Bitcoin (BTC) has performed “very well” as traders send more coins to exchanges than at any time since the March 2020 crash.

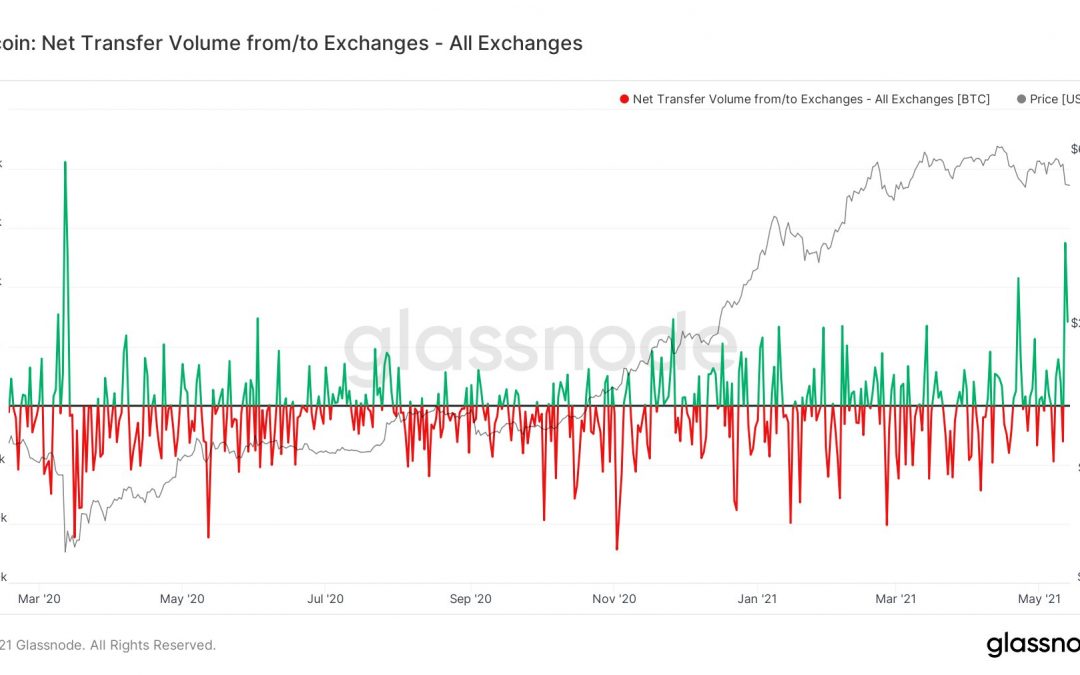

Data from on-chain monitoring resources CryptoQuant and Glassnode shows that BTC exchange inflows hit a one-year high on May 13.

Nearly 30,000 BTC hits exchanges

Bitcoin saw intense pressure from sellers this week as multiple news triggers combined to turn many bearish.

Tesla abandoning BTC payments, followed by rumors of an investigation of major exchange Binance by United States regulators, was enough to send BTC/USD to lows of $46,000 before stabilizing.

As Cointelegraph reported, the dip could have been considerably worse, with longer-term price features providing support at crucial levels.

Nonetheless, $50,000 remains out of reach at the time of writing, as hodlers lick their wounds and assess Bitcoin’s likely next move.

Data tracking trader behavior reveals the scale of the sell-off and likewise suggests that Bitcoin, in fact, weathered the storm rather well.

Inflows to exchanges hit 30,000 BTC ($1.47 billion) on Thursday, while liquidations totalled $200 million in just one ten-minute period during the height of the price volatility.

“Yesterday was the largest day of exchange inflows since the March crash last year,” analyst William Clemente summarized on Friday.

“BTC held up very well given this and $200M of liquidations in 10 minutes.”

Whale warnings

Inflows to exchanges reflect the desire to sell BTC at short notice. Some may not divest themselves of their holdings for cash, but rather take a stablecoin position and then buy back in once prices stabilize. As such, outflows may soon begin to rise, as panicky investors join those “buying the dip.”

Continuing the analysis, however, Ki Young Ju, CEO of CryptoQuant, highlighted whales still sending coins to exchanges more than usual as a potential sign that the bearish phase is not yet over for good.

“If you’re a derivative trader, be careful in the short term. (Relatively speaking) whales are depositing $BTC to exchanges,” he told Twitter followers.