It comes as no surprise that Bitcoin is ranked high among the most crowded trades

The COVID-19 pandemic has impacted almost all fronts of the financial landscape. In particular, the US dollar has suffered quite a blow, and it seems asset managers have lost faith in it. Many of them have turned their backs on the dollar and are considering other investment options that are more inflation-resistant.

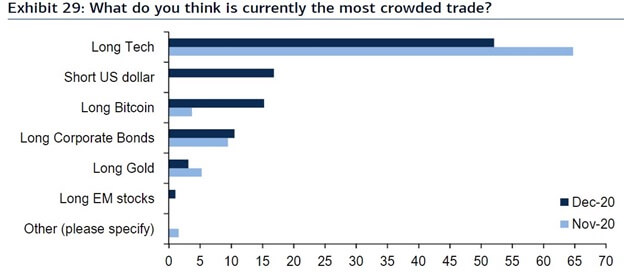

Bitcoin is one of the options that has attracted massive interest. A recent survey of global fund managers indicates that Bitcoin has jumped up the most crowded trade list. The digital asset has outstripped traditional investment options bonds. Bitcoin ranked as the third busiest trade with a 15% vote.

Tech stocks and short dollar positions were first and second receiving approvals of 52% and 18% of the survey respondents.

List of the most crowded trades as per the BofA GFM survey. Source: Twitter

The findings are a part of the Bank of America (BofA) Global Fund Manager (GFM) survey carried out this month between 4 December and 10 December. It involved a total of 217 fund managers across the globe. Many investors appear to be moving away from other assets to cryptocurrencies, based on the survey results. This could be partly due to the poor performance of other assets and the recent Bitcoin price rally.

Notable figures in the finance world like Michael Saylor (MicroStrategy), Jack Dorsey (Square) and Paul Tudor (Tudor Investment Corporation) have laid a path many investors are keen on following. MassMutual and Ruffer Investment Company have also followed suit.

As reported by Bloomberg, the survey further revealed that fund managers are underweight in cash—the first time it has happened since May 2013.

Bitcoin has been named among the busiest trades on several occasions since September 2017. It had garnered a total of 26% of respondent votes back then. Bitcoin’s market cap exceeded the bank’s valuation for the first time on 18 August this year and is now ahead by 45%.

The post Bitcoin among the most crowded trades in fund manager survey appeared first on Coin Journal.