Bitcoin (BTC) may be consolidating at $47,000, but longer timeframes show just how significant this week’s mini bull run has been.

According to the Golden Ratio Multiplier (GRM) metric, on March 27, BTC/USD reclaimed an essential support zone for securing further upside.

Bitcoin exits trendline slump that beat March 2020

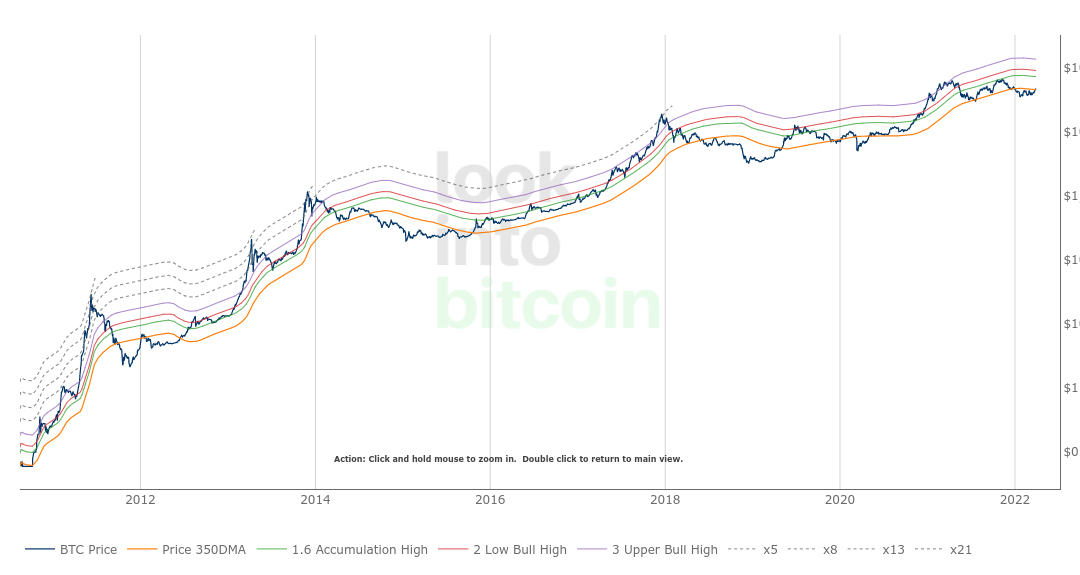

GRM is a long-term observational metric for Bitcoin price action. It is used to determine whether Bitcoin price growth (or the opposite) is overstretched relative to its overall maturity as an asset in terms of adoption.

It does so using a log scale, which comprises Bitcoin’s 350-day moving average (DMA) and Fibonacci sequences to give multiples of that trendline.

As such, BTC/USD dropping below the 350DMA is a now conspicuous sign of outlier price action, as the vast majority of days have been spent above it since mid-2019.

As Bitcoin matures and adoption spreads, logarithmic extremes become less pronounced.

“The Golden Ratio Multiplier is an effective tool because it is able to demonstrate when the market is likely overstretched within the context of Bitcoin’s adoption curve growth and market cycles,” analyst Philip Swift, who created the tool in 2019, explained at the time.

March 2020 COVID-19 crash, for example, had marked Bitcoin’s longest recent trip below the 350DMA, but 2022 managed to beat it by three months to two.

As such, the first three months of this year look like a clear exception to the rule when it comes to GRM.

Another use for GRM is naturally tied to predicting Bitcoin market cycle tops. In 2019, Swift estimated that the next top would be roughly three times the 350DMA.

“If this decreasing Fibonacci sequence pattern continues to play out as it has done over the course of the past 9 years, then the next market cycle high will be when price is in the area of the 350DMA x3,” he reasoned.

Weekly chart makes mincemeat of once solid resistance

On mid-range timeframes, as Cointelegraph reported, Bitcoin is already making a statement when it comes to trendlines in place throughout 2022.

Related: Bitcoin sentiment hits ‘greed’ in 2022 first amid calls for $45K BTC price pullback

Two MAs providing resistance in Q1 — the 21-week and 50-week exponential MA — saw their first challenge this week, and bulls are currently battling for them as new support, data from Cointelegraph Markets Pro and TradingView shows.

The two roughly divide Bitcoin’s current trading range, in effect since the start of 2021, into two parts with $28,000 and $69,000 as the floor and ceiling, respectively.

Moving above them, popular trader and analyst Rekt Capital previously said, would allow BTC/USD to have a shot at new all-time highs.

“BTC has performed a Weekly Candle Close above the 21-week Bull Market EMA when price is in an uptrend for the first time since mid-July 2021,” he added in an update on the topic this week.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.