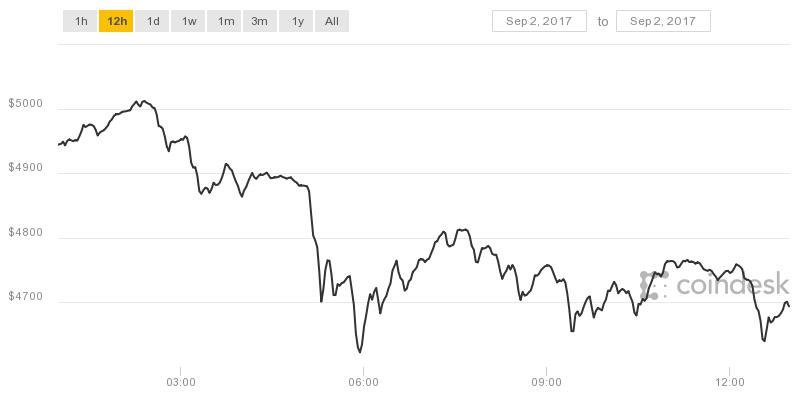

It’s the biggest sell-off since mid-July.

At press time, the total value of all publicly traded cryptocurrencies was $166 billion, a figure that was down more than 7 percent from a high of nearly $180 billion last night.

That’s when bitcoin, surging on technical improvements and growing investor optimism, topped $5,000 on the CoinDesk Bitcoin Price Index for the first time.

The decline was similar to what was observed on bitcoin, with average global prices declining from a high of $5,013.91 to a low of $4,619.97, a more than $250 decline.

Overall, it was the largest sell-off in the cryptocurrency markets since July 15, when the total value of the asset class plunged roughly 12 percent from $72 billion to $63 billion. However, that decline was part of a multi-day sell-off that saw prices drop more than 25 percent on what was then concern over bitcoin’s technical roadmap.

At press time, market observers seemed split on how to read the market movement.

In remarks to CoinDesk, some stated it might be too early to say the market has peaked given the recent upswell in institutional interest and the finite nature of new cryptocurrency creation.

On the latter point, some went so far to speculate the decline could be a “bear trap,” one that quickly opens the door for larger gains.

“Since bitcoin is getting a lot of media attention lately a lot of people are looking for a moment to enter the market,” Bram Ceelen, founder of cryptocurrency brokerage AnyCoin, told CoinDesk.

Others pointed to declines in July and May as evidence the market has still retracted, even during its 2017 rally, and that further declines were possible.

Money in mousetrap image via Shutterstock

The leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Have breaking news or a story tip to send to our journalists? Contact us at [email protected].