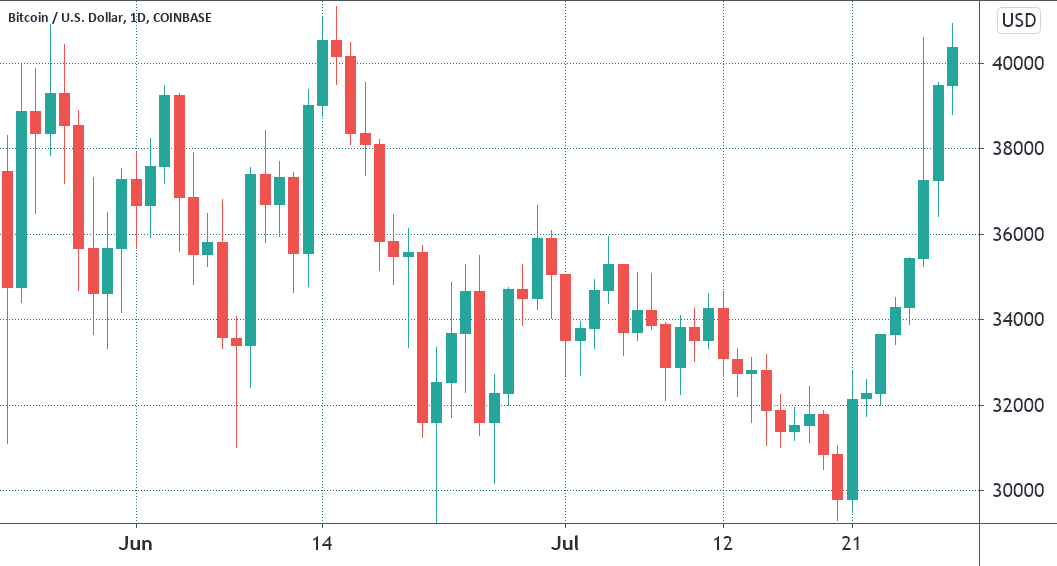

Bitcoin (BTC) traders might be feeling extra euphoric after the recent 35% rally, but data suggests bears are not too worried because a similar breakout took place in mid-July and the price failed to hold the $40,000 support.

To understand how bullish investors are this time around, let’s take apart the derivatives data and look at the futures contracts premium and options skew. Typically, these indicators reveal how professional traders are pricing the odds of a potential retrace to $36,000.

Even though the pattern isn’t exactly similar, Bitcoin crashed to $31,000 on June 8 and bounced to $41,000 six days later. The 32% rally caused $1.4 billion BTC short contracts liquidation that spread over the week. Bears were clearly not expecting this move, but in less than three days, Bitcoin was trading below $38,000 and initiated a downtrend.

Therefore, bulls have reasons to doubt the current rally’s sustainability, considering there haven’t been any significant changes to justify the $40,000 level. Moreover, the price could be suppressed by the ongoing FUD regarding miners’ exodus from China and Binance moving to seek regulatory approval.

The futures premium has not shown a significant recovery

One of the best measures of professional traders’ optimism is the futures market’s premium because it measures the gap between monthly contracts and the current spot market levels. In healthy markets, a 5% to 15% annualized premium is expected. However, a backwardation scenario occurs during bearish markets, and the indicator fades or turns negative.

According to the chart above, the one-month futures contract has been unable to recover an annualized premium above 5%. Some periods of backwardation happened over the last month, although the current level is deemed neutral.

To exclude externalities specific to the futures’ instrument, one should also analyze options markets.

Related: $60K is now more likely for Bitcoin than $20K, Bloomberg’s senior strategist asserts

Whenever market makers and professional traders lean bullish, they will demand a higher premium on call options. Such a trend will cause a negative 25% delta skew indicator.

On the other hand, whenever the downside protection is more costly, the skew indicator will become positive.

“Fear” is out of the picture, but neutrality defines the current market

When the figure oscillates between negative 10% and positive 10%, the indicator is deemed neutral. The 25% delta skew indicator had been signaling ‘fear’ between May 14 and July 24.

However, even the recent rally to $40,000 wasn’t enough to flip the sentiment towards ‘greed,’ as the indicator remains neutral at negative 4%.

According to both derivatives metrics, there is absolutely no sign of bullishness from professional traders. The 35% price hike might have eliminated a recent pattern of fear, but it was not enough to flip the sentiment.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.