by Ashlee Vance

The goal is to pump money into risky, long-term energy technology that could dramatically reduce greenhouse gas emissions, according to a statement.

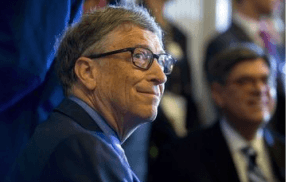

Bill Gates and more than a dozen of the world’s wealthiest individuals revealed a new $1 billion investment fund late Sunday to foster major advances in clean energy production.

Dubbed Breakthrough Energy Ventures, the 20-year fund is backed by a mix of technology luminaries and heavyweights from the energy industry. The investments will likely go into areas such as electricity generation and storage, agriculture and transportation.

Investors include Jeff Bezos, founder and chief executive officer of Amazon.com Inc., Richard Branson, the founder of Virgin Group Ltd., Jack Ma, the executive chairman of Alibaba Group Holding Ltd., John Arnold, a billionaire natural gas trader, and Prince Alwaleed Bin Talal, the founder of Kingdom Holding.

Last year, a number of these investors joined Gates in announcing the Breakthrough Energy Coalition — a group of wealthy investors who pledged to aim a large portion of their fortunes toward energy technology. The arrival of the fund marks a more concrete step by this group toward their stated goals.

“I am honored to work along with these investors to build on the powerful foundation of public investment in basic research,” Gates said in a statement. “Our goal is to build companies that will help deliver the next generation of reliable, affordable, and emissions-free energy to the world.”

Gates, co-founder of Microsoft Corp., spent much of the last year stumping for advances in energy production. He maintains that things like solar plants, nuclear power and electric cars will do little to solve global warming in the relatively near-term. The only way to halt global warming is to find an energy source that produces no greenhouse gases, Gates has said.

He has personally backed a number of radical energy startups and has encouraged other wealthy individuals to follow suit. Clean energy was a hot niche of venture capital investing several years ago, but many of those investments didn’t pan out and some VC firms pulled back.

“The dearth of venture funding for clean energy technologies threatens to create a valley of death for the industry, with emerging ideas unable to find the necessary capital to reach commercialization,” Arnold said in a statement. “As an investor led effort, Breakthrough Energy Ventures is designed as a source of patient capital to spur innovation to meet the growing demand for low-cost, clean energy solutions.”Two venture capitalists who have invested in clean energy startups — John Doerr and Vinod Khosla — are among the backers of the new fund.