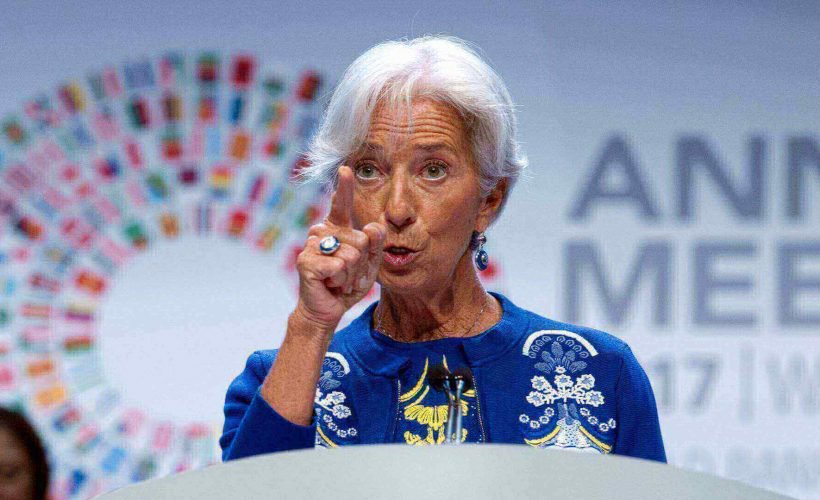

International Monetary Fund (IMF) Managing Director Christine Lagarde released a blog post Tuesday, March 13, Addressing the Dark Side of the Crypto World. In it, she argues increasing fascination with cryptocurrencies has brought along grave costs: money laundering, terrorism, and economic instability.

Also read: Québec Premier: We’re Not Really Interested in Bitcoin Mining

IMF Managing Director Christine Lagarde Warns of Crypto

Addressing the Dark Side of the Crypto World contains Ms. Lagarde’s most pointed remarks on cryptocurrencies since her first toe-dip back in Fall of last year. Since then, however, her opinion seems to be devolving, and her current blog post doesn’t mince words. “The same reason crypto-assets like Bitcoin are so appealing,” Ms. Lagarde wrote, “is also what makes them dangerous.”

Her missive comes in at least five languages: English, Arabic, Chinese, Japanese, and Portuguese. Clearly, the IMF wants this read widely. The IMF formed in the aftermath of World War II, based largely on the ideas of English economist John Maynard Keynes. In its modern context, the IMF is employed during financial crises to manage balance of payments through an established pool of funds known as special drawing rights (SDRs), which currently total a little over half a trillion dollars.

Recalling her earlier optimism, Ms. Lagarde continued, “The technology behind these assets—including blockchain—is an exciting advancement that could help revolutionize fields beyond finance. It could, for example, power financial inclusion by providing new, low-cost payment methods to those who lack bank accounts and in the process empower millions in low-income countries.”

However, when it comes to central bank digital currency proposals, her tone turns ominous and curious. “The possible benefits have even led some central banks to consider the idea of issuing central bank digital currencies,” Ms. Lagarde teases. It’s curious because the issue of central banks and crypto isn’t prefaced; it just suddenly appears as the post’s focus. It could very well be the IMF is attempting to buttress, backup, a recent 34-page Bank for International Settlements (BIS) warning about the issue. And timing could not be better, considering the Group of 20 (G20) meeting in Argentina right around the corner.

Fire and Brimstone

Both BIS and IMF betray understanding of basic cryptocurrency literacy. A cryptocurrency isn’t just a digital form of payment encrypted. To cause the sort of mischief it’s accused, a crypto must for sure use encryption, a necessary but not sufficient condition, and at least have something akin to a decentralized, distributed ledger of accounting. Central banks are, well, centralized and thus defy the basic definition. Still, where there is a fuss to be made, government agencies are hardly afraid to make it.

“Before we get [to central bank-backed crypto], however, we should take a step back and understand the peril that comes along with the promise,” Ms. Lagarde begins. And there can be pitfalls in using crypto, as many enthusiasts are aware, especially as infrastructure is built and the ecosystem grows. However, the IMF Managing Director insists typical cryptos are decentralized “without the need for a central bank,” giving “crypto-asset transactions an element of anonymity, much like cash transactions. The result is a potentially major new vehicle for money laundering and the financing of terrorism,” citing Alphabay as a prime case in point.

If financing terror isn’t enough to convince readers of the need for IMF intervention, “Financial stability is another. The rapid growth of crypto-assets, the extreme volatility in their traded prices, and their ill-defined connections to the traditional financial world could easily create new vulnerabilities,” she thunders. She goes on to unironically bluster about “working on these issues” for two decades. For some mysterious reason, the events of 2008 aren’t mentioned, where literally the entire world economy melted even with a very well funded and established gaggle of IMFs and central bank type arrangements. The single largest economic collapse in modern history does not warrant so much as a line from Ms. Lagarde, and it’s no wonder the entire crypto notion born from it mere months later isn’t retold. Crypto falls from the sky, evidently.

If financing terror isn’t enough to convince readers of the need for IMF intervention, “Financial stability is another. The rapid growth of crypto-assets, the extreme volatility in their traded prices, and their ill-defined connections to the traditional financial world could easily create new vulnerabilities,” she thunders. She goes on to unironically bluster about “working on these issues” for two decades. For some mysterious reason, the events of 2008 aren’t mentioned, where literally the entire world economy melted even with a very well funded and established gaggle of IMFs and central bank type arrangements. The single largest economic collapse in modern history does not warrant so much as a line from Ms. Lagarde, and it’s no wonder the entire crypto notion born from it mere months later isn’t retold. Crypto falls from the sky, evidently.

Her rhetoric morphs into the plain shrill toward the end. Laughable lines such as protecting “consumers in the crypto world just as we have for the traditional financial sector” are surpassed by “the same innovations that power crypto-assets can also help us regulate them,” an idea she glibly asserts they “can fight fire with fire.” She believes, correctly, distributed ledger technology can be utilized, with a few tricks, to track users, a fact that undermines her earlier claim of crypto’s dangerous anonymity.

“Better use of data by governments can also help free up resources for priority needs and reduce tax evasion, including evasion related to cross-border transactions. Biometrics, artificial intelligence, and cryptography can enhance digital security and identify suspicious transactions in close to real time. This would give law enforcement a leg up in acting fast to stop illegal transactions. This is one way to help us remove the ‘pollution’ from the crypto-assets ecosystem,” the Managing Director urged.

What do you think about Ms. Lagarde’s remarks? Let us know in the comments!

Images via Pixabay, IMF.

At news.Bitcoin.com we do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post Big Sister Watching: IMF’s Lagarde Warns of Crypto’s Dark Side appeared first on Bitcoin News.