The tide might have gone out on Bitcoin Ordinals, but there’s a strong undercurrent of investments in Bitcoin-only companies. River, a U.S.-based Bitcoin (BTC) technology and financial services company is the latest to make a splash.

River announced a $35 million Series B equity funding round despite the bear market. Kingsway Capital led the round, with notable contributions including Paypal co-founder Peter Thiel, Cygni, Goldcrest and Valor Equity Partners.

According to Alex Leishman, the CEO of River, the new wave of Bitcoin interest is “largely driven by business and institutional adoption.” He added:

“It’s not fueled by hype. This year’s bank failures and bailouts have been a wake-up call, revealing the cracks of the traditional financial system and reminding us why Bitcoin is so important–it’s a secure path to a stronger and more transparent global economy.”

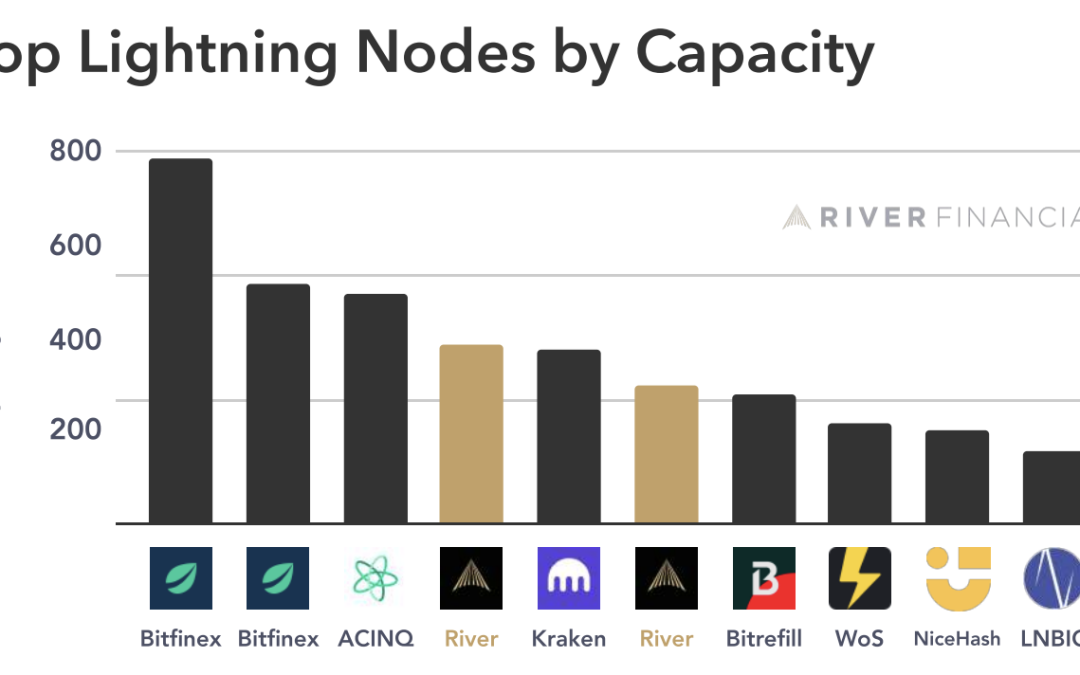

The San Francisco-based company manages one of the largest Bitcoin lightning nodes, enabling payments and managing liquidity for the Bitcoin Lightning Network.

The River Lightning API enables companies to easily integrate with the Lightning Network. The service has already taken charge of one of the key players in the Bitcoin payments landscape; El Salvador’s Chivo wallet use River for near-instant and near-free Bitcoin payments.

River was an early adopter of the Lightning Network, similar to global crypto exchanges including Bitfinex and Kraken.

Moreover, the world’s largest exchanges, Coinbase and Binance, may soon adopt Lightning as the world slowly warms up to the low-fee, high-throughput payments network. At the Advancing Bitcoin conference in London, River CEO Leishm told Cointelegraph:

“I still think that we are very early. Yeah, there’s a lot of cool things happening. We’re building this really amazing foundation protocol-wise.”

He said that it’s important to see more people “ working backward from the real human problems as well. We need more of that.” In light of the surge in mainchain transaction fees due to meme coin mania, more and more exchanges and crypto companies may turn to the Lightning Network as a solution.

Related: The state of the Bitcoin Lightning Network in 2023

River joins a burgeoning list of Bitcoin companies making raises during the bear market. Custody service provider Unchained Capital recently raised $60 million, while El Salvador’s education program received a flood of investments from Bitcoin advocates around the world.