The price of bitcoin cash (BCH) has been on a tear lately as network participants are steadily preparing for the upcoming hard fork. At the time of writing, the digital asset’s value is averaging $495 USD and currently commands the second highest cryptocurrency trade volume in the world.

Also read: Swiss Vocational School Lucerne University Accepts Bitcoin for Tuition

Bitcoin Cash Markets

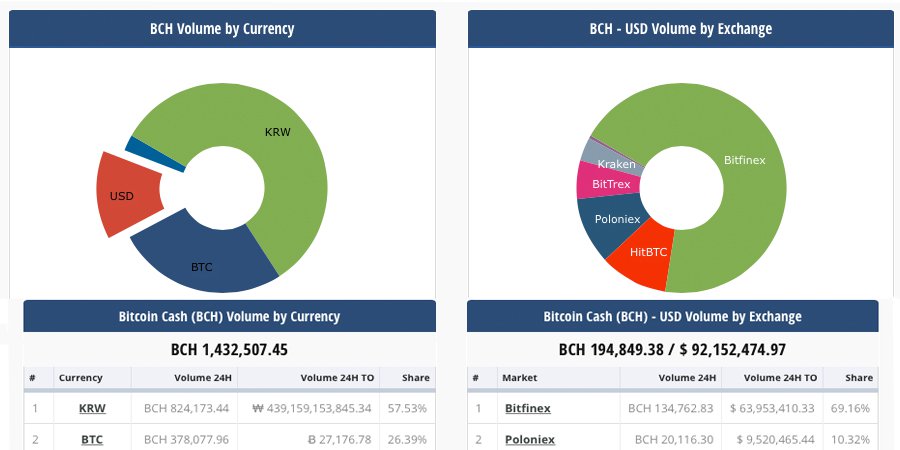

Over the past week, BCH markets have been pushing quite a bit of trade volume as the price has jumped above its long-standing $300 price range. Now with $879M in global trade volume stemming from exchanges like Bithumb, Hitbtc, and Bitfinex the price spike had surpassed $500 per BCH on November 1. Korean markets are taking the lion’s share of BCH volume as the South Korean won is capturing 57 percent of the market volume. Additionally, the price rise is taking place just before digital asset’s upcoming hard fork centered around fixing the Difficulty Adjustment Algorithm (DAA). On October 31, the Bitcoin ABC development team released its 0.16 source code which is hard fork ready for November 13th, 2017 at 2:06 PM GMT.

Technical Indicators

According to the one week chart, bitcoin cash markets have been experiencing a nice rally by capitalizing an upswing of 25 percent over the past three days. At the moment order books on Bitfinex and other popular exchanges show a solid foundation within the $375-450 range if bears drag the price down. However, markets look bullish as charts show the 100 Simple Moving Average is well above the 200 SMA which indicates markets could spike again after some consolidation.

Looking at the 24-hour charts show the RSI is heading north, but the Stochastic oscillator shows overbought conditions which could mean bulls are just rearranging positions. If buyers push pressure higher ranges between $550-700 are obtainable, but traders will likely meet resistance between the two price points. Daily charts show BCH markets have climbed 15 percent during the end of October 31st into November 1st.

Bitcoin Cash News & Community Sentiment

Of course, bitcoin cash supporters are quite pleased with the price, and many traders believe it will continue to rise steadily. The reason for this is, there are a lot of people who think BCH might be a safeguard against the possibility that the upcoming Segwit2x fork may get messy. As the fork gets closer, the price has continued to head north gathering significant trade volume across global exchanges. Further, the BCH community seems pleased with the November 13 fork scheduled for the network which aims to fix the current DAA.

In other BCH news the well known online merchant, Wikileaks Shop, has just announced to its Twitter followers it will accept BCH for Wikileaks merchandise. “Do you have bitcoin cash? You can now use it in our shop to support Wikileaks,” explains the store’s administrators. Another positive announcement this week came from the company Bitcoin Plug ATM, which plans to implement BCH in the firm’s Los Angeles-based automated teller machines (ATM).

“We are excited to soon offer Bitcoin Cash at all of our Los Angeles BATM locations — Thank you General Bytes,” the ATM company details.

The Verdict

Overall BCH proponents are optimistic about the currency’s market value and hard fork going forward. A good majority of BCH enthusiasts, and the network’s developers believe the fork will be smooth and without issue. Further, every week new infrastructure and BCH support has been steadily growing which has built a solid foundation for this nascent network. Over the next two weeks with the Segwit2x drama taking place people in BCH should be well positioned.

Bear Scenario: If BCH markets start to correct there should be a temporary floor within the $425-450 price territory. Further dips could bring the price to $375 where traders will find yet another foundation of support. Key levels to watch will be if BCH breaks the $475 and $400 zones which may lead to an additional sell-off.

Bull Scenario: At the moment bulls have the reigns going forward as order books show there are just a few obstacles before smooth sailing upwards. Fibonacci trend lines at a 61.8 extension (golden ratio) show prices could reach $700 in the short term with some resistance in between. With enough buying pressure from that vantage point, bitcoin cash could touch all-time highs once again over the next few weeks.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Cryptocurrency price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Pixabay, Bitcoin.com forums, Twitter, and Crypto Compare.

At Bitcoin.com there’s a bunch of free helpful services. For instance, check out our Tools page!