Bitcoin (BTC) has become considerably more decentralized in the past year, one metric suggests — and the trend is growing.

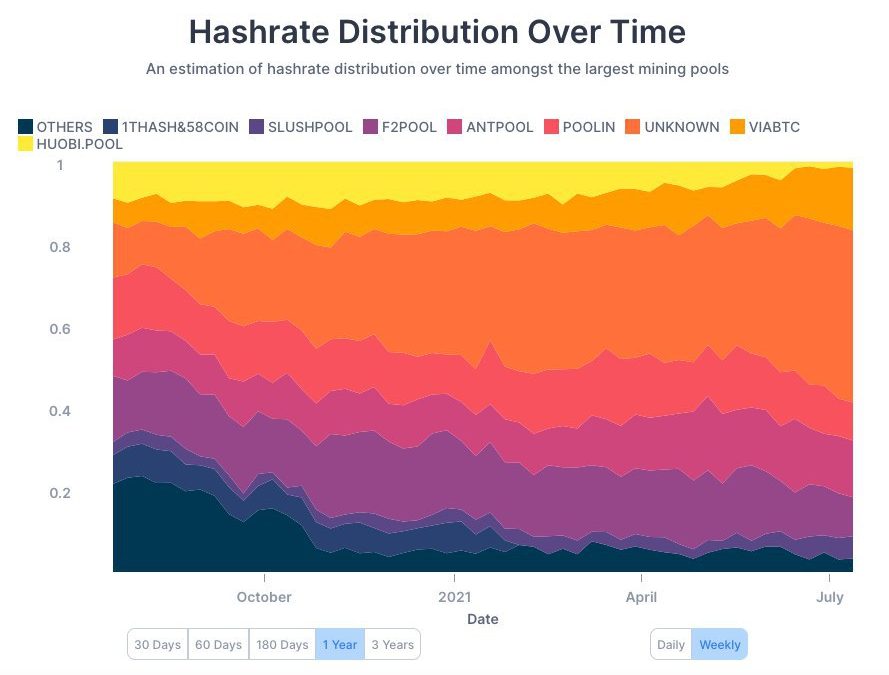

According to data from on-chain data resource Blockchain, hash rate distribution is increasingly favoring small, unknown miners.

Small guys increase slice of mining pie

Despite the past twelve months seeing a large price run-up, Bitcoin miners have not become more “corporate” — mining is actually seeing more anonymous, small-scale entities join in.

Looking at hash rate distribution, the trend is in evidence ever since the March 2020 crash, and this year has gathered pace.

The drawdown from $64,500 all-time highs precipitated the move towards smaller players, something which would be expected from a falling hash rate incentivizing them to mine.

As Cointelegraph reported, meanwhile, the hash rate has stabilized over the past two weeks and begun reclaiming lost ground.

Analysis of revenues collected by the mining community as a whole underscores the recovery taking place, giving hope for the upward trend which characterized hash rate until May to resume.

At the time of writing, the hash rate totaled an estimated 95 exahashes per second (EH/s), up from the floor of 83 EH/s.

Many miners “disproportionately sustainable”

Future changes among miners nonetheless appear to focus on larger players, which in the wake of the Chinese rout are gathering force in the United States and elsewhere.

Related: A green revolution in crypto mining? Industry answers wake-up call

A slew of announcements this month, including one mining firm planning to go public in the U.S., combines with news that the industry’s environmental credentials are changing rapidly.

“We’re also seeing a lot more disclosure from miners – 32% of the hash rate joined a council, Bitcoin Mining Council, and they produce quarterly disclosures now, and within that sample, the miners were 67% renewable or nuclear powered,” Nic Carter, co-founder of CoinShares, told CNBC Wednesday.

“So the miners that are disclosing — and a lot of these are western miners that are exposed to western capital markets — are disproportionately sustainable in their operations.”

Elon Musk, CEO of Tesla and SpaceX, hinted that Tesla may begin accepting Bitcoin for payments again in the coming months based on these environmental changes.