As bitcoin nurses a weekly drop of 9%, the cryptocurrency’s social metrics indicate the retail crowd is high on hopium – a crypto slang for hopes of a quick recovery and a continued bull run.

However, past data shows pullbacks or downtrends typically end when social chatter leans bearish.

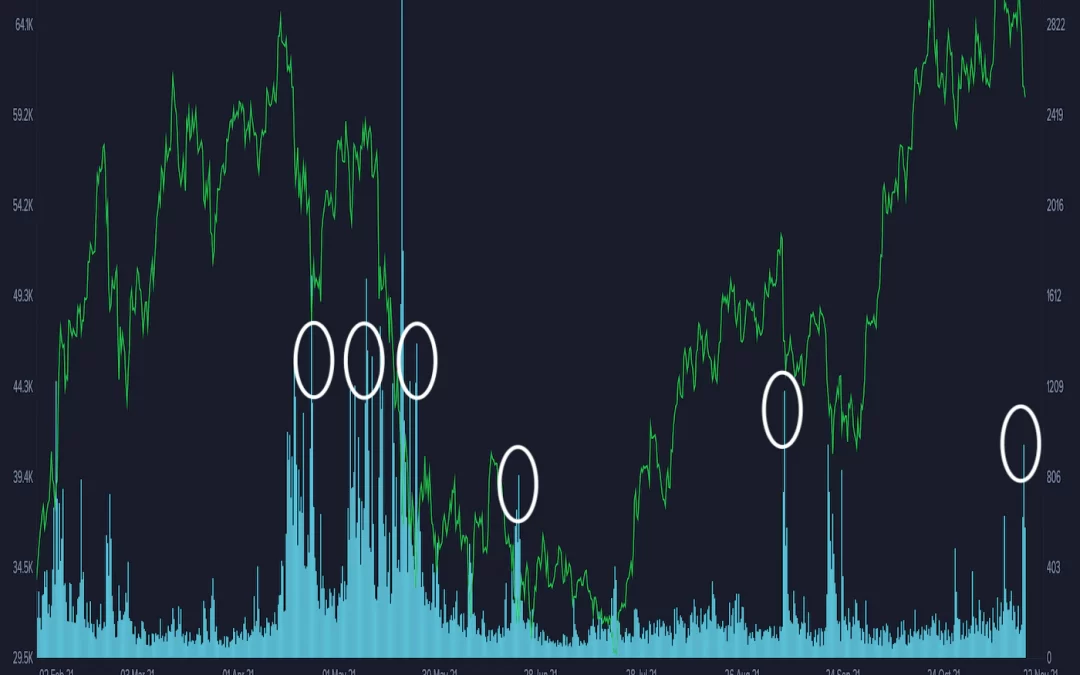

Data tracked by blockchain analytics platform Santiment shows “buy the dip” mentions on social media rose to 952 on Tuesday, hitting the highest levels since Sept. 7, when bitcoin crashed by 11%. The number of mentions remains elevated at press time.

It may be a sign that bitcoin is yet to find a bottom. “Just look at the previous spikes in the buy the dip calls and you’ll notice that they’ve often come early (like back in April and May, respectively) and tend to be accompanied by another leg down before the crowd is finally proven right,” Santiment said in its market update on Wednesday.

While buy the dip chatter on social media surged after the Sept. 7 slide to $43,000, the cryptocurrency bottomed out below $40,000 two weeks later. A similar pattern was seen several times in May and June.

If history is a guide, bitcoin is unlikely to chart a recovery to recent highs near $69,000. The U.S. dollar’s ongoing rally and renewed uncertainty about crypto taxation in the U.S. may keep bitcoin buyers at bay for some time.

That said, the big picture remains constructive, with the blockchain data leaning bullish, as discussed in Tuesday’s First Mover newsletter.