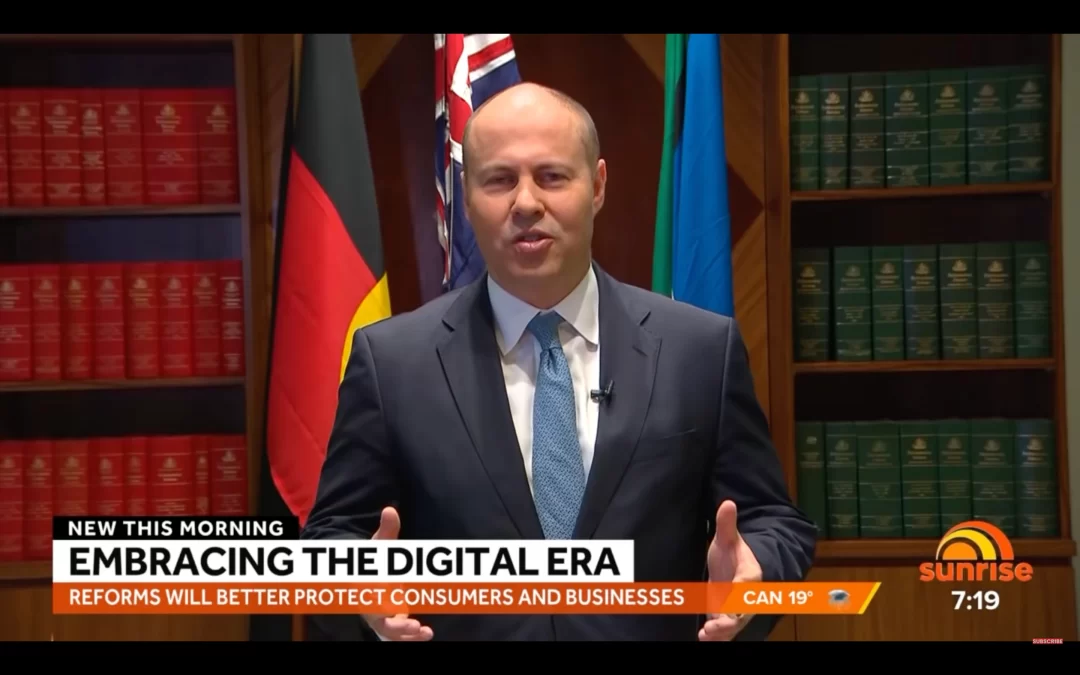

The government of Australia will announce the biggest reform in payment systems in 25 years, including crypto, on Wednesday, Treasurer Josh Frydenberg said.

- In an attempt to modernize Australia’s payment systems, the new regulations will “broaden the definition of services and products that can be regulated,” taking cryptocurrencies and digital assets “out of the shadows” and into a “world-leading” regulatory framework, Frydenberg said in an interview with 7NEWS Australia on Wednesday.

- Firms that buy and sell cryptocurrencies will have to be licensed to bring safety and security to users, the treasurer said. The government will also work out a licensing plan for crypto exchanges next year, the Australian Financial Review reported.

- The treasury will also be working with the central bank on a digital currency, according to Frydenberg.

- In October, an official from the Reserve Bank of Australia said that there is no strong case for a CBDC in Australia, but that the central bank was ramping up its development to stay ahead of global competition.

- More than 800,000 Australians own some form of crypto assets, Frydenberg said. That figure is about 3% of the population, significantly lower than previous estimates based on online surveys.

- The treasurer’s proposed regulation will also take aim at “buy now, pay later” services. Over five million accounts for such services exist in Australia, he said.

- Australia’s Senate formed a committee to research crypto regulations in March, which submitted a report to legislators on Oct. 20.

Read more: Australia Faces Big Choices on Crypto Regulation