On Friday, Aug. 13, a total of $675 million worth of Bitcoin (BTC) options are set to expire and currently the bulls enjoy a significant advantage after a 20% weekly rally to $46,743.

According to Cointelegraph, two things that marked the positive shift seen from institutional investors were deposits to derivatives exchanges reaching their lowest levels since May 11 and entities with 10,000 to 100,000 BTC adding over $12 billion additional Bitcoin to their holdings.

Meanwhile, cryptocurrency adoption continues to rise as the Paypal-owned payments firm Venmo has expanded its support by allowing credit cardholders to convert their cash back rewards into four cryptocurrencies.

Investors could also be reacting to the new wave of indirect exposure exchange-traded fund (ETF) filings to the United States Securities and Exchange Commission. The latest request came from the asset manager VanEck on Aug. 10.

BitMEX’s $100 million settlement and ETF hopes fueled the bullish bets

On Aug. 3, United States Securities and Exchange Commission chair Gary Gensler hinted that it would be more open to accepting a BTC ETF application if specific changes were made to the instrument.

This week, BitMEXalso agreed to resolve a case from the United States Commodity Futures Trading Commission and the Financial Crimes Enforcement Network. As part of the settlement, BitMEX will pay up to $100 million in civil monetary penalties “for illegally operating a cryptocurrency trading platform and anti-money laundering violations.”

This bullish newsflow helped fuel some bullish bets for Friday’s options expiry, but some traders became overly excited.

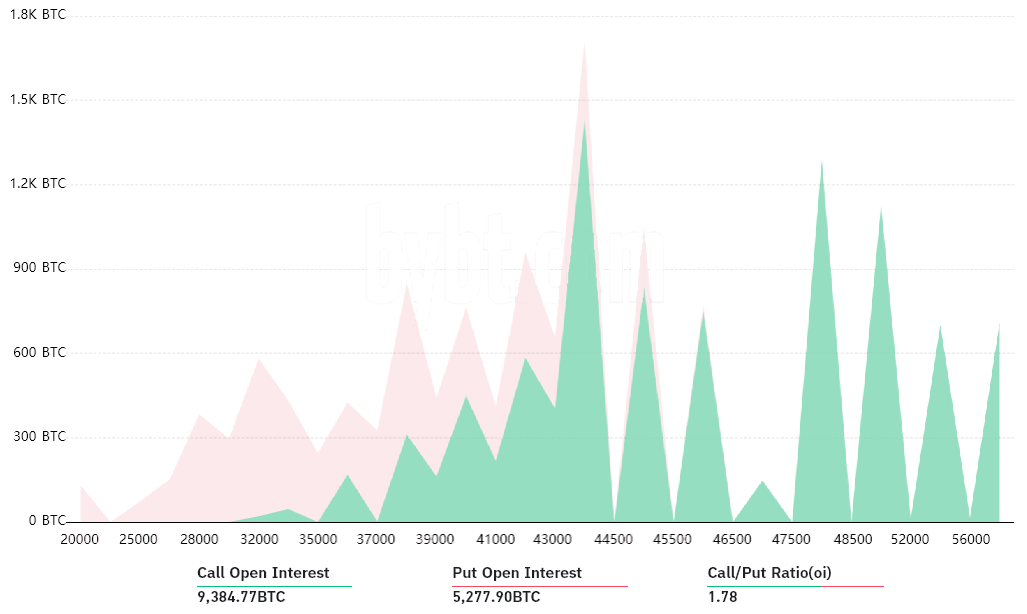

The total figure is similar to the previous week’s $625 million options expiry which also had a 1.78 call-to-put ratio at the time. This week, the neutral-to-bullish call options dominate again and the protective put options are below the current $46,500 price level.

If Bitcoin remains above $46,000 on Aug. 13 at 8:00 am ET, all of the 5,278 BTC put option contracts will become worthless.

On the other hand, only 5,335 BTC call (buy) options will take part of the expiry, and this is equivalent to $245 million. Investors got overly excited, buying $48,000 and higher bullish options, which reduced the $435 million potential of these call options.

Bears place their dreams on a sub-$44,000 Bitcoin price

Bulls could use their significant advantage to force the price upward because reaching the $48,000 mark would increase the options expiry notional by $80 million. In this case, the bulls’ upper hand would reach $325 million and display an even stronger dominance over the market.

The only solution for the bears lies in an improbable expiry below $44,000. This would drastically reduce bulls’ advantage to a meager $80 million if it somehow happens on Friday.

Although it might be too early to call the race, the incentives for moving Bitcoin price 5% below $46,500 do not seem worthy of the effort.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.