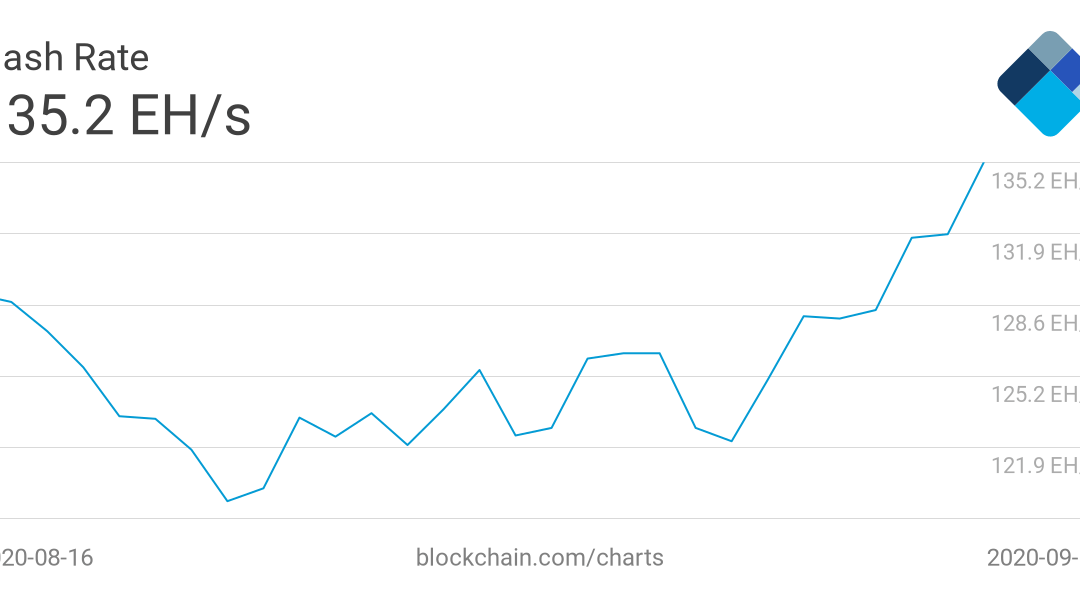

Hashrate is at the highest level despite a week in which prices dipped from $12,000 to test lows of $9,825.

Bitcoin’s hashrate has hit a new all-time high as miners continue to be bullish about the cryptocurrency.

The network’s seven-day average chart shows that the total computational power miners have contributed to the network security has reached 135.2 exahashes per second (EH/s).

On September 6, the total computational power expended on the network was about 122.9 EH/s, which means despite price falling from highs of $12k to lows of $10k, miners remain upbeat.

The 30-day average has also hit a new all-time high of 126.3 EH/s over the past month.

Generally, what this means is that miners are betting more and more on Bitcoin’s future price rising. It is a historically bullish signal for the top cryptocurrency. On the basis of it, a more secure network results in higher developer activity, increased usage and overall network health.

Again, that means price going up, with more miners joining the network and pushing the total computational power even higher.

While hashrate has climbed to new levels, miners are facing a shortage of high-performance next-generation rigs. Apparently, most mining rig manufacturers have been unable to keep pace with demand.

As well as Bitmain, other top mining rig companies Canaan, Whatsminer, and Ebang are reportedly out of stock, with both 7nm and 8nm semiconductors in short supply from giants TSMC and Samsung.

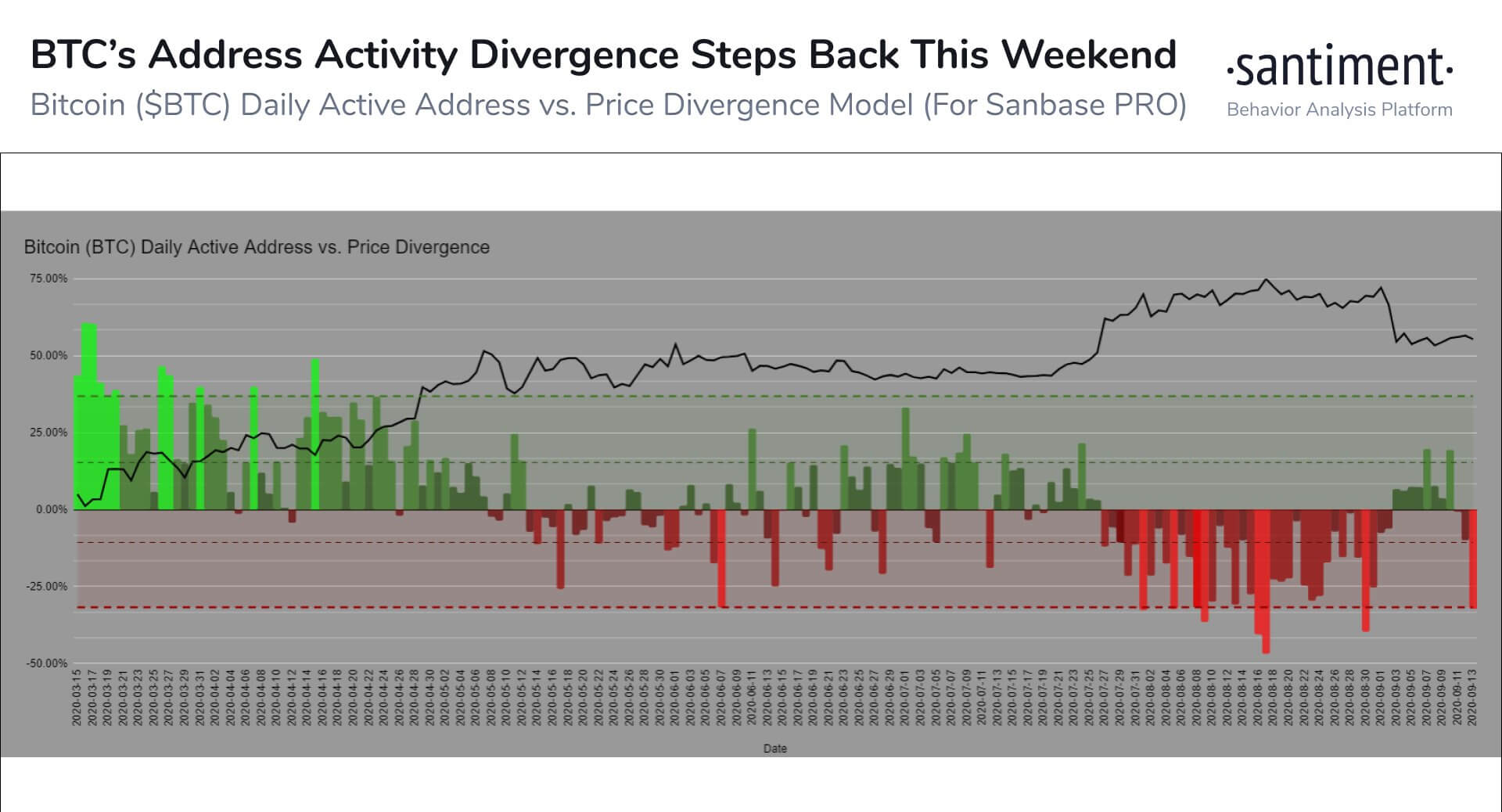

Meanwhile, Bitcoin’s on-chain activity from the past week was markedly bearish, with development activity falling after spiking in the first week of September.

However, despite the overall bearishness registered in price action, the week was dotted with several bullish divergences. As well as daily active addresses, the number of whales holding 1 bitcoin hit a new all-time high.

In the chart above shared by the on-chain analytics platform Santiment, we can see that the leading cryptocurrency’s address activity slowed down. However despite that, Bitcoin remains in an uptrend. It means that despite the recent price correction, BTC/USD is likely to rally higher after bulls managed to hold above $10,200 and prevented a revisit of $9,700 linked to an unfilled CME gap.

On Sunday, BTC/USD rallied above $10,500 for the first time since September 5 when it dropped from highs of $12,050. It suggests that bulls still have an appetite for more gains, which might see them attempt a weekly close above $10,800.

The post Bitcoin Hashrate Hits 135.2 EH/s as miners’ bullishness continues appeared first on Coin Journal.