CNBC host Jim Cramer has revealed he made “a ton of money” on Bitcoin (BTC) but gold “let him down.”

In an episode of the Pomp Podcast released March 22, Cramer thanked host Anthony Pompliano for inspiring him to invest $500,000 in BTC.

Cramer after Bitcoin buy: “Thank you”

“Here’s what’s going on: you made me a ton of money,” he began.

Cramer is well known as a mainstream media finance pundit, and is also familiar to Bitcoiners after a previous Pomp Podcast appearance in September 2020. His latest outing, however, puts him in pole position among CNBC presenters when it comes to being bullish on Bitcoin.

Continuing, he said that unlike with his experience with buying gold and stocks, Bitcoin actually delivered.

“It happened just as you said,” he told Pompliano.

“It also happened much faster than you said, but I’m very grateful — and you know who else is grateful? My kids.”

Turning to gold, Cramer updated advice that he claimed to have espoused for almost 30 years. Instead of allocating 10% of one’s portfolio to the precious metal, he revealed for the first time that this should now be 5% gold and 5% Bitcoin.

“When I got not schooled but taught by Pomp, I said, ‘What am I doing not protecting myself in what I’ve been saying to people could be hyperinflation?’” he recalled.

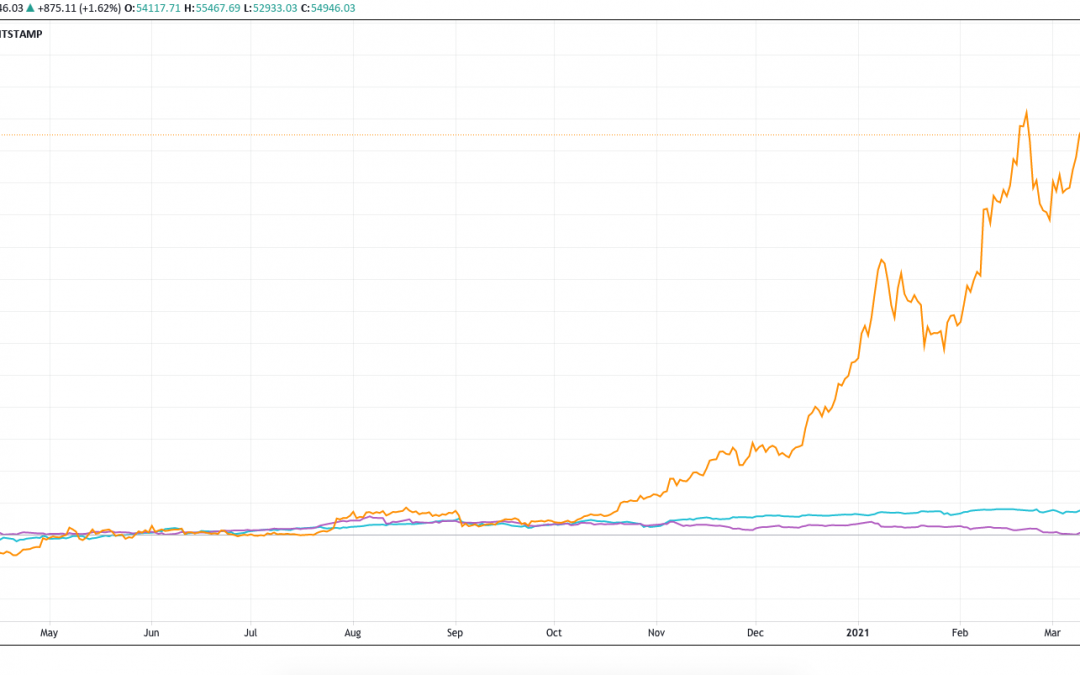

While he did not state exactly how much money he had made from his initial investment of around $500,000, the timing suggests that his stash is now worth approximately $2.4 million.

Earlier this week, even Fed Chair Jerome Powell described Bitcoin as a “substitute for gold” while stating that it did not challenge the U.S. dollar.

Stronger hands win out

Cramer is still a somewhat small-volume hodler compared to many Bitcoin investors who entered at much lower prices. As Cointelegraph reported, however, these whales have become increasingly weak-handed in recent times, selling into every major price rise this year.

The results continue to be seen in the form of spurts and lengthy consolidations for BTC/USD, a pattern which itself has sparked familiar accusations of volatility and unreliability from naysayers.

Proponents nonetheless cite on-chain data as evidence that the upside is not yet over, with popular estimates for the average price in 2021 running as high as $288,000.

If nothing else, that would make Cramer’s hoard worth around $12 million.