Investors put money into cryptocurrency funds for a second straight week as the bitcoin market stabilized following one of its worst-ever starts to a year.

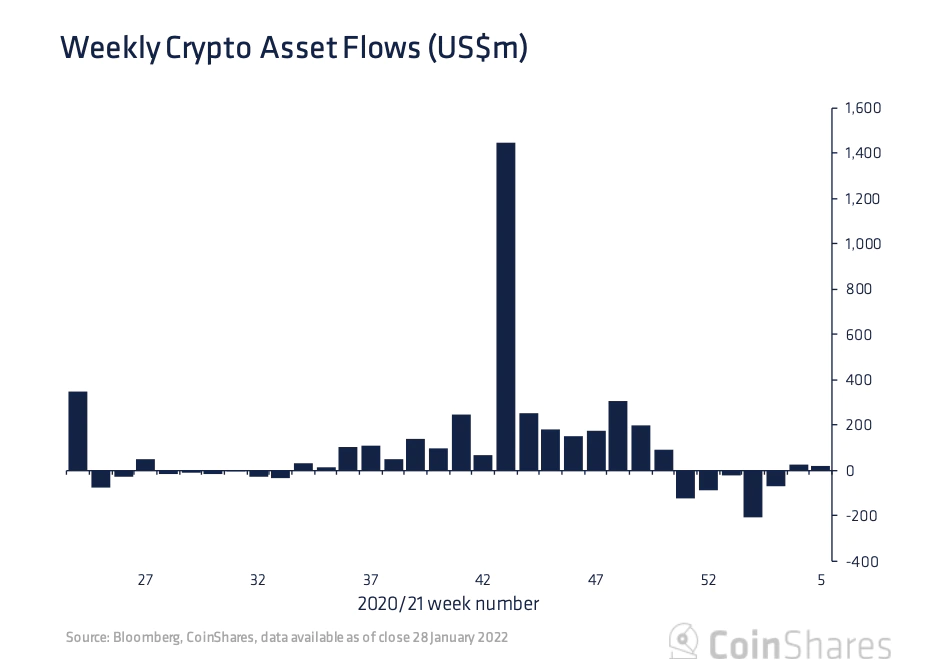

Crypto funds saw inflows of $19 million during the seven days through Jan. 28, according to a report Monday from the digital-asset manager CoinShares.

While the increase looks small relative to some of the $200 million-plus weeks of inflows in 2021, the trend suggests investors are cautiously adding to positions “at these depressed price levels,” the CoinShares analysts wrote.

Investors put some $14 million into crypto funds during the prior week – reversing five straight weeks of redemptions that totaled $532 million.

Bitcoin (BTC) is down 17% so far this year, changing hands around $38,500 at press time. The price is still well off the all-time high around $69,000 reached in November 2021.

Notably, some $22.1 million flowed into bitcoin-focused funds last week, while Ethereum-focused funds suffered outflows of $26.8 million.

Prices for the Ethereum blockchain’s native cryptocurrency, ether (ETH), are down 27% this year to about $2,700.

“Ethereum continues to suffer from negative sentiment,” CoinShares wrote.

Multi-asset funds – focused on a combination of coins – brought in $32 million, the most since June 2021. This suggests “investors are adopting a diversified investment approach,” according to CoinShares

But funds focused on Solana, Polkadot and Cardano all saw outflows last week, “suggesting investors are shunning altcoins,” CoinShares wrote.