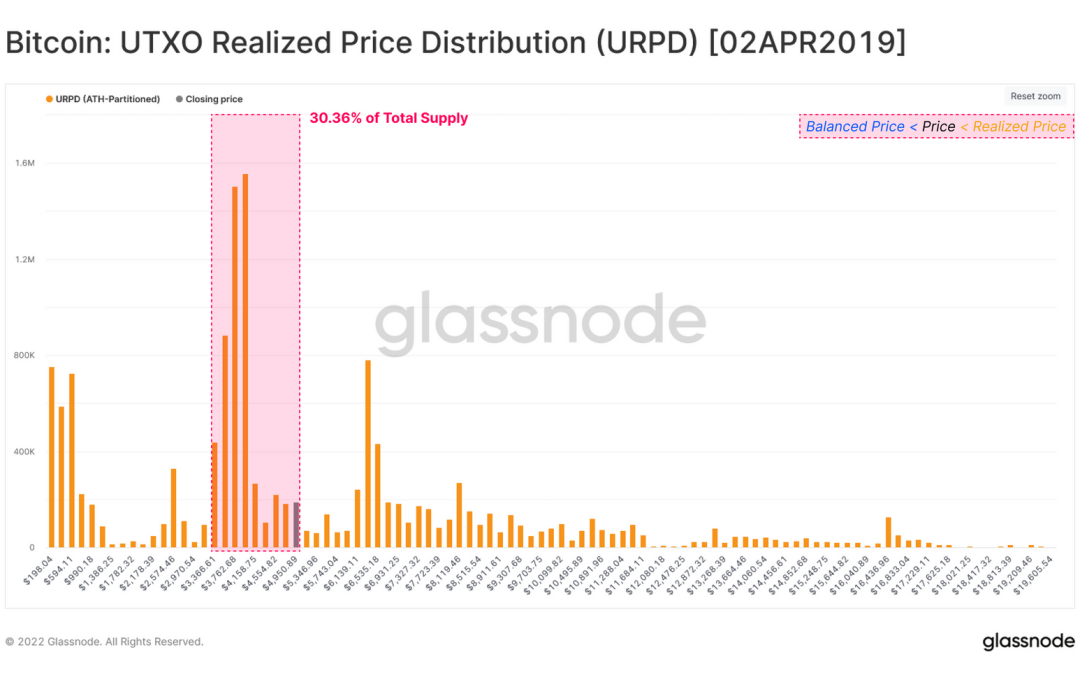

Realized price distribution

Bitcoin’s realized price charts the average cost buyers paid for their BTC holdings. If the price of Bitcoin goes below a user’s realized price, they are technically experiencing an unrealized loss. For visual effect, the UTXO Realized Price Distribution shows the percentage of supply distributed across the acquisition price.

The 2019 bear market shows that 30% of BTC’s total supply was concentrated within the realized price range. In April 2019, the price broke out above the realized price, signaling the start of a new bull market.

Looking at the current market and applying the same methodology, Bitcoin’s realized price is concentrating 20% of supply between $17,000 and $22,000. While this suggests that more redistribution may need to occur, the consolidation is significant and highlights a resilient holder base.

How long until the breakout?

Bitcoin’s valuation model may indicate how long until a breakout like in April 2019. Based on historical data, prior cycles have witnessed the realized price range lasting between 5.5 and 10 months. In the current cycle, Bitcoin has only been within range for roughly three months, meaning the next breakout may only happen after more months of sideways trading.

Related: BTC price sees ‘double top’ before FOMC

Long-term holders are still in profit

Utilizing the realized price distribution in terms of long-term holders versus short-term holders may also provide insight. Currently, long-term holders are the majority of the supply in profit, meaning they have less stress to sell and if they did, they would be in profit. The total amount of supply in profit is 56%, whereas, for long-term holders, it is at 60%.

While previous market cycles have lasted longer than the current cycle, signs are positive for a repeat breakout. And with long-term holders being an overwhelming majority of the supply in profit, sell pressure may be minimized in the event of upcoming sell-off events.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.