BTC price came close to breaking overhead resistance near $51,500

Bitcoin price rallied 5% to reach highs of $51,477 yesterday before retreating slightly to close at $50,967.

At the time of writing, BTC/USD was changing hands at $50,310. Although it faces some slight pressure, buyers might have the upper hand if it remains above the $50k level. This could see a significant upside towards a new all-time high.

BTC price to benefit from USD debasement

After the US Senate’s $1.9 trillion stimulus package vote, veteran trader Peter Brandt noted that “the devaluation of the purchasing power of the U.S. Dollar DX_F has only just begun”.

According to the trader, the debasement of the Dollar means Bitcoin is poised to rally higher alongside other assets.

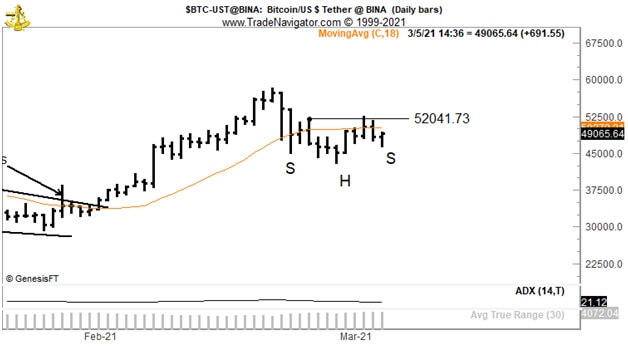

“Two charts to carefully watch in the days ahead. ES_F S&Ps ‘V’-extended bottom. New highs ahead. BTC inverse head and shoulders pattern. New highs ahead”, he added.

As per the chart below, BTC price will complete the inverse H&S pattern if it breaks above $52,000. Sustained upside momentum could then send BTC/USD to a new record high.

BTC/USD outlook

Looking at the daily chart, we see bulls were aggressive even as prices dipped to lows of $43,000 towards the end of February. The past week saw buyers rally higher, pushing the BTC/USD pair above the key support level marked by the 20-day exponential moving average ($48,699).

The RSI is also above the half-line but suggests buyers are facing short-term pressure. A negative divergence could push prices to the 50-day EMA ($44,058).

On the other hand, a positive divergence will put bulls under control and propel BTC/USD above $52,000. Such a scenario could allow bulls to seek further gains towards the all-time high of $58,330.

On the 4-hour chart, BTC/USD has turned lower from its recent highs with two red candles. This outlook is likely to invalidate the bullish technical pattern in the shape of an inverse H&S.

If the price fails to break above the overhead resistance at $50,900, a short-term downtrend could bring it towards the 20-day EMA ($49,581) and 50-day EMA ($49,114).

Further losses could lead to a breakdown to lows of $47,000, with a dip to last week’s lows of $43,000 also possible.

On the contrary, a breakout above $51k would see bulls target the aforementioned resistance around $52,000. From here, upside pressure will allow for a retest of the all-time high and potentially see bulls break above $60,000.

The post Bitcoin breaks $51,000 as top analyst predicts ‘new highs ahead’ appeared first on Coin Journal.