Jamie Redman

Two researchers from Spanish financial group Banco Santander S.A. have released a report concerning the benefits of Bitcoin versus credit cards and traditional bank services. The 10-page paper details the increasing risk for traditional financial management as cryptocurrency solutions become more popular.

Banco Santander & the Mercado Bitcoin Brokerage Discuss Bitcoin

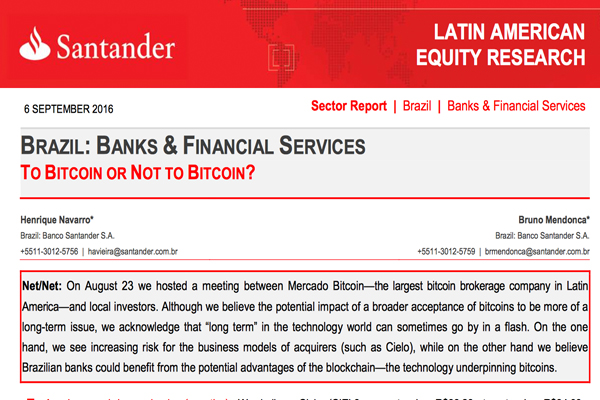

On August 23, Banco Santander affiliates met with the Mercado Bitcoin brokerage and Santander R&D officials from the Latin American region to discuss the future of the technology.

On August 23, Banco Santander affiliates met with the Mercado Bitcoin brokerage and Santander R&D officials from the Latin American region to discuss the future of the technology.

Researchers Henrique Navarro and Bruno Mendonca come to the conclusion that they believe Brazilian banks could benefit from distributed ledger technology.

Even though the technology is in its early stages, the researchers note that banks worldwide are investing resources into researching distributed ledger protocols. The Banco Santander affiliates said the blockchain concept and platforms like Bitcoin will “redefine money transactions in the banking world.”

The report notes that credit card services and traditional financiers will be at a disadvantage against merchants and suppliers who accept bitcoins. The study explains why Bitcoin may outperform legacy services, stating:

Some advantages are the low (near zero) costs in a bitcoin transaction; both parties to the transaction do not need to know each other; payment is fast (on average it takes 10 minutes to process a transaction, as set by the Bitcoin algorithm currently in place); there is no need to provide personal data. The Bitcoin concept means a virtual cash transaction with anyone, anywhere, in any amount.

Banco Santander researchers explained that traditional banks will feel the impact of the Bitcoin network effect unless they work with blockchain technology. Navarro and Mendonca also noted many organizations have shown significant process in testing this emerging protocol, including Visa. The report, while dedicated to championing blockchain technology, gives the Bitcoin network quite a bit of credit throughout.

Santander Associates Give Bitcoin Credit But The Underlying Message Is Banks Should Build Their Own Blockchains

The Santander Group has been interested in blockchain technology for some time. Back in June Santander U.K. revealed it had been testing its own distributed ledger app between employees. The application was one of the first blockchain-based international payments protocols used by a well-known legacy bank.

With associates from firms like Santander giving Bitcoin many compliments, it shows that traditional finance institutions are taking the protocol seriously. With its low costs, no third party issuer, and peer-to-peer resilience, Bitcoin puts the banking industry at risk the more it grows in popularity.

The report shows the authors do understand how Bitcoin is transforming finance for the better. The solution for Santander and rest of the banks concerned with Bitcoin’s benefits is to create their own blockchains. The question is: are legacy institutions too late? The Bitcoin network is now seven years old, and one of the most trusted distributed ledgers to date, as well as a $10 billion industry.